Ethereum

Ethereum outperforms Solana – Sign of ETH’s 2025 comeback?

Will ETH’s relative performance against SOL extend into 2025?

- ETH has outperformed SOL in December on price and capital inflows front.

- Will ETH’s remarkable performance continue into 2025?

Ethereum [ETH] made a strong comeback in December, after lagging behind Solana [SOL] and Bitcoin [BTC] since late 2023. Although SOL and BTC) topped in Q4 2024, ETH dominated price performance and capital inflows in December.

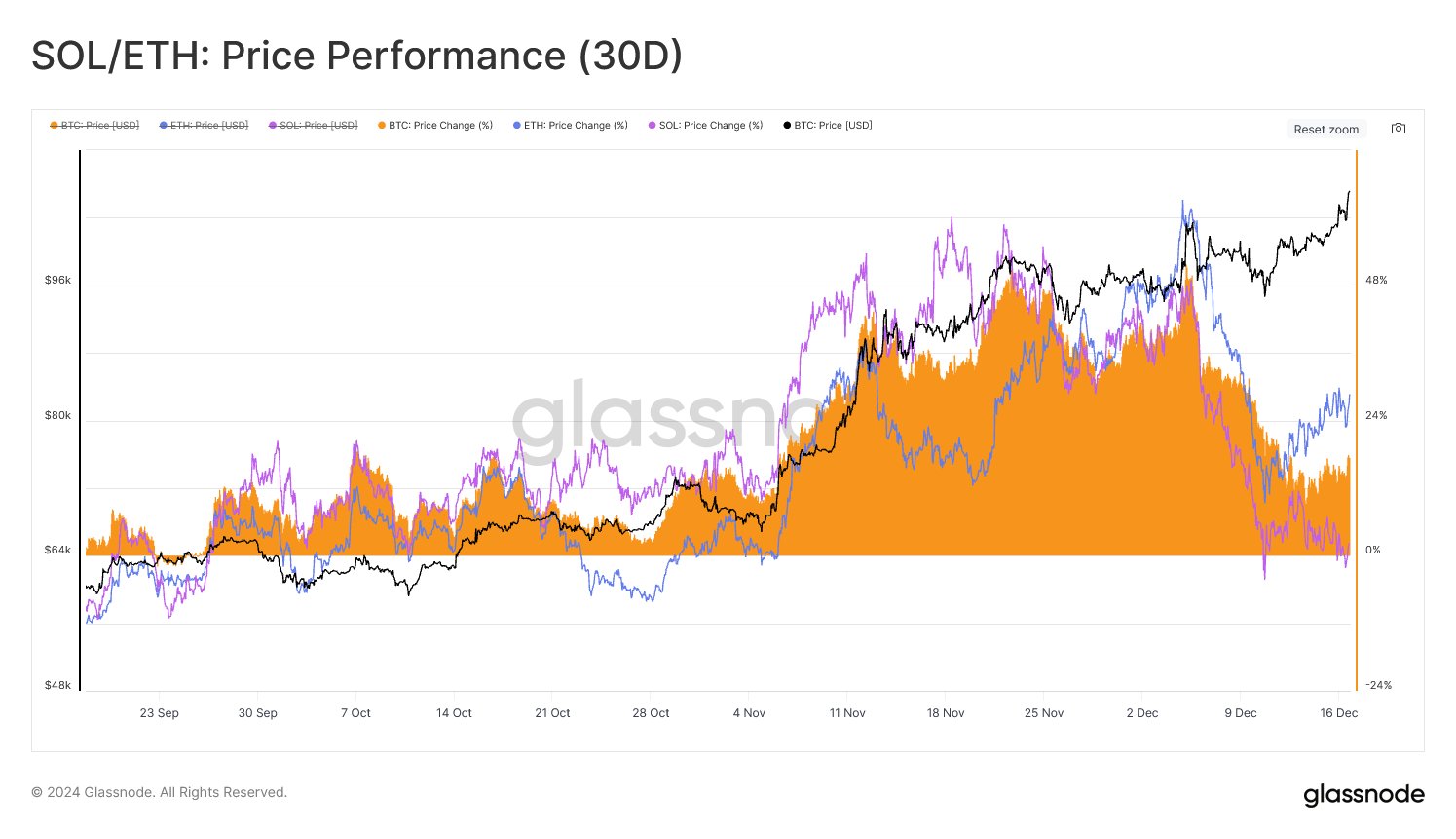

Over the past 30 days of trading, ETH was up 27% compared to BTC’s 17% and SOL’s 1%, noted blockchain analytics platform Glassnode.

ETH vs. SOL: Shift in capital inflows

Glassnode added that ETH also topped SOL on capital inflows, a trend that only changed in December. Since 2023, SOL and BTC saw more capital inflows into their respective networks relative to ETH.

In December, BTC maintained the lead, but ETH flipped SOL as illustrated by the realized cap metric. Part of Glassnode’s report read,

“SOL expanded faster than BTC and ETH until early December (over +5%). However, this pattern shifted in December, with BTC taking the lead and ETH outpacing SOL. A clear signal of shifting capital flows.”

This meant that ETH regained market interest relative to SOL, a trend that might boost the king altcoin in 2025.

The SOL/ETH ratio also supported the strengthening of ETH relative to SOL. For the unfamiliar, the ratio tracks SOL’s relative performance to ETH.

The recent decline meant SOL weakened relative to ETH. In other words, ETH outperformed SOL. Since mid-November, SOL’s value declined by 30% relative to ETH. A drop below the ascending channel could signal extensive SOL weakening.

But a SOL/ETH ratio rebound at the channel’s range-low could complicate ETH’s lead into 2025.

Read Ethereum [ETH] Price Prediction 2024-2025

That said, ETH was valued at $4K at press time and chalked a bullish ascending triangle on the 4-hour chart. A bullish breakout could push ETH to $4.5K target.

On the flip side, a bearish move could drag ETH to the nearest support and demand zone at $3.6K.