Ethereum Options paint a bearish picture after recent price action

Following Bitcoin’s lead, Ethereum prices dipped on 10 May by a whopping 14% in an hour. This took the value of the second-largest digital asset from $210.06 to $180.01. This sudden dip in the price of ether painted a bearish picture highlighted in its derivatives market.

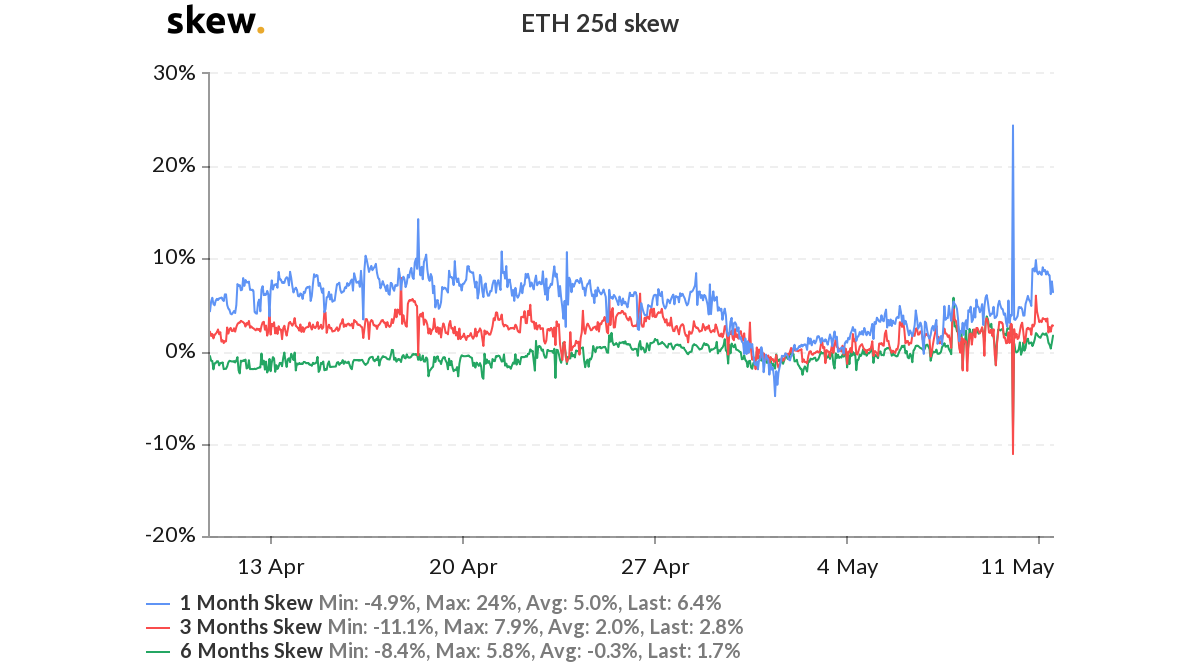

Ethereum’s options market noted the 25-d skew reporting a sharp rise in the short-term. The 1-month skew, which was at 2.4%, jumped to 24% indicating a rise in options contract of Ethereum. However, the same was not reflected in the longer-term skew of 3-month and 6-month periods. The 3-month and 6-month skew moved under zero to -11.1% and -8.4% on 10 May, indicating that the panic of the fall caused many to opt out of the ETH options market. However, as the market started to trade, buyers were interested in the options market.

Source: Skew

At press time, the 1-month skew stood at 3.4%, while the 3-month and 6-month skew stood at at 1.6% and 0.2%, respectively. The low range of long-term skew might be a sign of traders losing interest in the ETH options market.

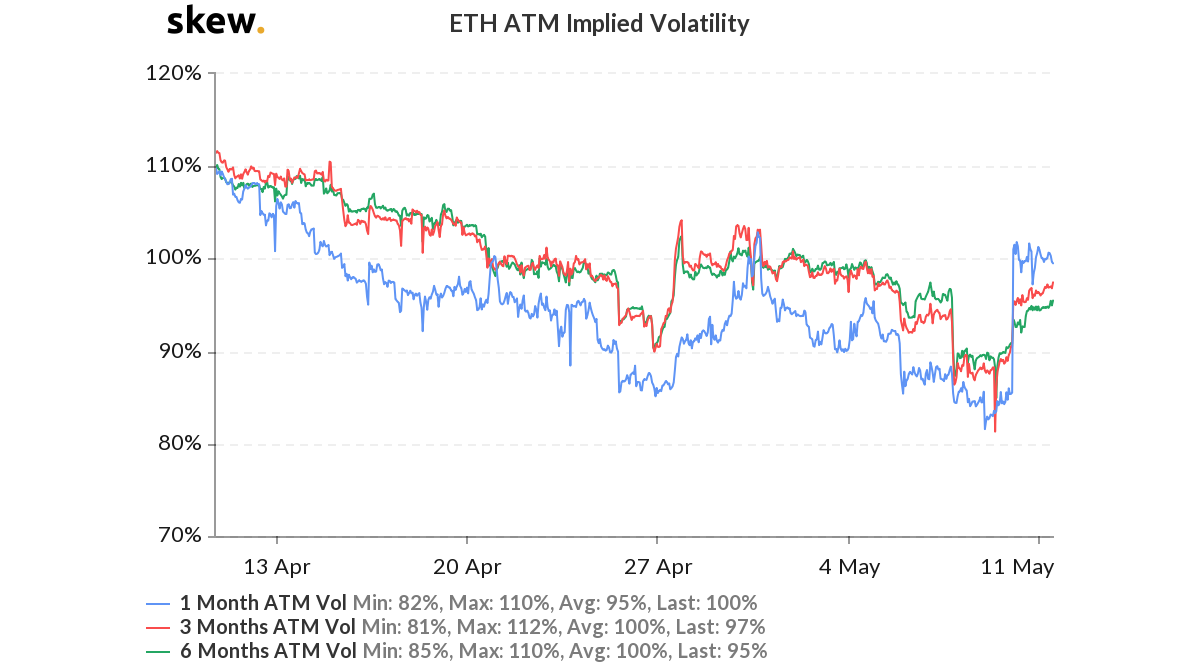

Similarly, the short-term ATM implied volatility of Ethereum, which was surfing under the longer-term IV, crossed over the 3-months and 6-months IV on Sunday. The 1-month Implied volatility which was around 85%, surged to 101%, indicating the market’s speculation of a volatile future. Last recorded Implied volatility in the short-term was 100%, while the longer-term volatilities were not much further.

Source: Skew

Price uncertainty has increased in the ETH derivatives market. Extreme sell-off in the ETH futures market did not help with the panic-stricken market and indicated that the sellers might be lining up. Options market saw an influx of Puts over shorts, seen as a bearish sign as traders were buying more contracts to sell an asset than to buy.