Ethereum mempool transactions are on the rise – Can it impact ETH?

- The concentration of mempool transactions on Ethereum increased.

- ETH’s prices continued to surge as whales showed interest.

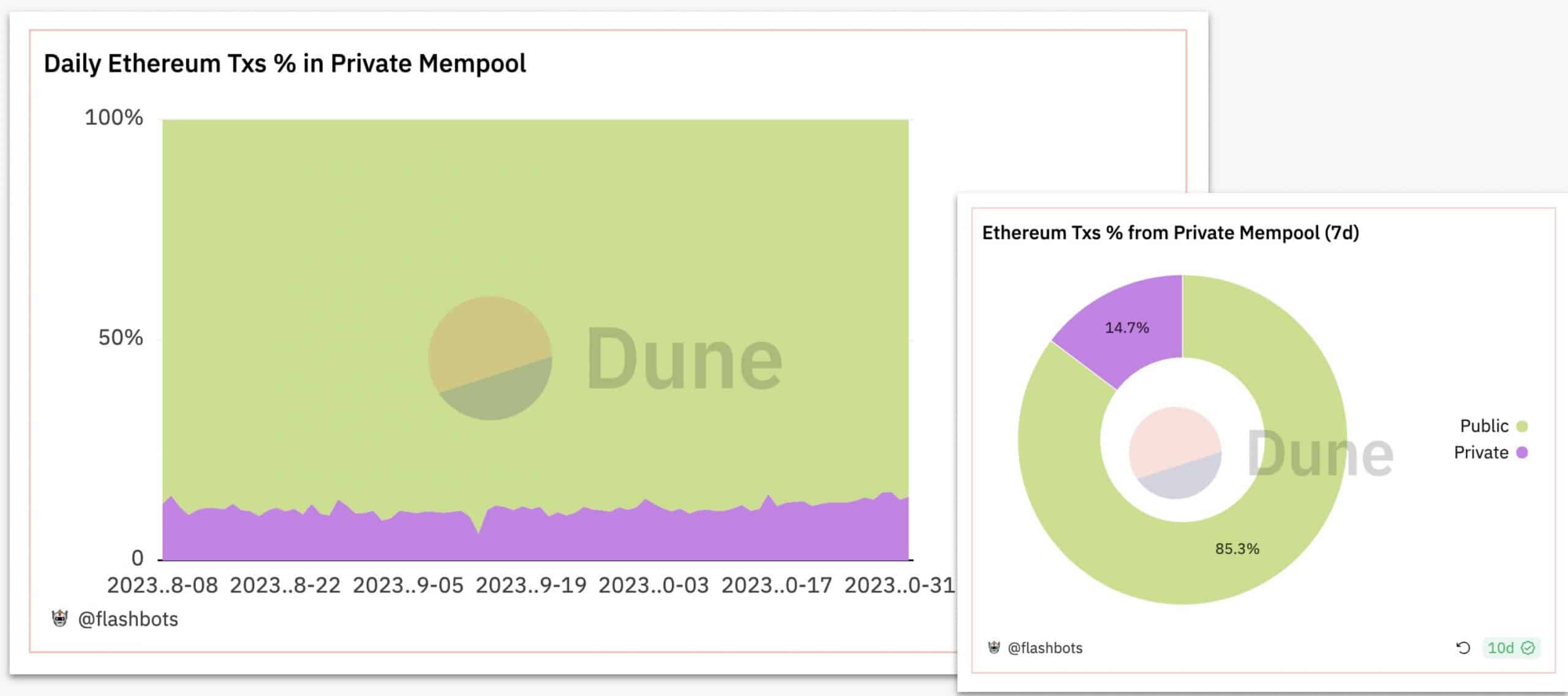

In the ever-evolving landscape of Ethereum transactions, a notable shift has emerged, with approximately 15% of transactions now traversing through private mempools.

Interest in mempools rise

In simpler terms, a private mempool is like a private club for Ethereum transactions. Instead of everyone seeing a transaction, it’s more exclusive as only a select few get to know about it.

What’s interesting is that more and more transactions are choosing this exclusive route, and it’s changing the crypto landscape.

Approximately 50% of these transactions, which exclude any deceptive activities such as trading bots, are currently being routed through these private mempools.

Today, ~15% of Ethereum Txs are landed thru Private Mempools.

Cross-checking txs seen by public mempools, we are able to observe the trend of Ethereum txs moving towards private channels over time – thru metrics across the Tx Settlement Stack on Ethereum. ?

— danning.eth⚡️? (@sui414) November 30, 2023

Now, what does this mean for Ethereum? It’s a bit like a double-edged sword.

On the positive side, it could mean smoother and more private transactions for regular users. Moreover, all these transactions are protected against sandwiches and front-running in general.

But, on the flip side, if more transactions go through these private channels, it might make things a bit trickier for keeping an eye on the overall Ethereum network.

So, while it gives users a more exclusive experience, Ethereum might need to figure out how to balance the secrecy with keeping an eye on the entire network to ensure everything runs smoothly.

How is ETH doing?

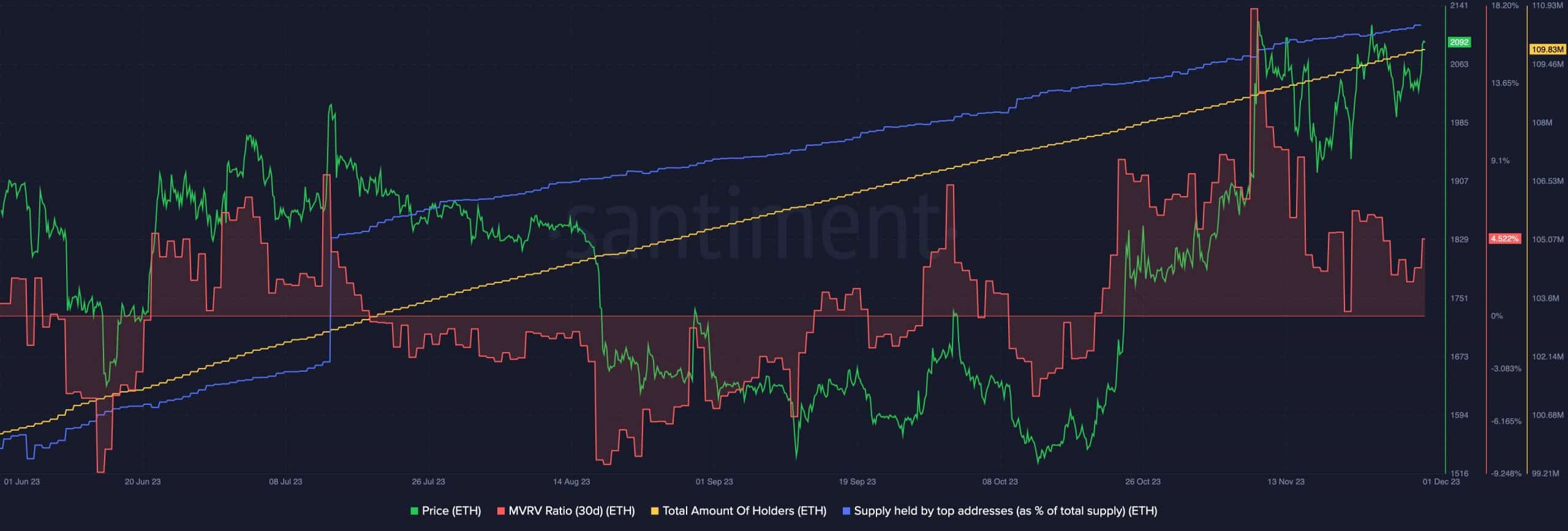

Only time will tell how ETH will be impacted by this. At press time, ETH was trading at $2,092.58 and had grown by 2.87% in the last 24 hours.

The number of ETH holders also increased during this period. Overall, whale interest in ETH also surged.

This could help the price move towards green. However, a large concentration of whale holders may make the crypto more centralized.

Moreover, the MVRV ratio for ETH also grew. This implied that ETH holders were largely profitable.

How much are 1,10,100 ETHs worth today?

This development could affect ETH negatively going forward.

With more profitable holders, the incentive for them to sell their holdings rises. This could add increased selling pressure on ETH and could result in a correction going forward.