Altcoins

Ethereum lead large-cap assets, while the small-cap slips lower

The low volatility streak of cryptocurrencies has finally concluded and the bulls have rushed back into the market. Bitcoin, the largest crypto witnessed a surge in its price on 27 July, and the altcoins also felt its impact. The BTC price had witnessed a surge of 18% within a day, which pushed the digital asset’s price above $11k. While the second-largest asset, Ethereum reported an 11% growth at the same time.

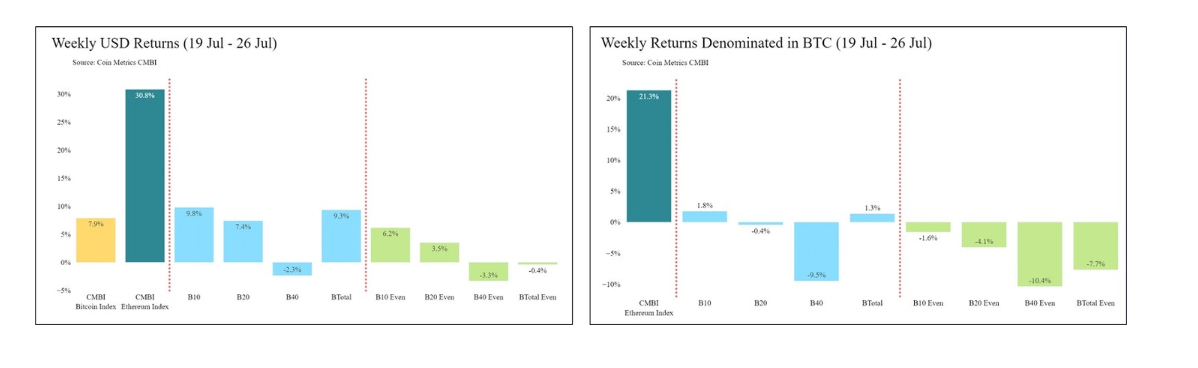

Ethereum registered over 30% in returns over the past week and was followed by other large-cap assets like Cardano [ADA] with 20%, and Litecoin [LTC] with 13%. According to CoinMetrics‘ Ethereum Bletchley Index, it was the best performer in the week, followed by the CMBI Bitcoin index that returned close to 8%.

Source: CoinMetrics

As per the chart above, the large-cap assets and the mid-cap assets performed best through the week, returning 9.8% and 7.4% respectively. As mentioned above the performances of large-cap assets like Cardano, Litecoin, and Ethereum have led to the growth of these categories.

According to Arcane, the large and the mid-cap asset were reporting a monthly growth of 25.3% and 31% respectively. This was larger than BTC, which noted a monthly spike of 11.77%, however, the small-cap assets that were outperforming the remaining market, have seen a minimal profit of 7.80% in July.

Source: Arcane Research

The small-cap assets index [a weighted index of the top 30-70 cryptocurrencies] had been surging in the middle of July but has since been struggling to maintain its momentum. As Bitcoin remained dormant, the traders had a risk-on approach as they sought returns in more volatile assets. However, with great movement in the Bitcoin and Ethereum market, the small-caps have fallen as the traders’ attention moved back to large-cap assets.

Similarly, the Bletchley 40 [small-cap] did not reflect growth but experienced a fall of nearly 2% during the week. As the focus of the crypto world moved back to major cryptocurrencies, the sentiment in the market has moved away from fear to extreme greed which was last witnessed in July 2019. However, this boost did not confirm the bull run, as the BTC price will have to sustain in the $11k range, but a correction might once again push the price lower.