Ethereum: How close is ETH to $4K? – THESE datasets hold the clue

Key takeaways

Fresh capital is flowing into Ethereum, with first-time buyer supply up 16% since July. Over 90% of ETH holders are now in profit, and on-chain resistance looks light until $4,000. While ETH may see a short-term cooldown, technicals suggest the broader uptrend remains intact.

Ethereum [ETH] is back in the spotlight, and this time, it’s fresh hands fueling the momentum.

First-time holder supply has jumped 16% since July, indicating renewed confidence among new investors.

With over 90% of ETH holders now sitting on unrealized gains and limited on-chain resistance until the $4,000 mark, the setup is looking increasingly bullish.

Could Ethereum be gearing up for an extended breakout?

First-time buyers drive new wave of Ethereum accumulation

After months of subdued activity, Ethereum is witnessing a notable shift in investor behavior.

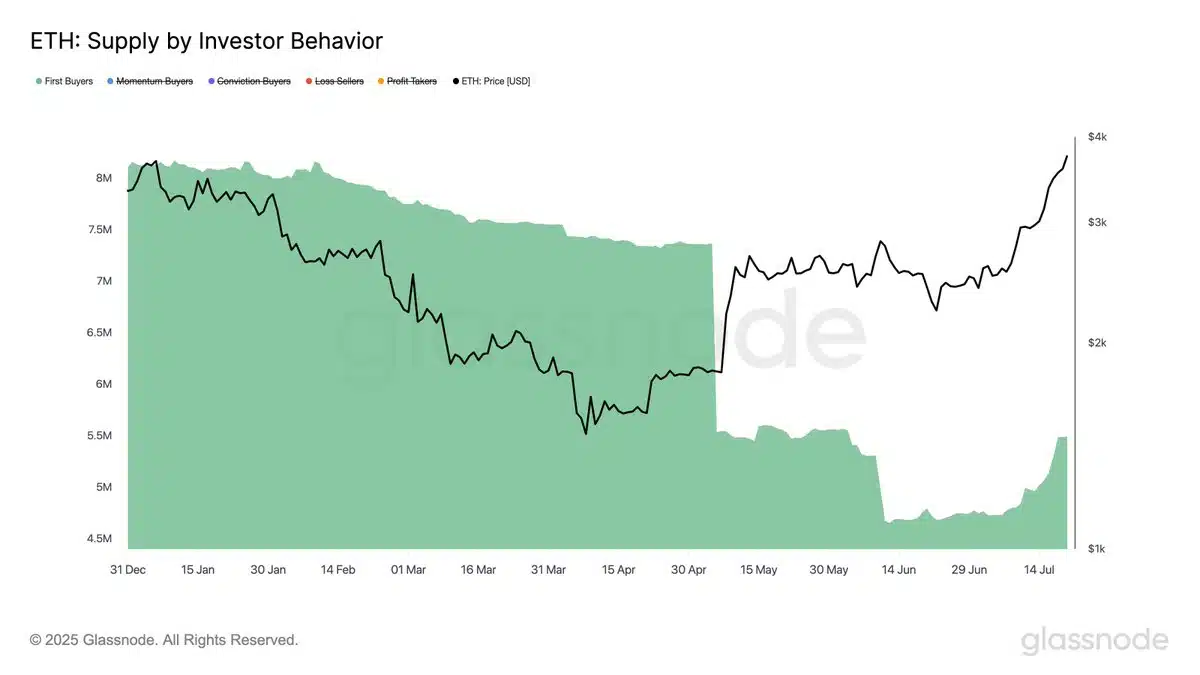

According to Glassnode data, the supply held by first-time buyers has surged by 16% since early July; its first meaningful rise in months.

As the chart illustrates, this uptick coincides with ETH’s price pushing above $3,000, suggesting that fresh capital is re-entering the market amid renewed optimism.