Ethereum Whale Alert: How a $32M ETH deposit scares the $4k price

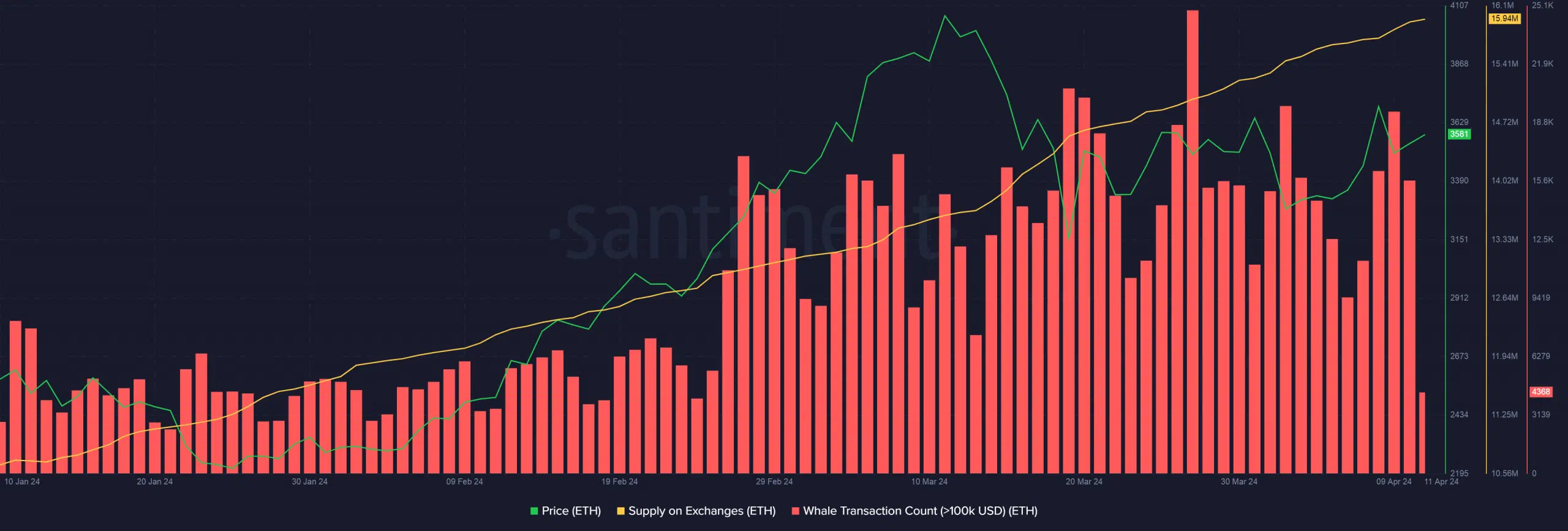

- Whale transactions have spiked since ETH hit $4k last month.

- ETH supply on exchanges also increased sharply.

An influential Ethereum [ETH] whale was seen transferring a massive chunk of their holdings to cryptocurrency exchange Binance recently.

ETH whale becomes richer

According to on-chain data tracker Spot on Chain, the wealthy investor deposited a whopping 900 ETH coins, worth more than $32 million at prevailing prices, on the 11th of April. This was the biggest amount the whale had ever deposited on an exchange.

Additional details showed the investor still in possession of more than $100 million worth of Ether, selling which could earn them profits of $68.5 million.

However, profit-taking on ETH wasn’t just limited to this one single entity.

A broader market trend?

ETH transactions worth more than $100,000, a proxy for whale transactions, have remained on the higher side in the last month, AMBCrypto noticed using Santiment’s data.

Additionally, ETH reserves on exchanges swelled up to nearly 16 million as of this writing, up from 13.62 million a month ago.

Analyzing the aforementioned indicators, it became clear that a whales on a larger scale were depositing ETH for profits.

Notably, whale activity spiked since ETH broke past $4,000, its first since December 2021. Helped by the surge, the portion of ETH’s total supply in profit had jumped past 96%. This could have encouraged investors to offload their bags.

The market appeared to have reached the supply distribution phase, where each price increase was followed by heavy profit-taking.

Take for instance, ETH’s rise to $3,700 earlier this week, which helped lift the total supply in profit to 92% from 86%. The correction in ETH’s price thereafter implied that investors were locking profits immediately.

Is your portfolio green? Check out the ETH Profit Calculator

More downsides to follow?

As of this writing, the second-largest digital asset was trading at $3,610, up 2.53% in the last 24 hours. The market sentiment was one of extreme greed, raising concerns about a further drop in ETH’s price.