Ethereum and hodling: What to expect from ETH 2.0

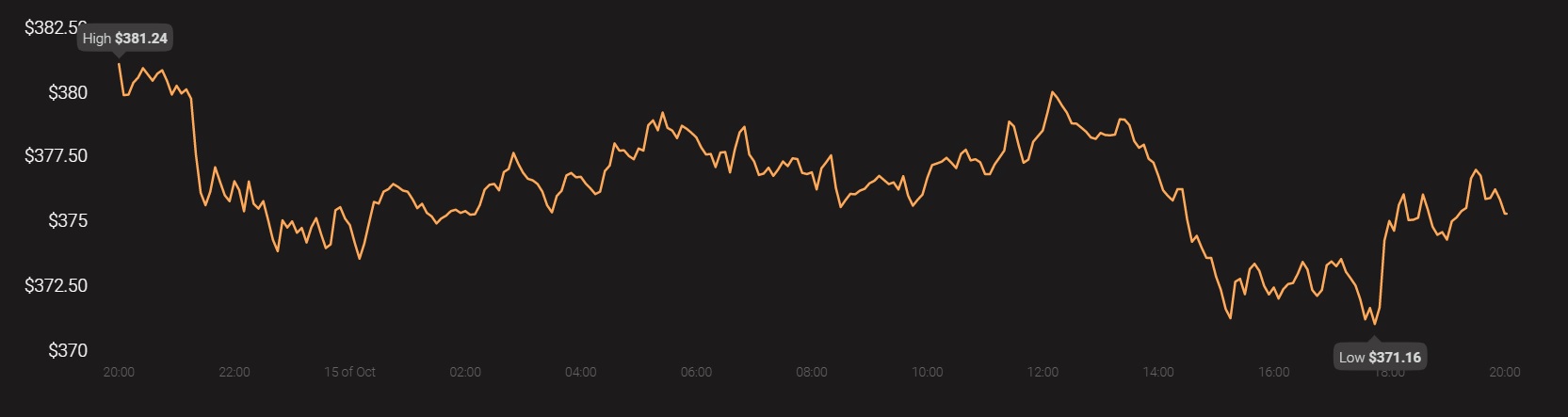

For Ethereum, the world’s second-largest cryptocurrency, 2020 has been fairly promising. While its transition to Proof of Stake continues to be plagued by delays, the altcoin has performed rather well on the price charts. At press time, Ethereum was being traded at $376, with ETH’s price seemingly aided by strong hodling sentiment within the Ethereum community.

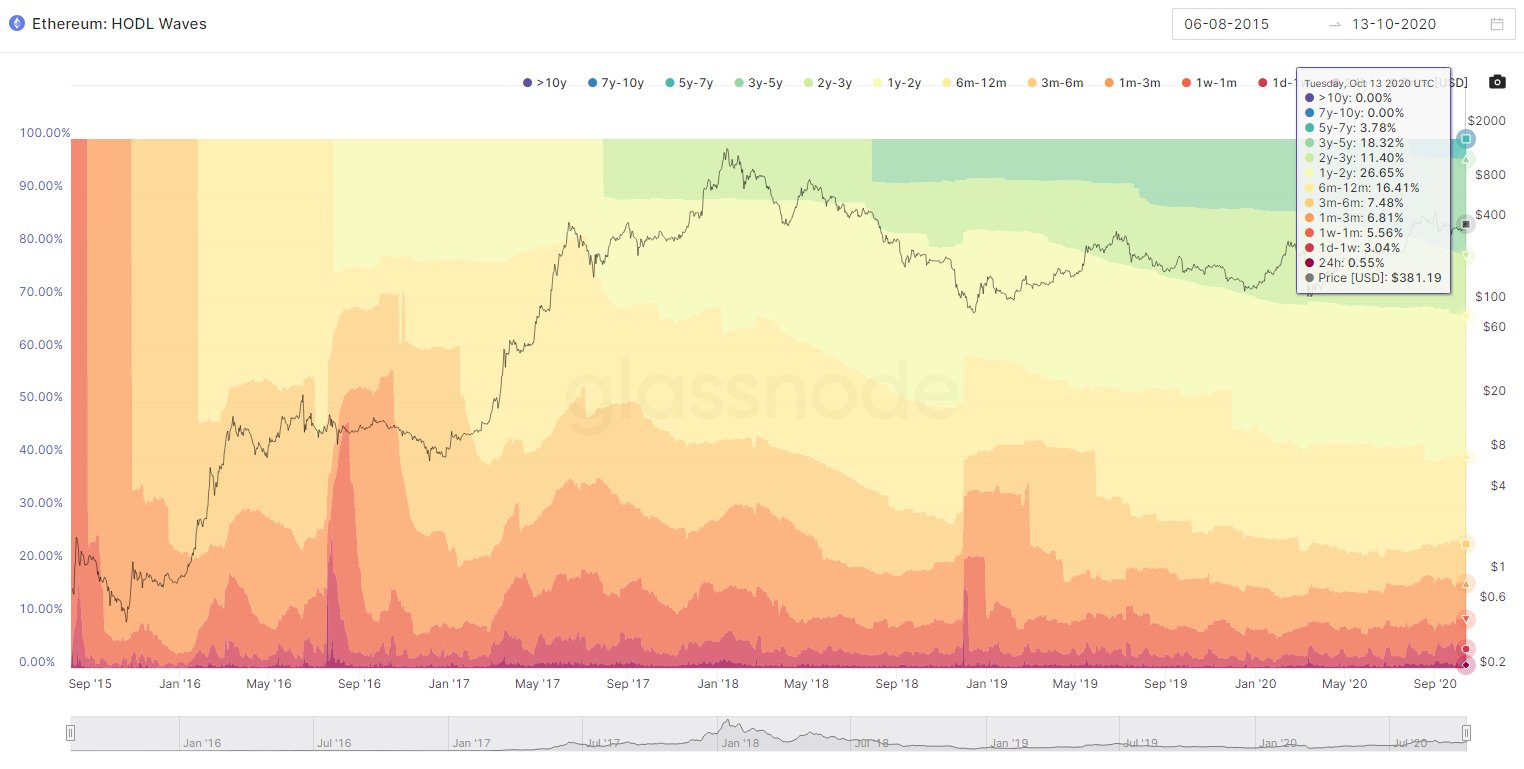

According to data provided by Glassnode, such strong hodling sentiment within Ethereum can be evidenced by its Hodl waves metric. As per the aforementioned, over 60 percent of all Ethereum hasn’t been moved in over a year. With over half of all ETH being stashed away, the previous year saw only close to 38 percent of Ethereum being moved on the network. This can be considered to be a rather bullish sign for Ethereum, with the hodling habits seemingly spilling over from the BTC ecosystem. Further, such a trend also signals long-term investor confidence in the coin.

However, given the transitory position Ethereum now finds itself in, especially in light of the scheduled move to PoS, the question of whether such strong hodling sentiment will survive once staking is introduced onto the Ethereum network has arisen. The Co-founder of EthHub Anthony Sassano pointed out the same concern in a recent tweet, one in which he highlighted whether or not this trend will be disrupted and whether ETH that hasn’t been moved in over 5 years will see a shakeup as users move their ETH coins to be staked.

~60% of all ETH hasn't moved in 1+ years.

With eth2 phase 0 approaching, it'll be interesting to see how much this percentage comes down by as Ethereum OG's move their stash into staking.

I'm particularly curious to see if any of the coins in the 5+ years category move ? pic.twitter.com/9H38dYAHDq

— Anthony Sassano | sassal.eth ⛽ ? (@sassal0x) October 14, 2020

With ETH 2.0’s Phase 0 slated for launch in 2020, the possibility of a shake-up when it comes to ETH’s Hodl waves pattern is quite real. However, investor confidence in Ethereum has only surged for the majority of 2020.

Since the Black Thursday price crash during which Bitcoin fell to a sub-$3k valuation, Ethereum has managed to see its price rise by a whopping 286 percent on the charts.

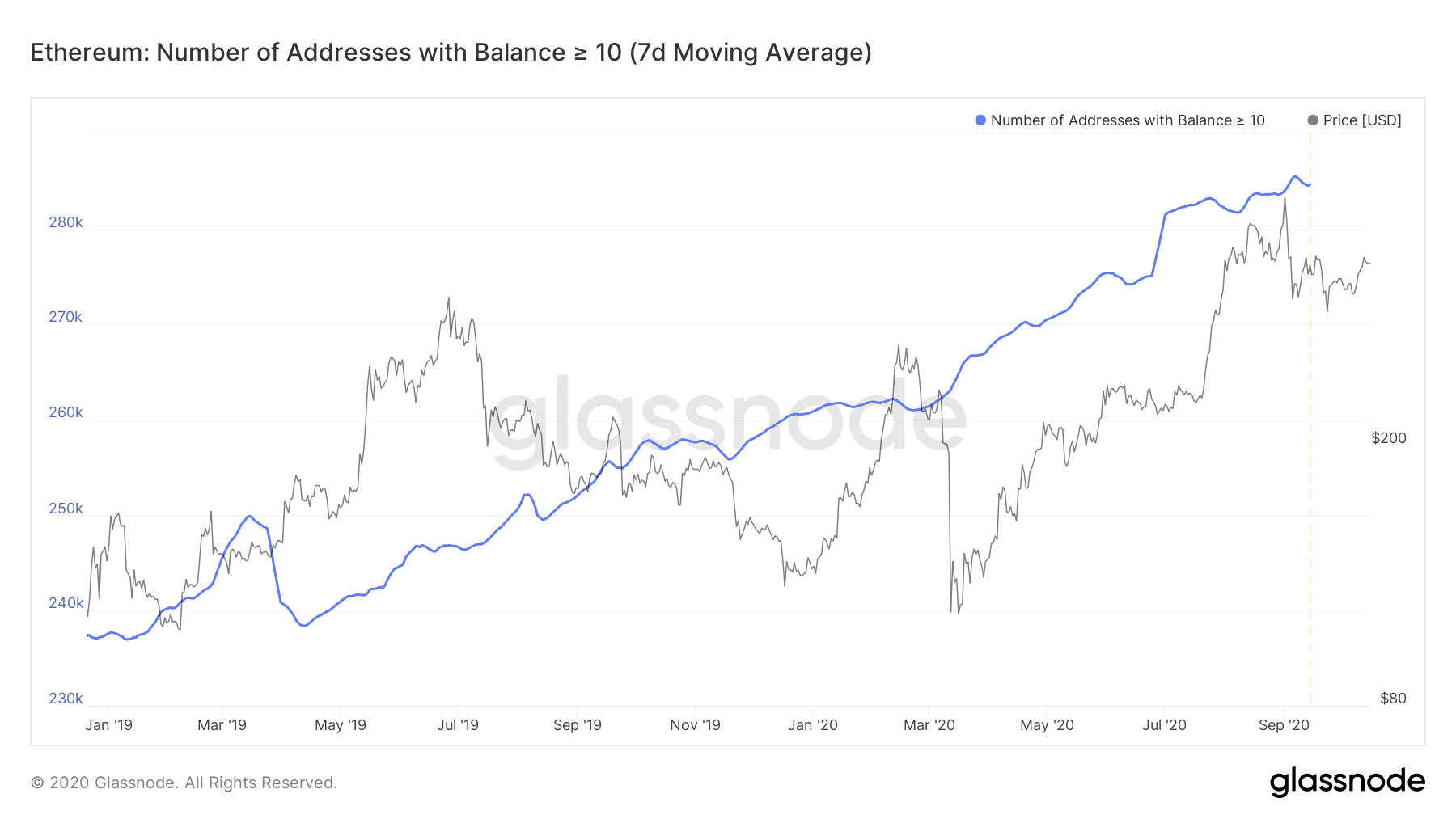

Source: Glassnode

Along with its strong performance on the price charts, Glassnode’s data on the number of addresses holding 10 or more ETH has only grown since Q2 of 2020. While the exact impact of ETH 2.0’s Phase 0 cannot be ascertained as of now, the steady increase in addresses holding Ethereum, coupled with a strong holder demographic backing the coin, is quite promising for Ethereum and its investors.