Ethereum hodling is active, but it may or may not last

The cryptocurrency market is well-versed with the subject of volatility. Such volatility has not only helped many a crypto-asset break out of its sideways movement on the charts, but the same has also precipitated sudden sell-offs. Traders often use volatility in their favor to hedge against potential risks in the market, while avoiding unexpected price swings.

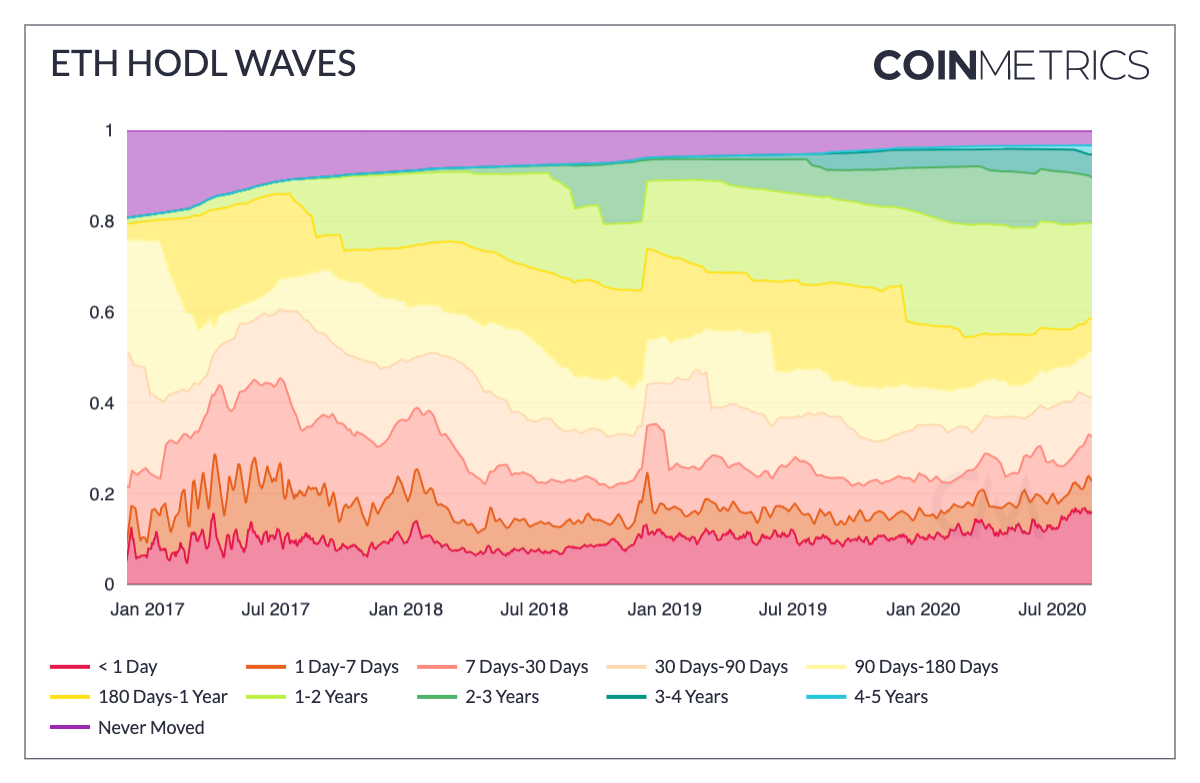

To do this, investors must enter the market at the right price point to accrue maximum gains. As 2020’s crypto-market was gaining steam, it packed a lot of kinetic energy to kickstart a potential bull run. In fact, while Bitcoin has been the go-to asset in terms of hodling, 2020 has managed to highlight the growth potential available with Ethereum too. HODL waves or age distribution bands show the supply grouped by the age ETH was last moved on-chain or, the age that it was last sent as part of a transaction.

Source: CoinMetrics

The attached chart has been divided across various periods to understand the holding activity in the Ethereum market. Reading from the bottom of the chart, the red and orange-colored bands showed the percentage supply that has been active relatively recently. This could range from less than 1 day to 30-90 days and tends to peak during market tops.

The short-term bands appeared to have been increasingly active in July and August. This was the time when ETH’s dull movement was met with great upwards moving volatility due to the growth contributed by Decentralized Finance [DeFi] and stablecoins.

ETH reported 110% in gains from the beginning of July and the end of August, thus, if you got ETH for $232.77 on 1 July, the value of that ETH today will be $415.52, after witnessing minimal correction. However, while this technique can be beneficial for long-term investors, it is quite problematic for new traders entering the market. As the holding sentiment increases, the volume on the market will drop, causing a rise in the value of the crypto-asset due to scarcity.

At the time of writing, the price of ETH was known to have climbed even higher, with hodlers registering great gains in the market. However, if the price were to climb down, hodlers may want to be careful since their profits could be wiped out by a sudden price swing in the opposite direction. This shedding of coins was visible when Ethereum’s price was hit lower by volatility. The 180 day-1 year band fell from about 11% on 12 March to less than 7.3% in late-August.

Nevertheless, the Ethereum ecosystem is currently supported by the growth driven by the DeFi space. Owing to such growth, ETH was up by 17% over the past week, outpacing Bitcoin and XRP, at press time. The strides taken by ETH have been driving it further apart from BTC as the correlation between the two has reached its lowest level since March 2018. As Hodling continues and DeFi pumps, Ether holders may see plenty of opportunities to reap gains, but caution must be practiced as volatility remains prevalent in the market.