Ethereum: Here’s why ETH bulls are struggling at $4K resistance

- Indicators showed Ethereum maintained its longer-term uptrend

- The struggle to break the $4k resistance could continue for more days

Ethereum [ETH] was forced to fall by 5.7% in the past 40 hours of trading. During the same time, Bitcoin [BTC] set a new all-time high above $108k and fell to the $103.4k level. Despite the pullback and range formation, Ethereum bulls have a good chance of keeping the rally going.

Ethereum bulls continue to scuffle without success around $4k

While Ethereum has a higher timeframe bullish bias, the inability to maintain prices above $4k was a concern. In the past two weeks, ETH has tested the $4.1k resistance level twice and been rebuffed both times.

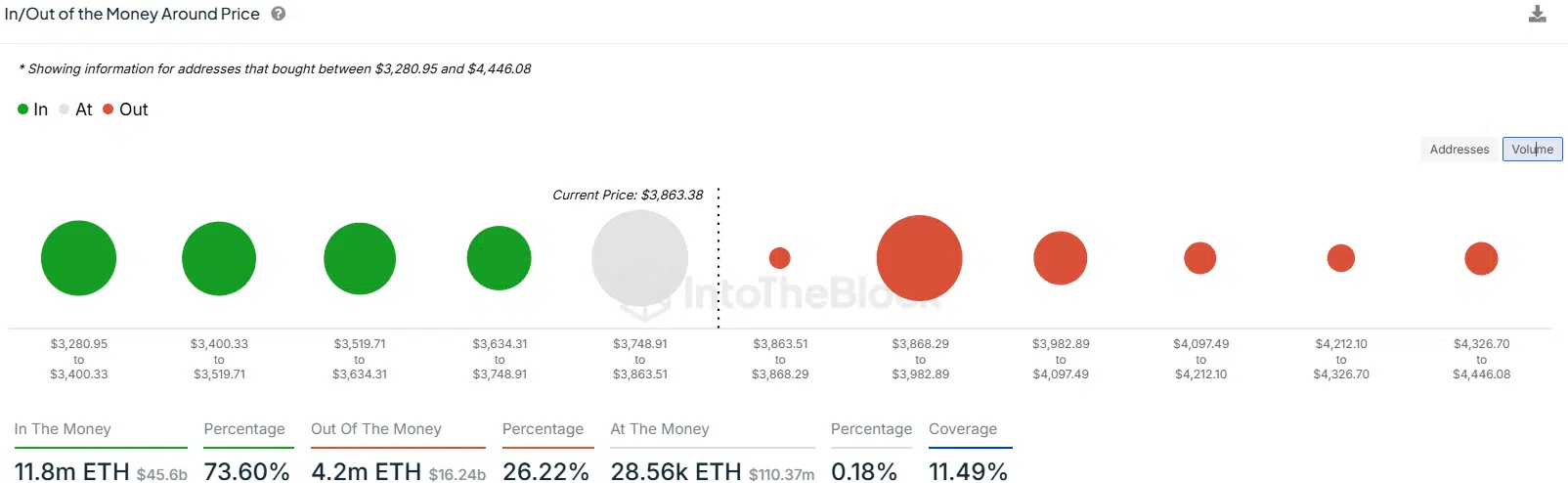

AMBCrypto looked at the data from IntoTheBlock. The In/Out of the money around the price identifies the average purchase price of Ethereum and the volume bought by addresses within a certain range around the market price.

The high volume of purchases at the $3,868-$3,982 zone meant that a move beyond this zone could be tough. Buyers in that price range were out of the money due to the recent dip and could sell their holdings if prices bounced, opposing further gains.

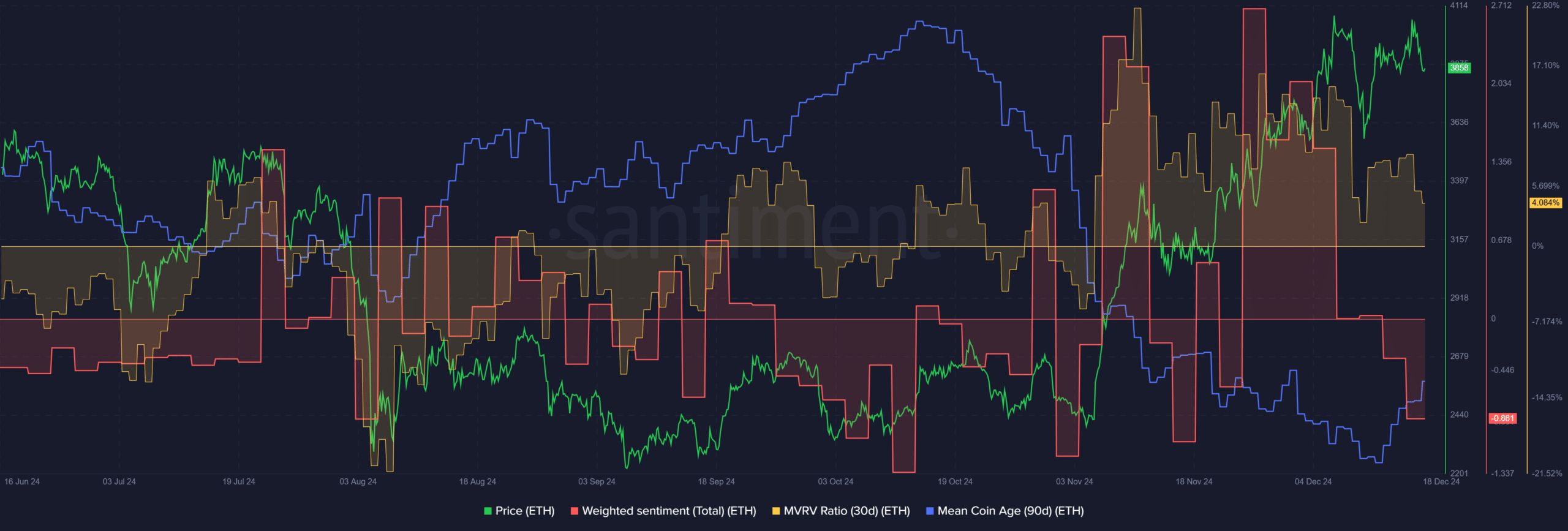

The data from Santiment outlined a shift in sentiment in recent days. The weighted sentiment flipped bearishly to indicate bearish online engagement. The 30-day MVRV was also high, showing short-term holders were profitable.

Some profit-taking and sell pressure is expected and could delay attempts at recovery. Meanwhile, the mean coin age, which had been in a strong downtrend since mid-October, has begun to recover.

Ethereum bulls would want to see this accumulation continue over the coming weeks.

Potential range formation ahead

In December, ETH has ranged between $3.6k and $4k for the most part. The mid-range level at $3.8k has acted as support, and Ethereum was trading above this level at press time.

Read Ethereum’s [ETH] Price Prediction 2024-25

The DMI showed a strong uptrend still in progress on the daily timeframe, as the +DI (green) and ADX (yellow) were both above 20. The OBV has climbed higher since October, reinforcing the idea of steady demand and sustainable gains.