Ethereum

Ethereum Futures volume inches closer to May 2019 ATH

As the cryptocurrency market recovers from the drastic fall on 25 and 26 February, the Futures market has a novel story to tell. While on one hand, Bitcoin Futures are seeing reduced Open Interest, on the other hand, Ethereum Futures are reflecting new great momentum in its daily volume.

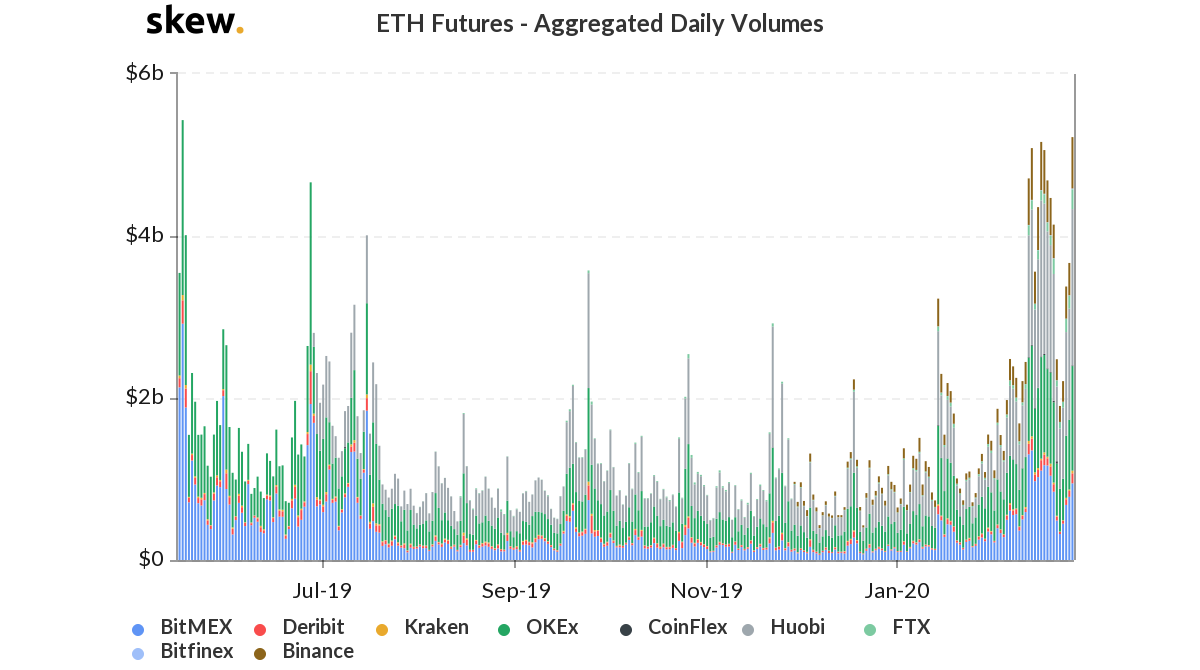

According to the data provider, Skew, Ethereum Futures’ Aggregated Daily Volume was recorded to be very close to its all-time high mark on 17 May 2019.

Source: Skew

The aggregated daily volume on 17 May 2019 was reported to be $5.45 billion. Since then, while numerous platforms have evolved, the volume noted on 27 February 2020 was $5.20 billion.

Source: Skew

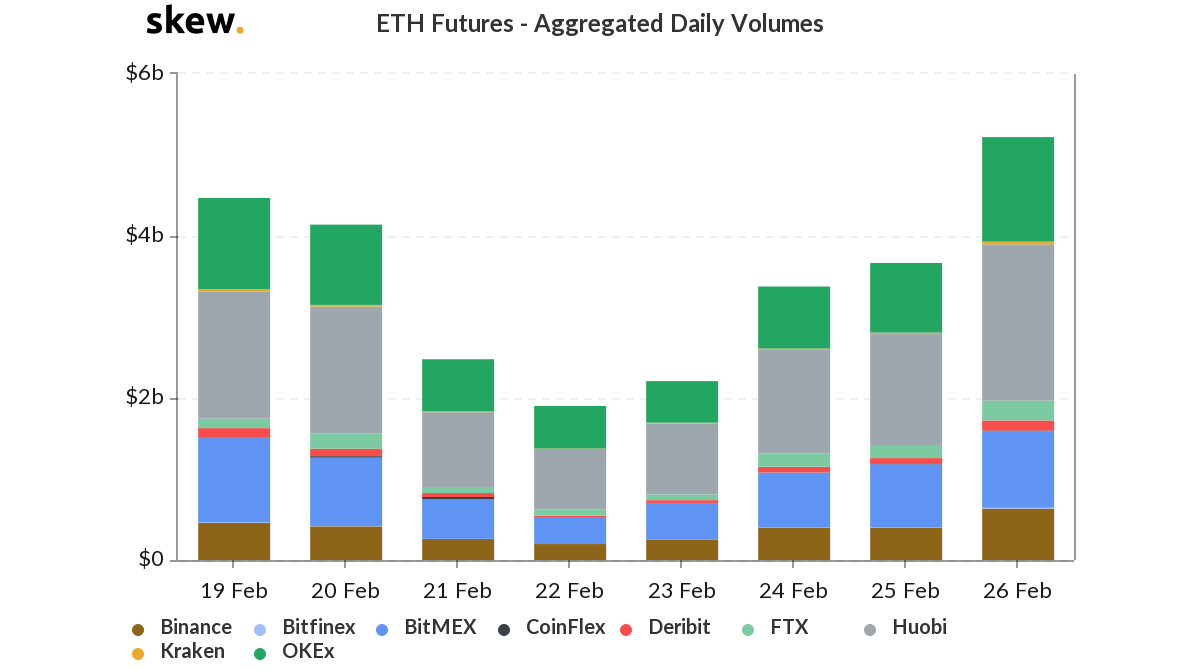

The highest volume was reported by Huobi at $1.9 billion, followed by OKEx, an exchange that was noting a volume of $1.3 billion. Despite the rising volume, however, the Open Interest had been noting a dip since 25 February. The Open Interest remained highest on OKEx with $163.8 million, while BitMEX followed at $146.6 million, at press time.

During the period of loss on 26 February, the BitMEX ETHUSD – Coinbase ETH-USD Basis reflected an upward spike of 0.7%. This spike could be indicative of the buying pressure in the Ethereum market. The Ethereum market appeared to be in a recovery phase as the coin noted a growth of 3.76%. At press time, the world’s largest altcoin had pushed its price upwards towards $226.16.

As the price of the coin is close to its critical support of $229, it has been predicted that a dip under $229 could cause the coin to crash below the psychological $200 mark. This could mean that Ethereum could end up losing 30% of its profits in 2020. Despite many in the community hoping that Ethereum would bring the alt season to the market, its correlation with Bitcoin could change things for the future.