Ethereum faces possible detour at $170, before return to elusive $200-mark

Over the course of April, Ethereum’s market has improved drastically on the charts. Over the past week itself, ETH registered positive returns of 9.86 percent and over the past 24-hours, a 3.81 percent spike was registered. As the 2nd largest crypto-asset aims to breach its resistance of $200 over the coming week, a couple of possibilities need to be analyzed.

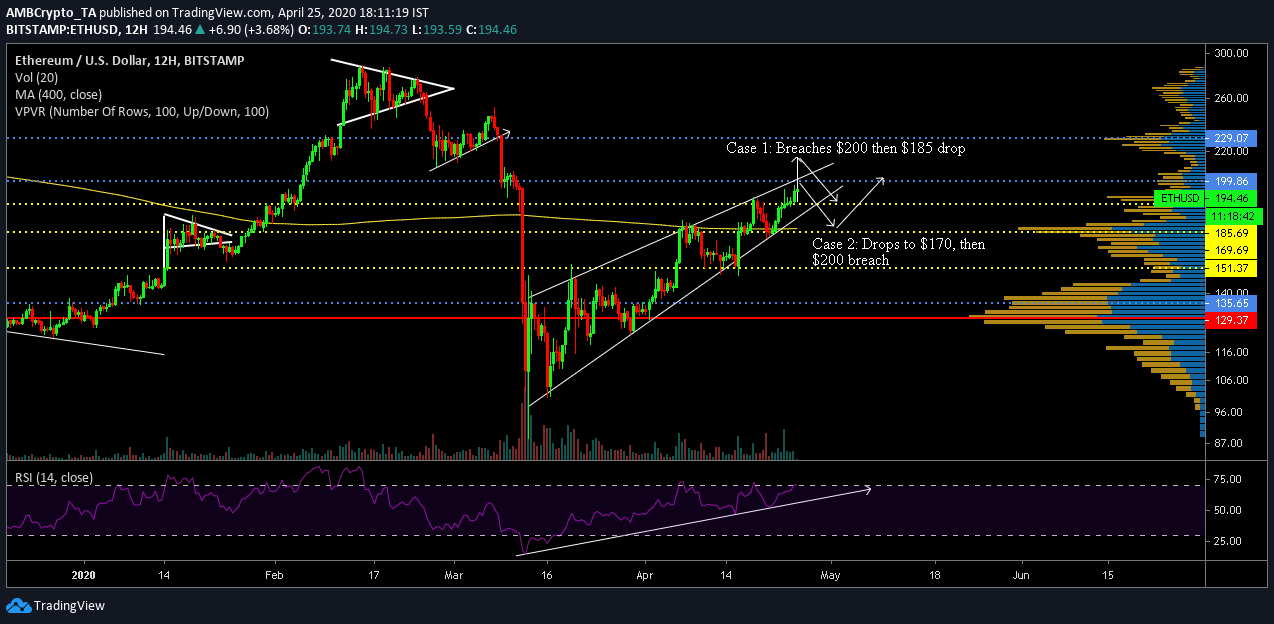

Ethereum 12-hour chart

Source: ETH/USD on Trading View

Ethereum has been on a steady incline since 12 March on the charts and its price movement has given rise to the formation of a rising wedge. The pattern hasn’t been breached yet over the past 30+ days. In line with the trend lines, ETH registered lower highs at $101, $124, $148 and $170, and clear higher highs were formed at $153, $172 and $189.

The Relative Strength Index or RSI also pointed to increasing buying pressure over the month, exhibiting a return of investors into the market.

With the 200-Moving Average turning support on 18 April after the token breached its resistance $170, the press time market may play out in a few ways,

Case 1: Breach of $200 before $185 re-test

Considering the fact that bullish momentum is high on the charts, there is a good chance Ethereum may cross $200 over the next week. However, the rising wedge pattern suggested that a bearish breakout would take place eventually, something that might see the token register a re-test at $185 after the rise. The VPVR indicated that $185 was holding as strong support, hence, a bounce from this range is foreseeable.

Case 2: Drop down to $170 before breaching $200

After registering 5 back-to-back green candles over the week, it is inevitable that a bearish pullback would take place. Although Ethereum is valued at $194, resistance strength at $200 may allow Ethereum to drop down to $170, before breaching $200.

Support at $170 has been a strong base since last year until the collapse took place on 13 March. Hence, ETH should be able to bounce back from $170 and eventually breach resistance at $200 by the first week of May.

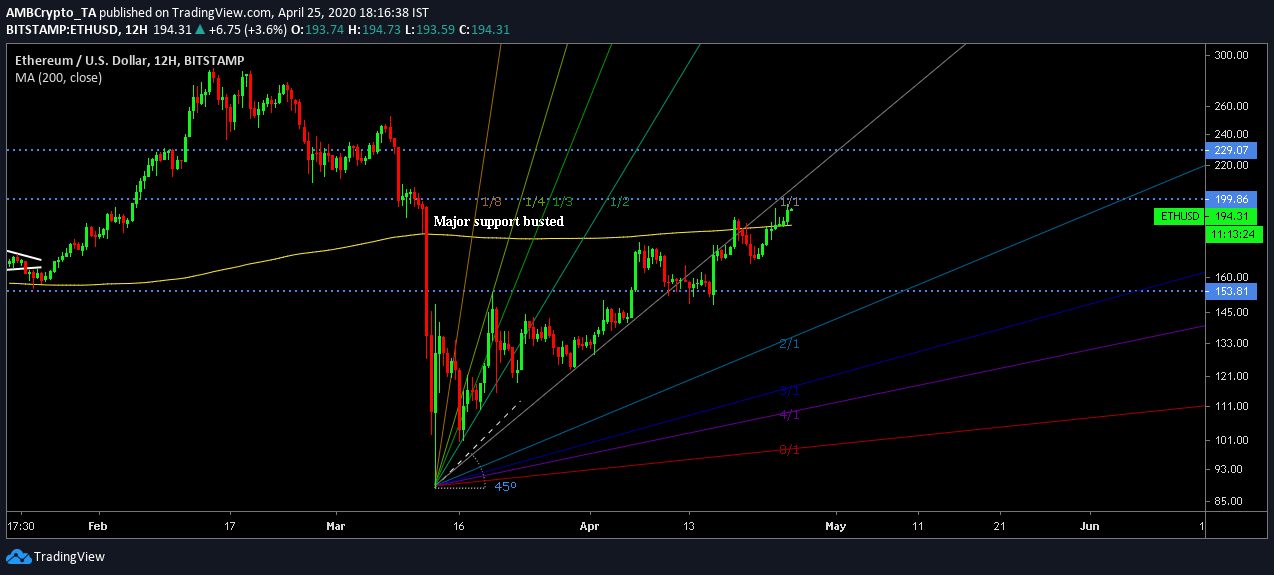

Gan-Fann indicate a bearish reversal

Source: ETH/USD on TradingView

Analyzing the input of Gan-Fann, it could be inferred that corrections may come next week. ETH’s price was hovering under the 1:1 line, which is a bearish signal over the long-term.

However, the price continued to mediate at close proximity to the 1:1 ratio, meaning the bullish momentum still had a significant grip on the market.

Conclusion

Ethereum should see a quick re-test at $170, before Ethereum recalibrates its compass to breach the $200 level again.