Ethereum: How much of a difference will DeFi’s absence make?

On 20 July, Ethereum was gearing up for a pivotal rally, one that was least expected by the rest of the community. Between 21 July and 1 September, Ethereum would register a whopping surge, one that would see it climb to $489 from $235, while also recording its 2-year high. While the bullish rally was memorable, the bearish pullback was pretty stunning as well, with Ethereum dropping to $309 on 5 September.

While Ethereum was above the $400-level yet again at press time, the key difference between July 2020 and the present rally remains the crypto-phenomenon of the year – DeFi.

How important was DeFi in July 2020?

DeFi’s interest was widespread and its impact was significant on Ethereum’s network. From high transaction fees to miners becoming more profitable, DeFi was bringing in a serious level of attention to Ethereum, and it possibly played a huge role during Ether’s price pump to $489.

However, the excitement was very short-lived. Bad DeFi tokens drowned the euphoric nature of these applications, and with Ethereum’s price plummeting on the charts, the hype was beginning to fade away.

YFI token, which was worth close to $43,000 at one point, had fallen dramatically and traded at around $13,900. Now, with another rally beckoning Ethereum’s price, market indicators seem pretty split down the middle.

According to Santiment’s latest analysis, Ethereum miners have remained resilient to turbulent market movements, holding their position. Additionally, an increase in new active ETH addresses was also noted.

Source: Twitter

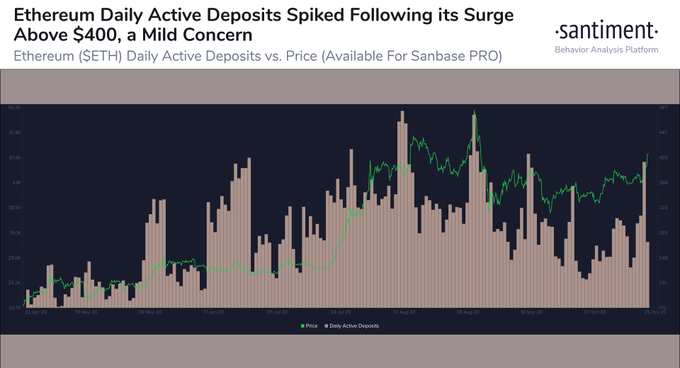

However, Daily Active Deposits (no. of unique deposits on Ethereum) has spiked a lot, a development that may lead to a selling outrage, eventually collapsing Ethereum’s rally.

Source: Skew

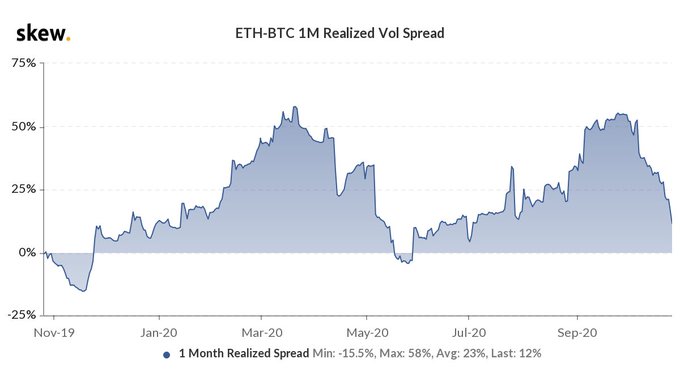

Further, as illustrated by the attached chart, the ETH-BTC 1-month realized volatility spread registered a sharp drop, indicating that Bitcoin’s price was more open to swings, when trading relative to Ethereum.

Can DeFi’s absence for Ethereum be tackled?

The long-term answer is Yes.

While DeFi had its allure for traders to incorporate transactions on Ethereum, it was likely just a summer bubble. Hence, the short-term rally in July 2020 raged towards the heights that it did.

While DeFi was a major reason behind Ethereum’s rally, it was equally responsible for the drop. DeFi tokens were already losing their grip on the community after several ‘rug-pulls’ questioned the space’s credibility. In fact, one can argue that it is a blessing in disguise for Ethereum that the present rally did not coincide with an active DeFi market. However, disregarding DeFi completely is also not ideal, since it does point to sensible forms of decentralized financial products for the future.

In fact, according to Lanre Jonathan Ige, a researcher at Amun AG,

“The mellowing in immediate hype for DeFi will be disappointing for the short-term trader but is likely good overall for the industry. The bubble over the summer was not sustainable but did show that various aspects of DeFi (lending, trading, DAOs) are actually useful for particular use cases.”

So, will Ethereum rally itself above $480 over the next 2-3 weeks? Possibly not.

However, if it does, it will be much more sustainable than the DeFi-backed rally of July 2020.