Ethereum: 521K ETH set to exit – Is $4K price target still possible?

Key Takeaways

Ethereum is staring down its largest exit queue since January 2024, with over 521k ETH lined up to unstake. ETH’s chart is flashing exhaustion, setting up for high-volatility chop in August.

Ethereum [ETH] holders are finally seeing their patience pay off.

ETH is up nearly 50% this month, ending a two-year trend of losses in July. It also surged past three major resistance levels, turning many early 2025 investors’ losses into gains.

Naturally, some profit-taking was expected.

But so far, no major flush. Price is still hovering above $3,700, and dip demand has been sticky. So what gives? Is the market maturing, or are we just in the calm before the next volatility spike?

Over half a million staked ETH set to exit

Since Ethereum flipped to Proof-of-Stake during the Merge in 2022, staking has been on a one-way climb.

Back then, around 14 million ETH was staked. At press time, it was over 36.1 million, with 600K ETH added this month alone. That means nearly 30% of the entire ETH supply is now locked up in staking contracts.

Validator count followed suit, hitting an ATH of 1,093,671 with +10k validators activated in July. But beneath the surface, validator churn is emerging, with 521,252 ETH now lined up to exit.

Simply put, a growing batch of validators (those who stake 32 ETH to help secure the network) are starting to tap out.

In fact, the active validator count has already dipped from 1.096 million to 1.092 million, marking a net drop of around 4,000 in just a few days.

It lines up almost perfectly with Ethereum’s monster rally, up 50% on the month. And now, nearly $1.9 billion worth of ETH is waiting to be unstaked, marking the biggest exit queue since January 2024.

Ethereum faces a key test

Beyond the spike in validator exits, Ethereum’s chart is starting to flash some real signs of fatigue.

We’ve got overbought signals flashing, dominance down 2.4%, Open Interest fading, and the ETH/BTC chart printing its longest red candle of the month, flagging rotation risk into Bitcoin [BTC].

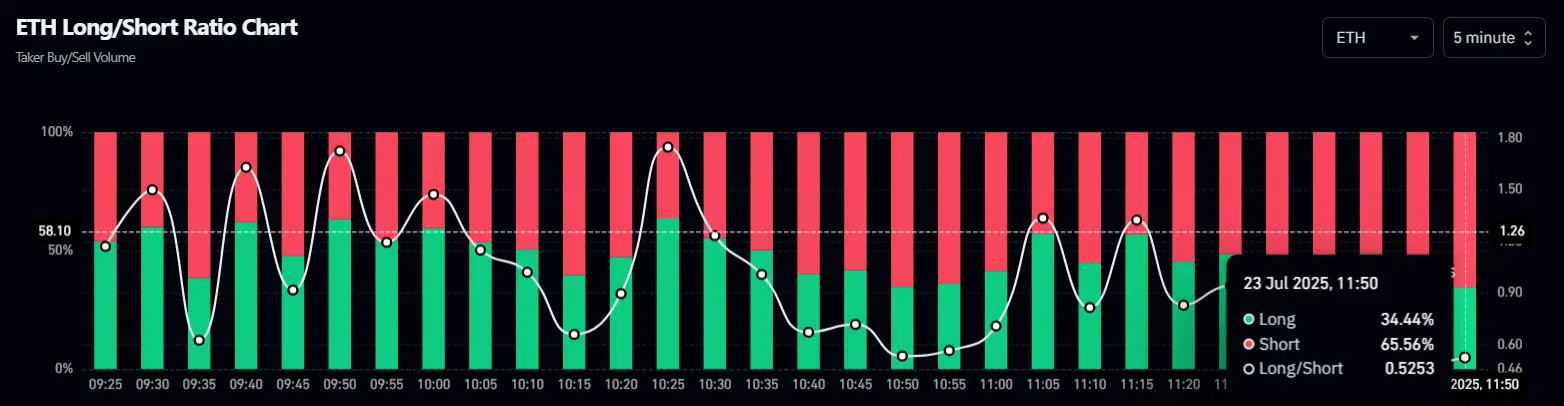

The $3,700 level is hanging in the balance, and positioning is turning bearish fast. Nearly 65% of accounts are skewed net short, suggesting traders are front-running downside continuation.

With Ethereum looking overcooked, profit-taking is starting to pick up, especially as traders look to lock in gains before volatility kicks off. That intensifies the wave of sell-side pressure hitting the market.

If buy-side liquidity dries up, the push toward $4k might get delayed, or worse, invalidated.

But if bulls treat this as a high-timeframe entry, scooping up supply on the dip, it could clear the decks for a fresh leg higher. Either way, August looks locked and loaded for some serious action.