ETH ETF stumble with $38M outflows, but Ethereum’s assets remain steady

- Ethereum ETFs faced $38M outflows, reflecting shifting market sentiment after weeks of steady inflows.

- Despite this, ETH’s price remained relatively stable.

Ethereum [ETH] ETF encountered a significant shift in investor behavior, with $38 million in outflows recorded last week.

This marked the first week of net outflows following five consecutive weeks of inflows, signaling a potential change in market sentiment toward Ethereum-based funds.

A closer look at ETH ETF outflows

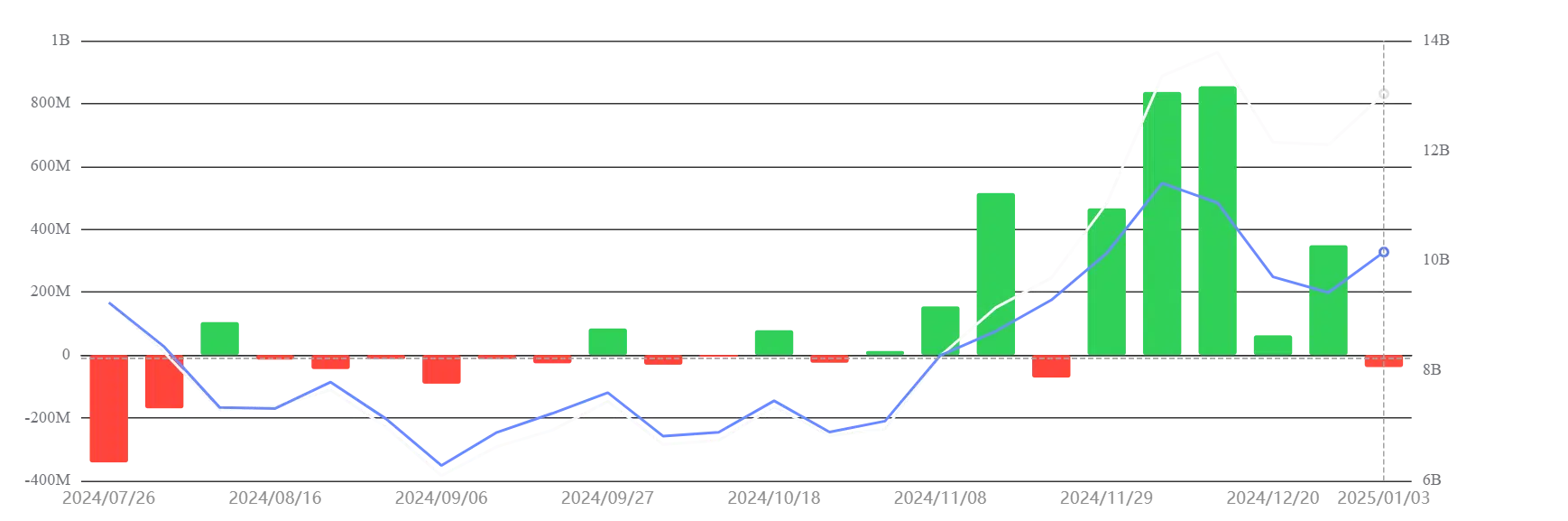

The weekly flow chart indicated a stark contrast from previous weeks, which saw substantial inflows, peaking in December 2024. The netflow surged to over $800 million during this period for two consecutive weeks.

Despite the recent outflows, Ethereum ETFs have accumulated a cumulative total net inflow of $2.68 billion over the past several months, reflecting steady demand during earlier periods.

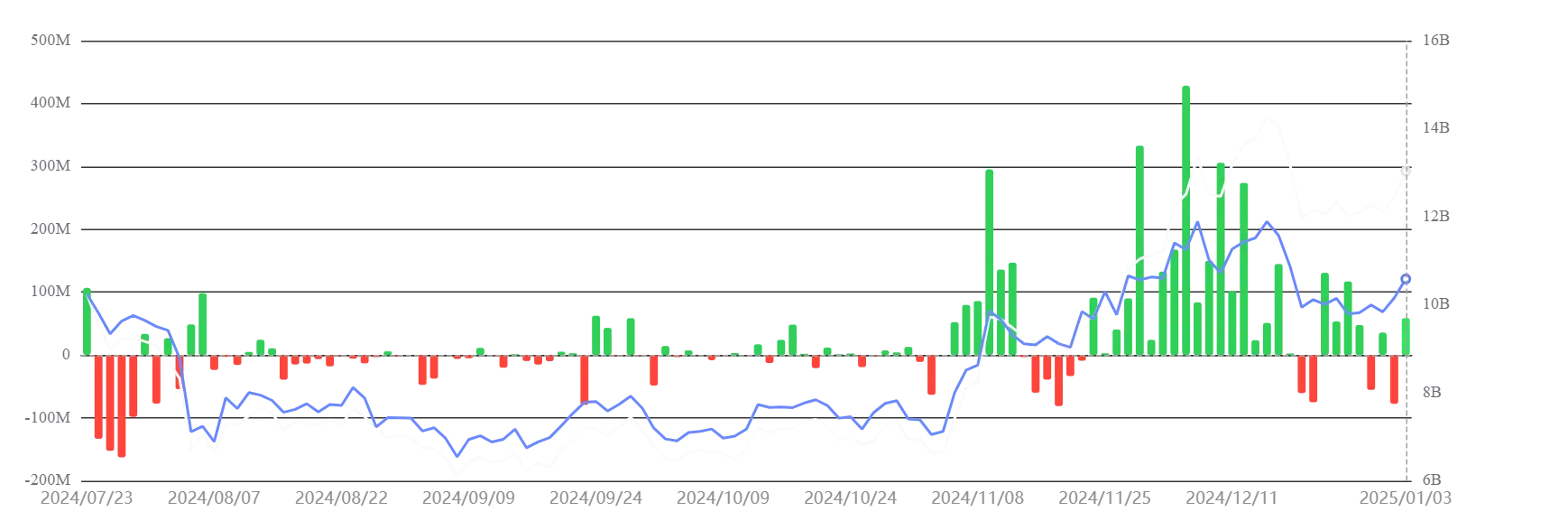

The daily ETF flow chart further emphasizes the gradual shift in momentum, with a notable red bar marking a significant single-day outflow.

ETH ETFs currently manage total net assets of $13.03 billion, which accounts for approximately 3% of Ethereum’s total market capitalization.

Despite the temporary setback, these figures underline the growing importance of ETFs in the broader Ethereum investment landscape.

Ethereum price analysis

Ethereum’s price remained relatively stable at press time, trading at $3,649.55. Technical indicators like the Money Flow Index (MFI) stood at 65.12, signaling ongoing accumulation despite ETF outflows.

The golden cross observed on the chart—where the 50-day moving average crossed above the 200-day moving average—indicated a long-term bullish trend.

However, the outflows suggest short-term caution among institutional investors.

Volume data highlighted a steady trading activity of 21.12K ETH, which may help Ethereum maintain its current price levels even as ETFs face reduced interest.

What’s driving the outflows?

The $38 million outflows could be attributed to several factors, including profit-taking after weeks of inflows and a strong price recovery.

Broader market volatility may have also triggered a shift in sentiment, leading to reduced exposure to Ethereum funds.

The reversal in ETH ETF flows underscores the fragility of market sentiment. While Ethereum’s price has shown resilience, the outflows may signal an early warning for potential corrections.

Read Ethereum’s [ETH] Price Prediction 2025-26

However, with a cumulative net inflow of $2.68 billion and total net assets of $13.03 billion, Ethereum ETFs remain a critical player in the evolving crypto investment landscape.

This setback might prove temporary, with inflows likely to resume as market conditions stabilize.