Dogecoin: What rising network activity means for DOGE

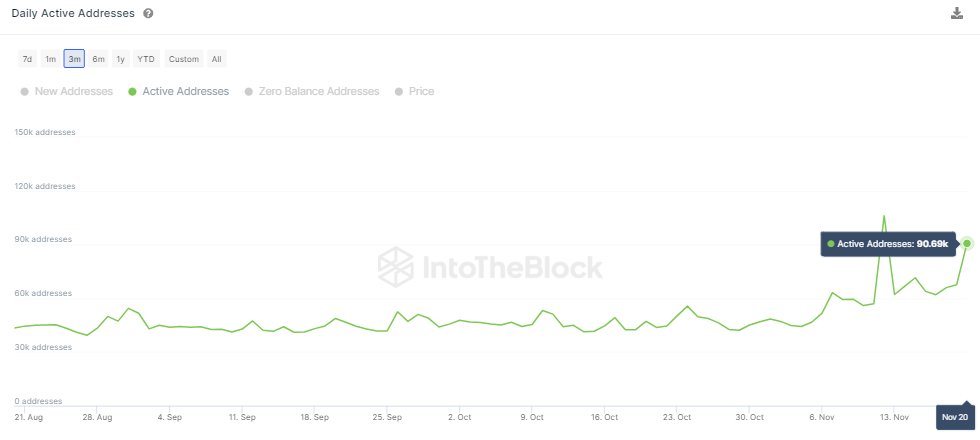

- The daily active address count jumped by a whopping 87% since early November.

- The transaction count hit 552.92K on 19th November, the highest since April 2021.

The upbeat sentiment on the broader crypto market altered the fortunes of memecoins as well. Market leader Dogecoin [DOGE] accumulated gains of more than 12% from the beginning of November until press time, AMBCrypto observed from CoinMarketCap’s data.

DOGE sees high network traffic

The bullish rally resulted in a drastic upswing in the memecoin’s network activity. The daily active address count jumped by a whopping 87% since early November, as per an IntoTheBlock post from 21st November.

The greater involvement suggested traders were aggressively selling and buying DOGE to flip quick profits.

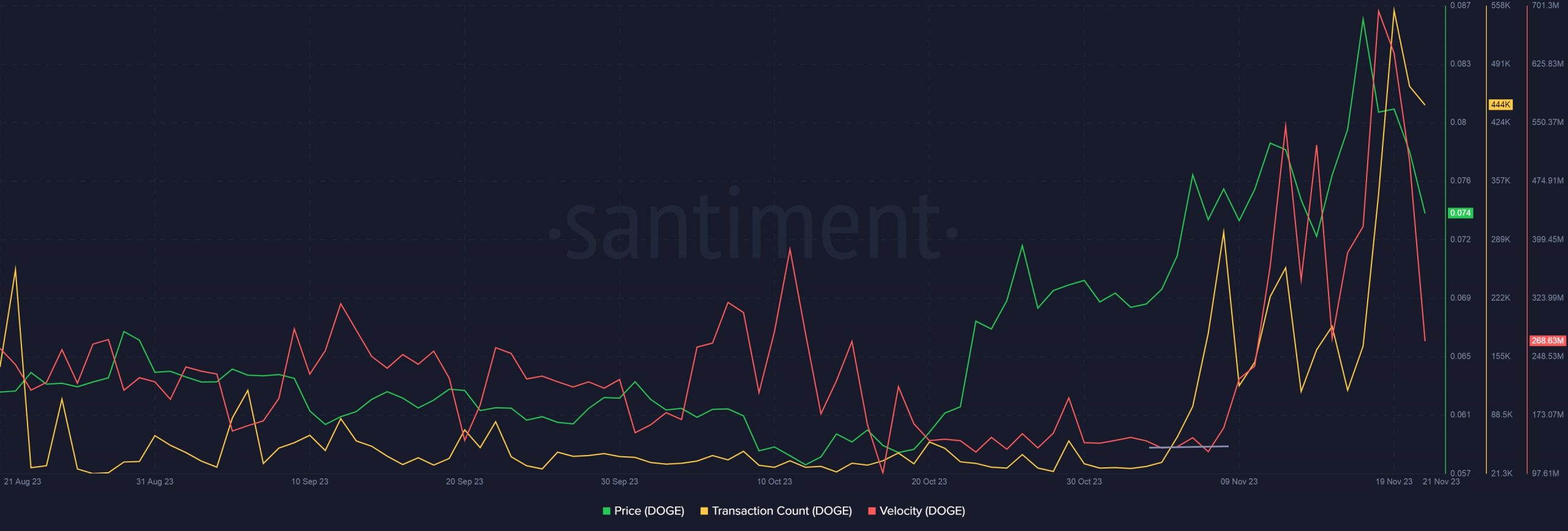

AMBCrypto tried to corroborate these findings with the help of Santiment data.

It was observed that the transactions on the network indeed increased in November. In fact, the count hit 552.92K on 19th November, the highest since April 2021.

Moreover, the frequency at which a single DOGE token exchanged hands spiked significantly, the reading of the Velocity metric implied.

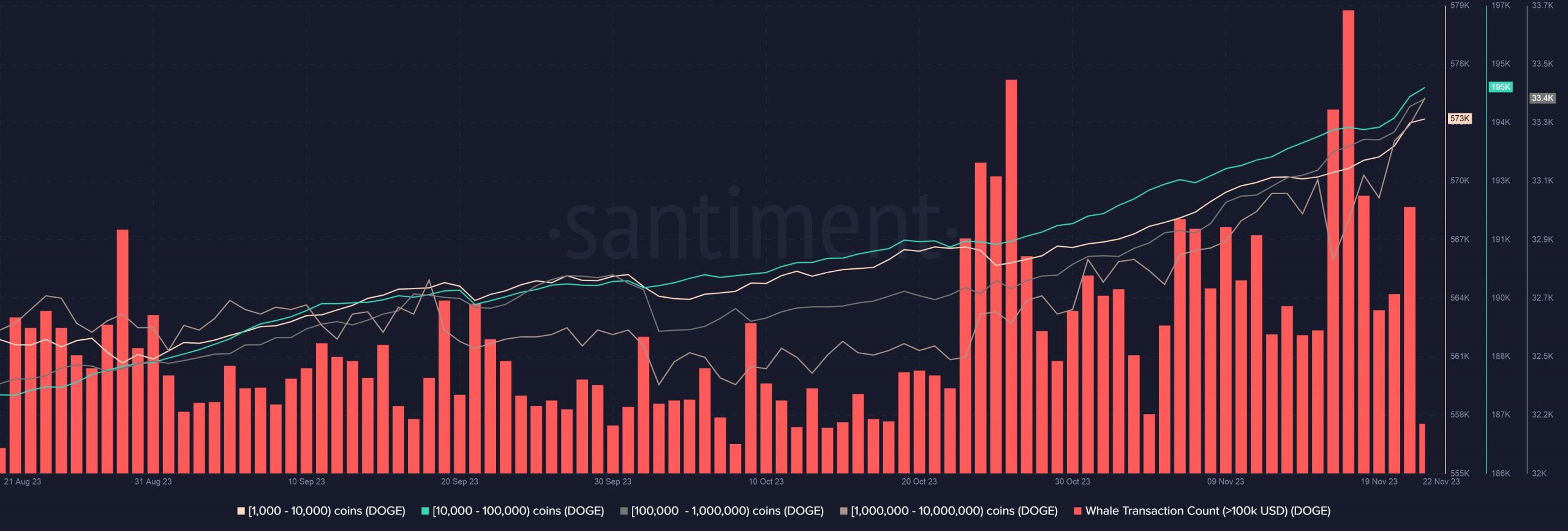

Whales turn their attention to DOGE

DOGE’s price pump also grabbed the attention of whale investors. When compared to the previous three months, the number of transactions worth more than $100K increased significantly in November.

The transactions were dominated by buyers as they led to an uptick in total whale holdings, AMBCrypto concluded after analyzing the supply distribution of DOGE wallets.

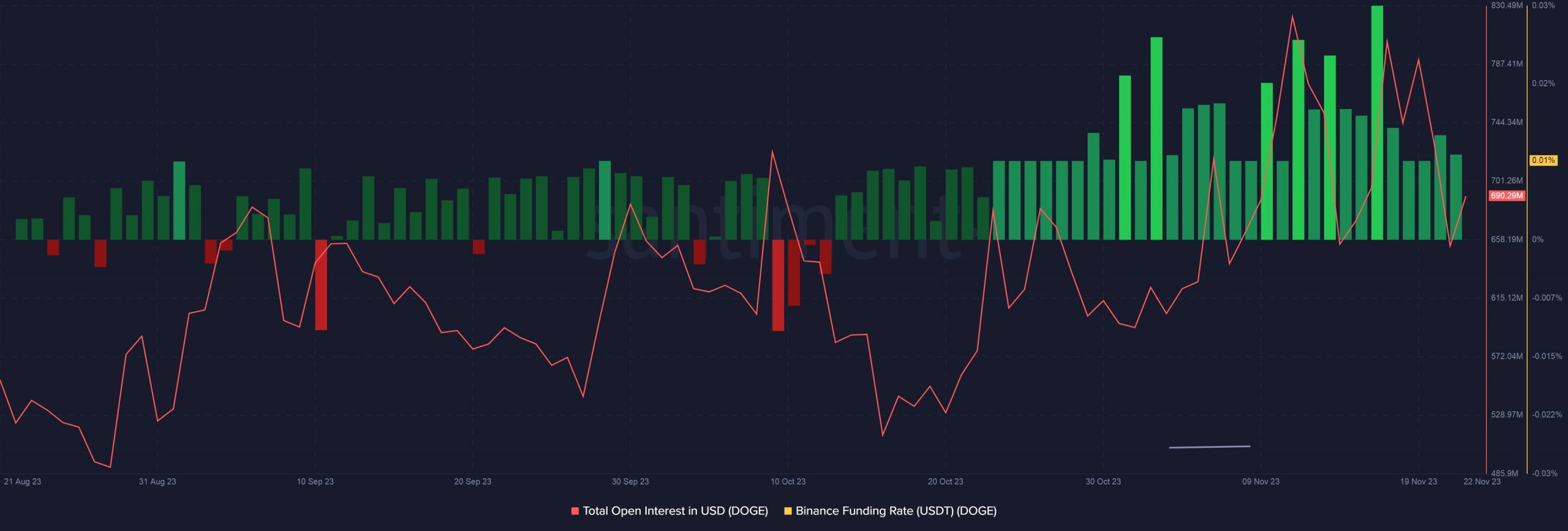

A glance at DOGE’s derivatives market

DOGE’s rally also caused a spike in its speculative interest. Open Interest (OI) in DOGE futures jumped 9.5% in November, suggesting fresh capital inflows into the market.

Furthermore, the funding rate on the largest derivatives exchange Binance has been positive in November. Typically, when the funding rate is positive and increases over time, it signals the dominance of bullish traders.

How much are 1,10,100 DOGEs worth today?

As of this writing, DOGE was exchanging hands at $0.07431, registering a 24-hour fall of 3.68%. The retracement was largely due to the ripples in the broader market due to developments involving Binance CEO Changpeng Zhao.

However, this didn’t cause a dramatic shift in investors’ sentiment regarding the memecoin. Most traders were still bullish on DOGE, as evidenced by Hyblock Capital’s Fear and Greed Index.