Dogecoin Crashed 15% in a Week: What’s Next?

The cryptocurrency market has witnessed a significant bull run since the beginning of the year, with memecoins gaining unprecedented popularity.

According to recent data from IntoTheBlock, the number of addresses holding meme coins for less than thirty days reached a record high last month, indicating a substantial influx of new traders investing in these digital assets.

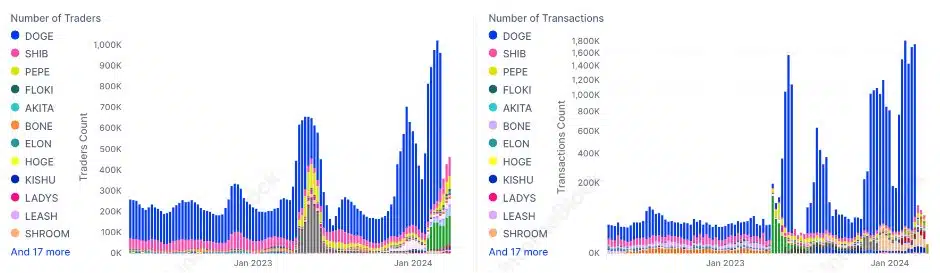

However, despite the overall memecoin frenzy, Dogecoin (DOGE), the leading memecoin in terms of both traders and transactions, has experienced a notable price decline in recent days. As of press time, DOGE was trading at $0.181, marking a 15.33% drop over the past week.

If the bearish trend persists, DOGE’s price could potentially fall further, reaching levels as low as $0.15949.

Technical indicators suggest a growing bearish sentiment among DOGE traders. The Chaikin Money Flow (CMF) has dipped to -0.11, signaling a prevailing outflow of money from the asset.

This implies that selling pressure is currently outweighing buying interest, contributing to the downward pressure on DOGE’s price. Moreover, the declining On-Balance Volume (OBV) confirms the presence of a downtrend, as it reflects diminishing trading volume alongside falling prices.

Despite the price decline, DOGE’s MVRV ratio remains high, indicating that many holders are still in a relatively profitable position. It remains uncertain whether these holders will continue to hold their DOGE or begin selling their holdings in response to the current market conditions.

Interestingly, the number of DOGE holders has surged despite the price fluctuations, which could potentially lead to a reversal of the bearish trend and a possible move towards the $0.2 level.

Other factors, such as the social popularity of DOGE and comments made by influential figures like Elon Musk, are expected to play a crucial role in shaping the future price movement of the memecoin.

As the cryptocurrency market continues to evolve, investors and traders alike will be closely monitoring the performance of Dogecoin and other memecoins to gauge the overall sentiment and potential for growth in this highly volatile sector.