DeFi’s staggering growth in TVL is a positive feedback loop

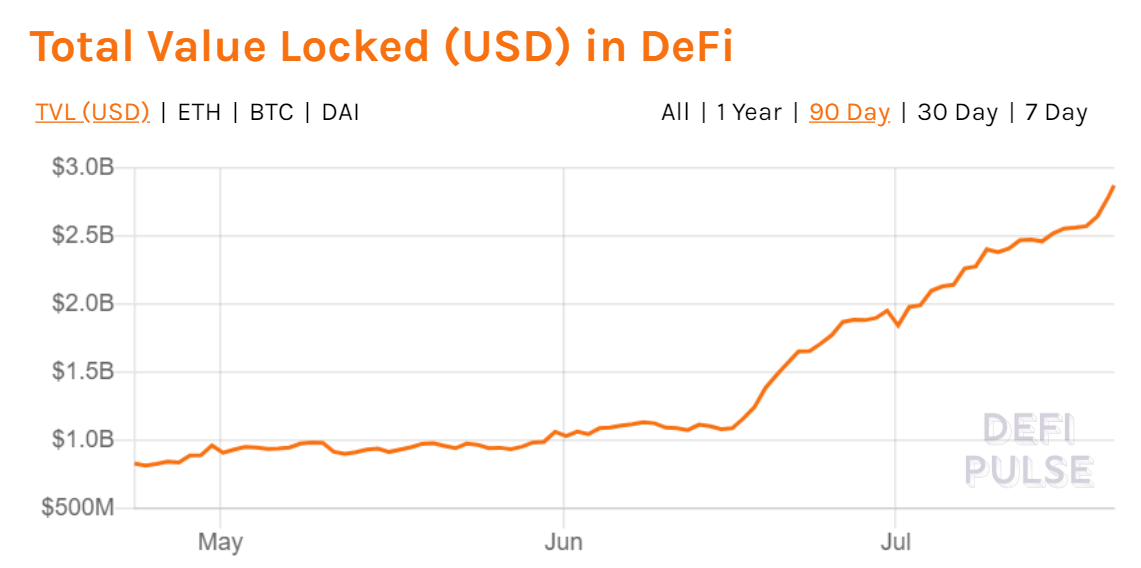

The DeFi ecosystem has come a long way since 13 March. After tumbling all the way down to $571 million in Total Value Locked (TVL) from a high of $1.28 billion on 15 February, all hope for its future seemed lost.

This was one of the reasons why no one could foresee the explosive growth in the DeFi markets, growth that would follow such a fall.

Since 13 March, TVL in DeFi has risen, now up to $2.85 billion, easily breaching its high of February 2020. DeFi tokens are expanding at such a meteoric rate that the market is rapidly on track to outperform Bitcoin’s performance.

The likes of Maker, Compound, Aave, and Synthetix have noted a massive influx of capital and the liquidity incentives off these assets continue to attract potential investors in the space.

However, without Ether’s price going up, many have failed to understand why the valuation of DeFi tokens was going up, which should technically be dependent on Ethereum. With the parent token stuck in a rut, the major reason came down to one key factor – Demand.

Yield Farming and Enormous Gains

In spite of common consensus, DeFi tokens are not dependent on Ether’s valuation as they are tokens that are based on the Ethereum blockchain, and Ether’s only functionality in the DeFi platform is to act as a medium to pay gas prices.

Investors are enjoying massive price dividends in this process, with major DeFi tokens recording at least 100% in gains over the last month.

However, the latest DeFi rally is largely due to Yield farming, and the foundation to that path was laid down by the launch of Compound’s governance token. It marked a new era of decentralized lending as the protocol took in funds from across the DeFI network and the TVL inflated by over $2 billion in lending.

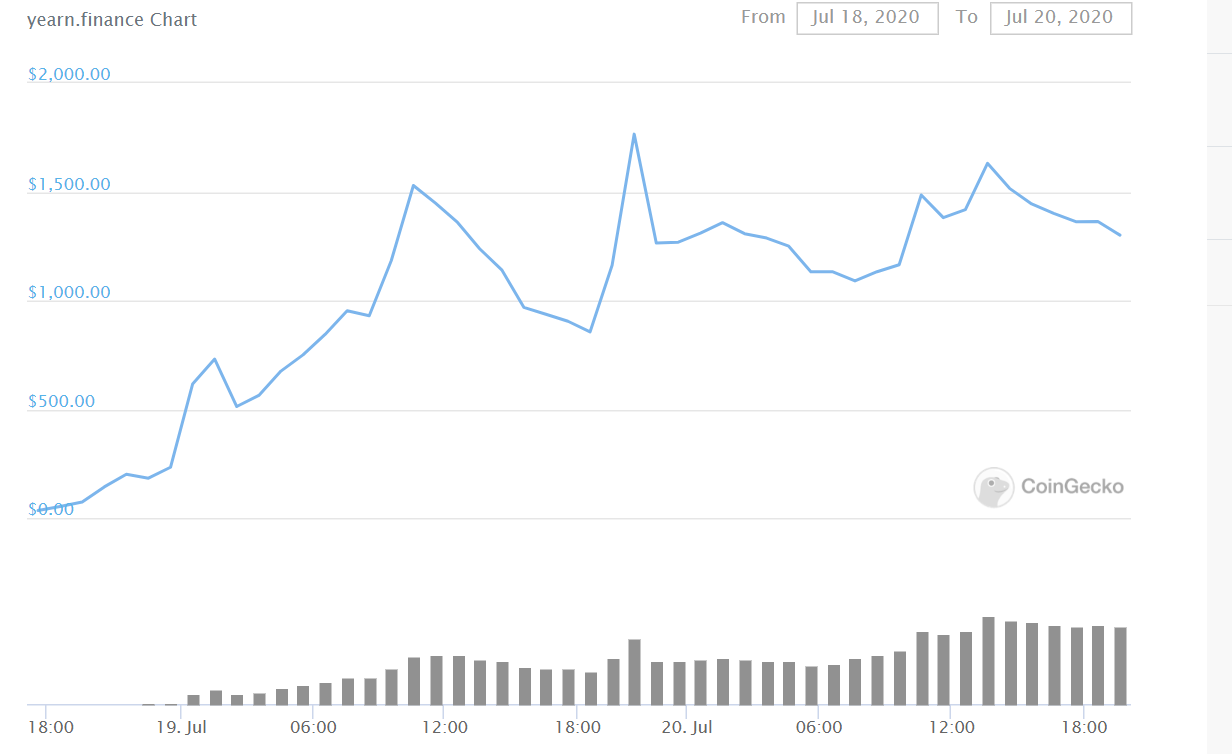

Now, the continuation of liquidity/yield farming introduced a new player in the game as iEarn Finance rebranded itself to yEarn Finance and launched its own governance token.

Slightly tweaking the blueprint of Compound tokens, YFI governance tokens have no pre-mined assets in order to further democratize the governance process. In fact, they have practically released 1000% APY for investors, making it the highest-earning pool in DeFi, at the moment.

YFI’s price went from $0 to over $1,700 at one point, giving yield farmers a return upwards of 1,200% APY. In fact, the token continues to sustain itself above $1,500, earning the continued attention of yield farmers.

YFI tokens are also the first form of governance tokens where even distribution was done at such a high rate and there was no pre-determined allocation to founders or existing investors.

A Positive Feedback Loop?

The rate at which investors are gaining off the DeFi market will stop at some point in time but right now, every development in the industry is leading to more growth.

In a sense, similar to a positive feedback loop, rather than being independent of each other, DeFi tokens are collectively improving the TVL figures, contributing to the valuations going up.

Investors are getting reeled in with assured gains and incentives, further pushing the TVL valuation, and right now, one act is taking place after the other.

It is difficult to anticipate how this positive feedback loop cycle will conclude, but the DeFi platform is becoming increasingly lucrative and hence, potential rumors of the space outperforming Bitcoin have a certain honest ring to it.