Crypto inflows show signs of recovery, but there is a problem

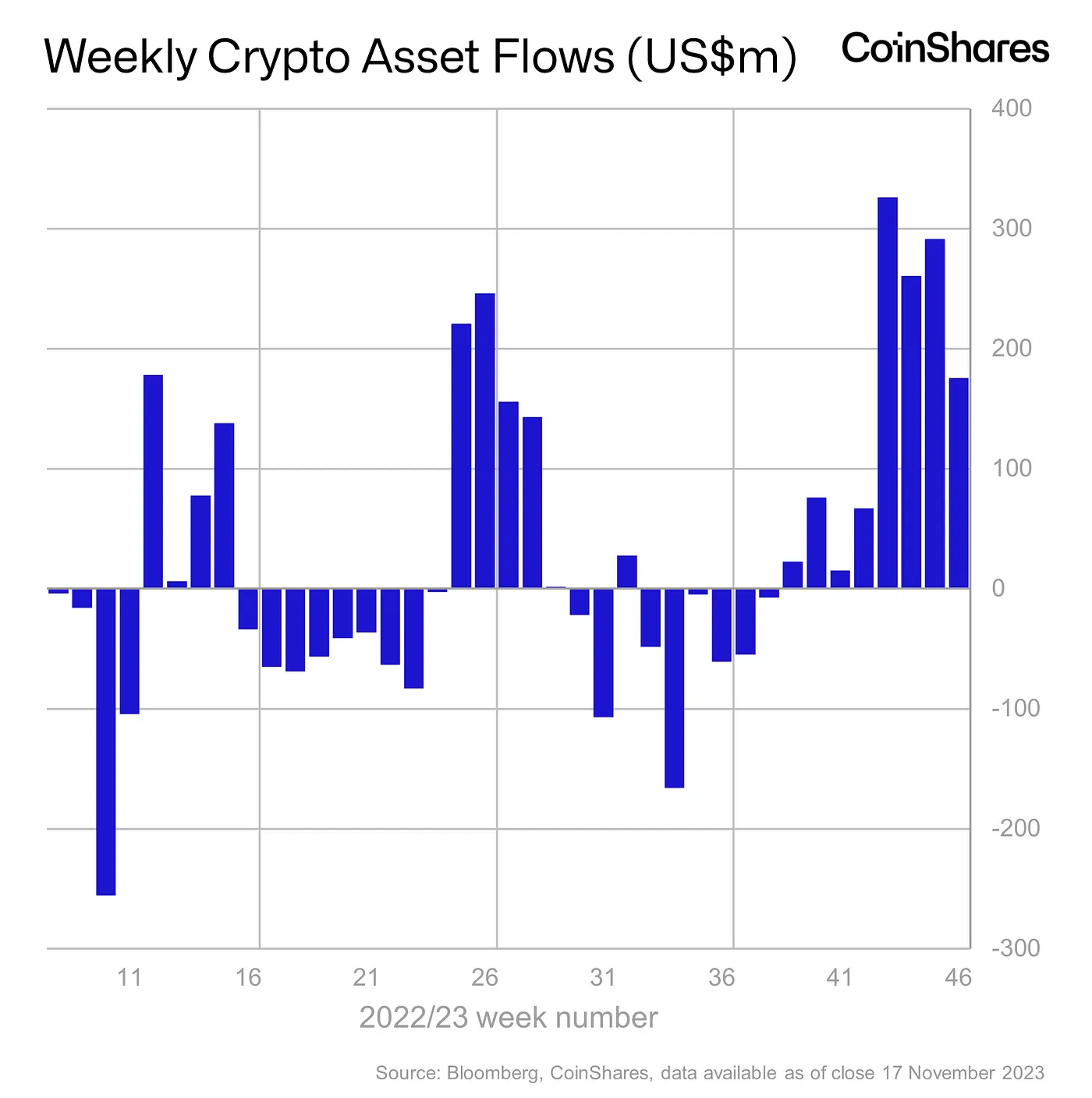

- The last eight weeks saw a steady flow of funds into crypto-backed investment products.

- However, the year-to-date figure remains significantly behind the numbers recorded in 2020 and 2021.

Last week’s inflows into crypto funds totaled $176 million, digital asset investment firm CoinShares found in a new report.

Although this represented a 40% decline from the $293 million recorded in inflows in the previous week, it marked the eighth consecutive week of inflows.

According to the report, the eight-week run of inflows brought the year-to-date (YTD) fund flow to a net positive of $1.32 billion.

However, with the year set to end in about six weeks, CoinShares noted that the current YTD inflows “remain(ed) well behind 2021 and 2020, which saw US$10.7bn and US$6.6bn, respectively.”

Further, CoinShares found that the week under review was marked by a rise in the total volume of cryptocurrencies traded through exchange-traded products (ETPs).

This suggested that investors became increasingly interested in using ETPs to gain exposure to cryptocurrencies.

“ETP share of total crypto volumes is rising, averaging 11% compared to the long-term historical average of 3.4%, and well above the averages seen in the 2020/21 bull market,” the asset firm said.

On a regional level, most of last week’s flows into crypto funds came from Canada, Germany, and Switzerland, with inflows of $98 million, $63 million, and $35 million, and $50 million, respectively.

Bitcoin domination continues

Last week, Bitcoin-backed investment products recorded inflows of $155 million. This represented 88% of all inflows seen in that week, pushing the coin’s YTD inflows to $1.2 billion, to mark an 11% uptick from the previous week’s YTD inflow of $1.08 billion.

Per the report, the last eight weeks of inflows into BTC investment products represented 3.4% of total assets under management (AUM).

During the week considered, BTC’s AUM totaled $31 billion, enjoying a 71% share of the entire market’s total AUM of $43 billion.

Regarding short-Bitcoin products, they recorded outflows of $8.5 million last week.

“We believe this continued positive sentiment is related to the imminent approval of a spot-based Bitcoin ETF in the US, we have written here about its potential price impact,” CoinShares opined on what might be the cause of the steady fund flows out of short-Bitcoin products.

Some alts led, while others followed

Altcoins such as Solana [SOL], Ethereum [ETH], and Avalanche [AVAX] recorded inflows of $13.6 million, $3.3 million, and $1.8 million, respectively, during the week considered.

On the other hand, Uniswap [UNI] and Polygon [MATIC] saw outflows of $550,000 and $860,000, respectively.