Bitcoin

Coinbase becomes a haven for Bitcoin holders amidst Binance’s troubles

Following CZ’s resignation from Binance, Coinbase has seen increased BTC inflow from the exchange

- BTC reserve on Coinbase has increased.

- BTC bears may have re-emerged, but bullish momentum persists.

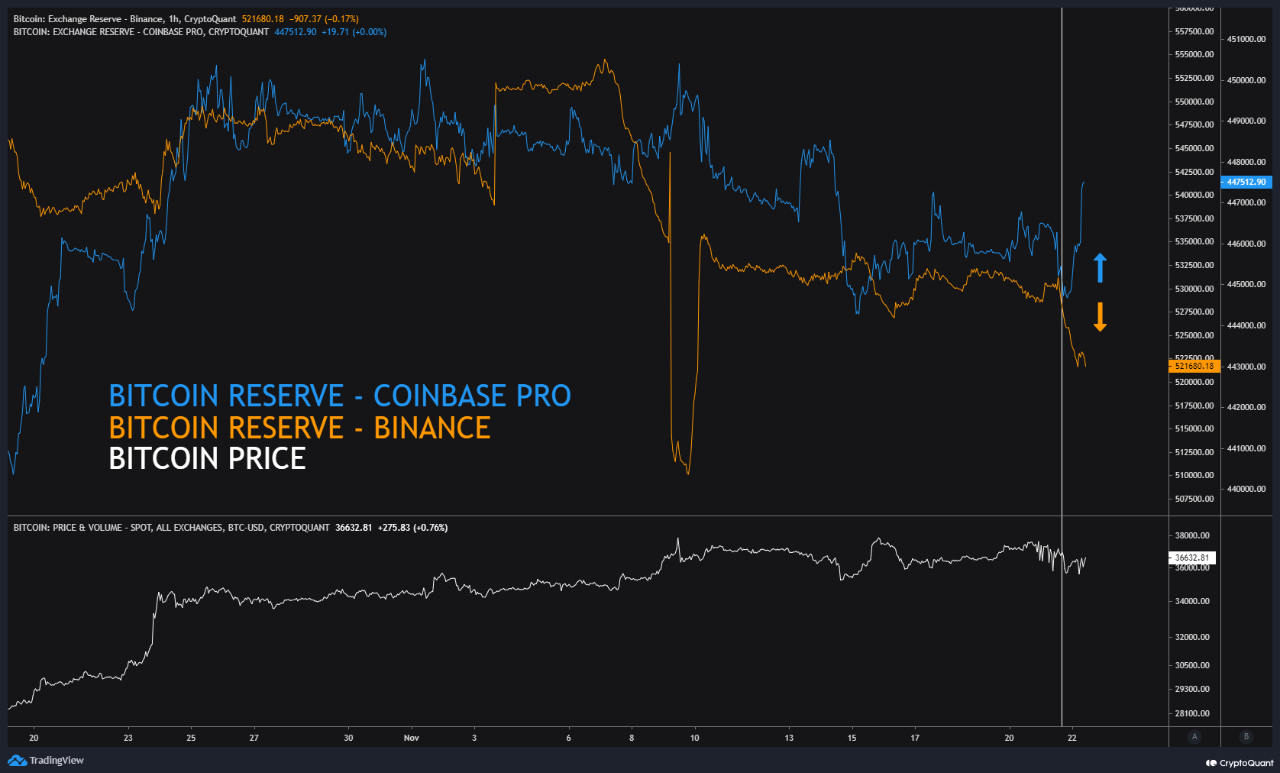

Huge fund outflows recorded on Binance following Changpeng Zhao’s resignation as its CEO have resulted in the depletion of Bitcoin’s [BTC] reserves on the exchange.

On 21st November, after news broke that Zhao had exited the company as part of the $4 billion settlement between United States regulators and his cryptocurrency exchange, the coin’s reserves on Binance declined by 5,000 BTC.

Investors, concerned about a potential bank run on Binance, have been turning to Coinbase for safety, resulting in a noticeable increase in its BTC reserves over the past 48 hours.

While Binance’s BTC reserve fell by 5000 on 21st November, Coinbase’s BTC reserve increased by 12,000 BTC.

In a recent report, pseudonymous CryptoQuant analyst Gaah even found that these coins were previously held on Binance.

Confirming increased activity on Coinbase in the last two days, its Coinbase Premium Index (CPI) rose by 100% between 21st and 22nd November.

The CPI is a metric that measures the difference between the price of an asset on Coinbase and Binance.

When an asset’s CPI value is positive and, in an uptrend, it indicates strong buying pressure among institutional investors on Coinbase.

As of press time, BTC’s CPI was 0.04.

Likewise, BTC’s Coinbase Premium Gap saw an increase after Zhao confirmed his announcement. It measures the difference between BTC’s price on Coinbase Pro and Binance

When this indicator returns a positive value and rises, it means that BTC is trading at a premium on Coinbase Pro.

Bear activity kept at bay

Following an extended period of rally, the bears regained control on 6th November, the coin’s Moving Average Convergence/Divergence indicator (MACD) showed.

On that day, the MACD line crossed below the trend line, ushering in a new bear cycle. Since then, the volume of daily accumulation amongst spot market participants has suffered a noticeable decline.

Read Bitcoin’s [BTC] Price Prediction 2023-24

BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) indicators have since trended downward as profit-taking activity gains momentum.

However, these indicators still rest above their respective center lines, suggesting that the bulls are yet to be completely displaced.