Cathie Wood bets $182 mln on Ethereum treasury giant BitMine: Here’s why

Key Takeaways

Cathie Wood’s Ark Invest bought $182 million stake in ETH treasury giant BitMine. This followed Peter Thiel’s Founders Fund’s 9% stake bid — What’s the end goal?

Ark Invest’s CEO, Cathie Wood, has doubled down on Ethereum [ETH] via public ETH treasury company, BitMine Immersion Technologies (BMNR), led by Tom Lee.

On the 22nd of July, the asset manager revealed that it acquired $182 million of BMNR common shares to enable Lee to ‘further advance its ETH treasury strategy.’

Emphasizing the move, Wood added that it was a ‘vote of confidence’ that Lee will be ‘one of the winners’ in the Ethereum-powered digital asset treasury (DAT) space.

She viewed DAT as the incoming disruptor and primitive for on-chain capital management.

“These companies could be the next-gen asset managers in the on-chain capital markets age.”

Lee acknowledged Ark Invest’s bet, linking it to the ‘exponential opportunity’ amid the expected stablecoin and tokenization boom.

“Cathie Wood’s ARK Invest is taking a substantial stake in BitMine as she sees the exponential opportunity ahead as we target reaching 5% of ETH.”

ETH treasury frenzy impact

BitMine, as of press time, has acquired 300.7K ETH worth $1.11B at current prices and surpassing Ethereum Foundation stash of 238.5K ETH.

Last week, serial tech investor Peter Thiel-backed Founders Fund acquired a 9% stake in BMNR, underscoring that these visionary leaders might know something that most of the market is yet fully grasp.

In fact, besides BitMine, other billion-dollar ETH treasury contenders are SharpLink Gaming ($1.33B) and The Ethereum Machine with a commitment of $1.5B for its strategy.

ETH demand surge 32x, $20B inflows expected

Interestingly, this corporate ETH treasury frenzy started in mid-May and has been the missing ‘demand’ piece for ETH price surge, noted Bitwise CIO Matt Hougan.

The CIO stated that ETH has experienced a ‘demand shock’, expanding 32x since mid-May, boosting the explosive recovery.

“ETPs and Corporate Treasuries have combined to buy 2.83 million ETH since May 15—more than $10 billion at today’s prices. That’s 32x net new supply over the same time period.”

Hougan added that the trend will continue provided firms’ stocks trade at a premium to the crypto assets’ value they hold.

Collectively, he projected these factors could attract about $20B inflows (about 5.3 mln coins) into ETH at current values.

“Meanwhile, the network is expected to produce roughly 0.80 million ETH over the same period. That’s ~7x more demand than supply.”

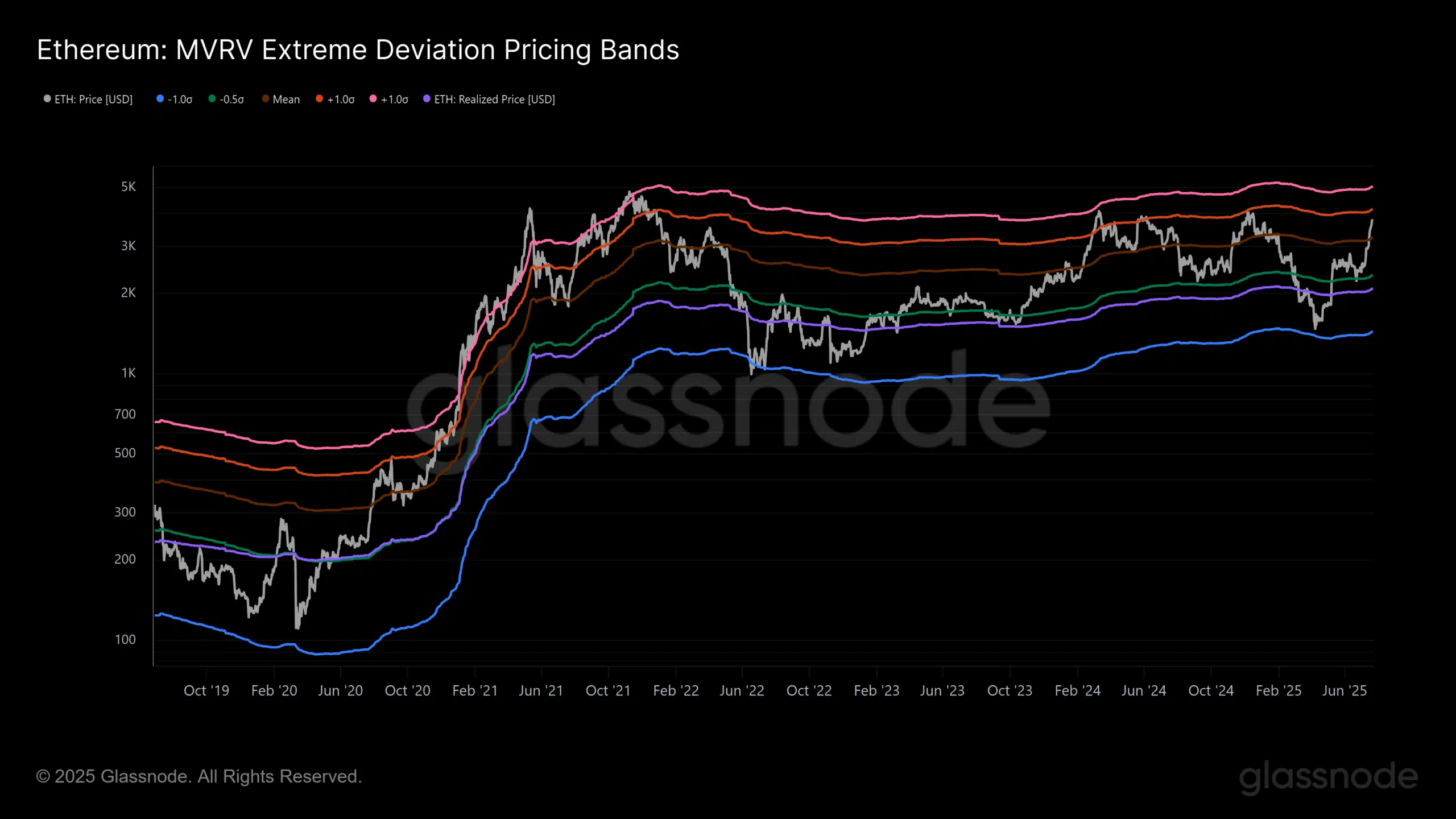

Meanwhile, Glassnode’s MVRV extreme deviation pricing bands marked out $4.1k and $5.0k as the key upside targets in the mid-term. In a downside scenario, $2.3k and $3.2k were key levels to track.