Cardano’s silent potential: Why ADA could surprise investors in 2025

- For ADA to break its cycle and grow, it needs renewed interest from retail investors.

- But for ADA to seize this opportunity, it needs to keep consolidating.

A month has passed since Cardano [ADA] broke the $1 mark, but despite the initial hype, its momentum has been steadily declining.

However, there’s a silver lining – high-cap coins are slowly turning green. It’s clear that the market is regaining its footing after being shaken by the volatile speculation surrounding 2025.

But as we step into the ‘new year,’ can ADA rebound? Two key factors point to a potential turnaround: the strong faith of whales and ADA’s ongoing consolidation, which may be setting the stage for a bullish Q1.

What are the odds?

ADA needs a surge of fresh FOMO

Since 2022, ADA has faced an uphill battle, much like other altcoins. The “Trump pump” offered a momentary lifeline, but it was short-lived.

In fact, the real challenge began after it hit its yearly high of $1.25 – a peak that prompted a massive exodus of profit-takers.

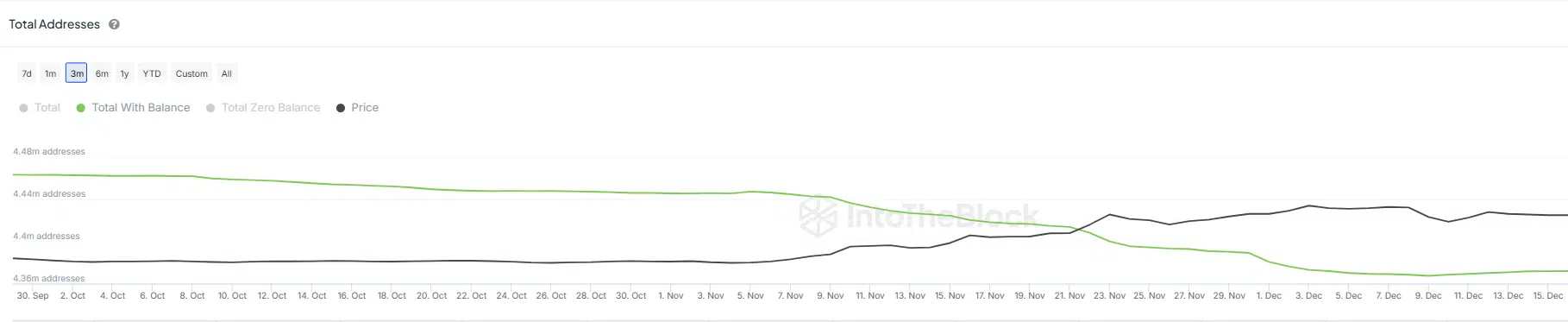

What’s surprising is the lack of FOMO. Instead of gaining traction, ADA’s holder base has shrunk, slipping from 4.46 million addresses in early Q4 to 4.37 million now.

Also, there was a noticeable drop after crossing the $1 mark.

While patient HODLers seized the chance to cash out, fresh capital hasn’t flowed into the network. This gap has kept ADA stuck in the red, despite solid whale backing.

As a result, ADA has struggled to break free from its weekly lows.

This becomes especially concerning when you look at the hard data: 71.16% of Cardano’s total supply was held by retail investors at press time, with 25.77 billion coins.

Meanwhile, whales held just 8% of the total supply.

Why does this matter? On a psychological front, retail investments are often driven by “external” trends, such as social media hype or short-term speculation.

Simply put, their quick exits following profits – or fear of loss – creates a volatile cycle.

Even though whales continue to hold, their smaller share of the supply means they can’t tip the market at their will. For ADA to break out of this stagnation, it needs a new wave of retail interest.

Yet, there is a silver lining

Despite the bearish on-chain signals, there’s a silver lining for ADA. Over the past week, whales have been accumulating, and ADA has entered a consolidation phase – a key bullish sign given current market conditions.

Why is this important? When retail FOMO re-enters the market, combined with whale support keeping ADA from a deeper pullback, the stage could be set for a major Q1 rebound.

Right now, with Bitcoin in a bearish phase, investors are playing it safe and hesitant to diversify. This gives ADA room to grow, especially with its neutral RSI.

Read Cardano’s [ADA] Price Prediction 2025-26

But for ADA to seize this opportunity, it needs to keep consolidating. If it does, it could ignite the FOMO cycle, setting the stage for big returns.

With Q1 expected to be volatile, if the right conditions hold, ADA could be poised for significant gains. Keep an eye on it – it may surprise us all.