Cardano: Are there any positives to ADA’s bearish signals?

- An analyst expressed skepticism about the network’s current state.

- Price of ADA fell, while short interest in ADA grew.

Cardano’s [ADA] price movement has been negative since the past month, which has impacted many optimistic holders. Many believe this trend will continue and ADA will not see a reversal anytime soon.

A bearish stance

Adding to the negativity, an analyst from K33 Research recently presented a bearish perspective on Cardano, expressing skepticism about the network’s current state.

Some Cardano supporters may counter this viewpoint by highlighting the average of around 90,000 daily transactions.

However, the analyst argues that equating blockchain transactions to meaningful transactions may not be accurate. This was because the Cardano Network primarily sees exchange transfers and a group of holders potentially inflating blockchain activity.

One notable aspect the analyst pointed out was the stablecoin situation on Cardano.

Stablecoins are crucial for DeFi altcoin trading, and the absence of prominent stablecoins like USDT or USDC on a network could indicate a lack of meaningful DeFi activity.

The analyst emphasized that there were no USDT or USDC present in the Cardano network. Instead, there were Cardano-based stablecoins, totaling 20 million, which are collateralized by Cardano and have fallen in value.

Market comparisons

The analyst argues that Cardano lacks the potential to become significant due to its historical lack of traction despite its lengthy existence.

Many projects start with no traction, promising advancements with tech upgrades or partnerships, but eventually fail.

Successful blockchains evolve over time, while those with grand ideas and subsidized bootstrapping tend to fade, as seen with IOTA, NEO, EOS, Concordium, and others.

He attributes Cardano’s current market value of $19 billion to its well-established status and availability on various exchanges, including smaller local ones.

The coin’s failure to rally along with stronger smart contract tokens during market improvements was also viewed as a strong indicator of its declining status.

At press time, ADA was trading at $0.537667 and its price had fallen by 1.88% in the last 24 hours.

Is your portfolio green? Check out the ADA Profit Calculator

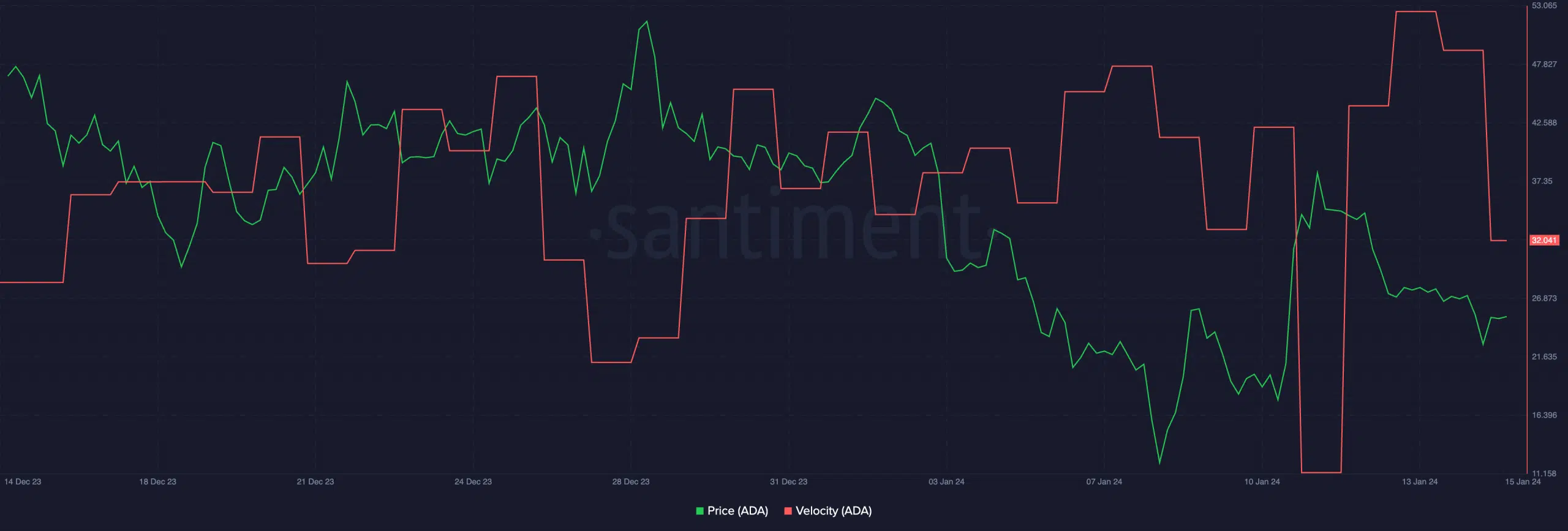

The velocity at which ADA was trading also fell. This indicated that the frequency at which ADA was trading decreased materially in the last few days.

Moreover, the percentage of short positions taken against ADA had also reached 51.2%. This showed that more traders were expecting ADA’s price to fall.