Cardano at a crossroads – Factors that must align for ADA to breakout

- Whales added over 40 million ADA in the last 48 hours, signaling strong bullish momentum.

- Key resistance at $1.20 could define ADA’s next breakout, backed by solid whale activity and on-chain support.

Cardano [ADA] has seen a sharp uptick in whale activity, signaling growing confidence among large holders as the token traded near $1.10.

Over the last few days, whales have accumulated more ADA tokens, showing a bullish sentiment. But is this growth being reflected across the board?

Cardano holds key levels

Cardano’s Whale Momentum Waves indicator showed a clear uptick in accumulation trends.

This increased buying pressure was also reflected in the Accumulation/Distribution (A/D) line, which remained at 12.18 billion at press time.

These movements highlighted the growing conviction among large holders that ADA could see further price appreciation soon.

Key resistance zones

Cardano’s trading volume has fluctuated significantly over the last few weeks, with spikes aligning with whale accumulation and price surges.

Santiment’s volume chart analysis reflected a cooling off after earlier highs in late December. This suggested that ADA was in a consolidation phase.

However, this consolidation is occurring with strong support near $1.00, a level fortified by whale buying activity.

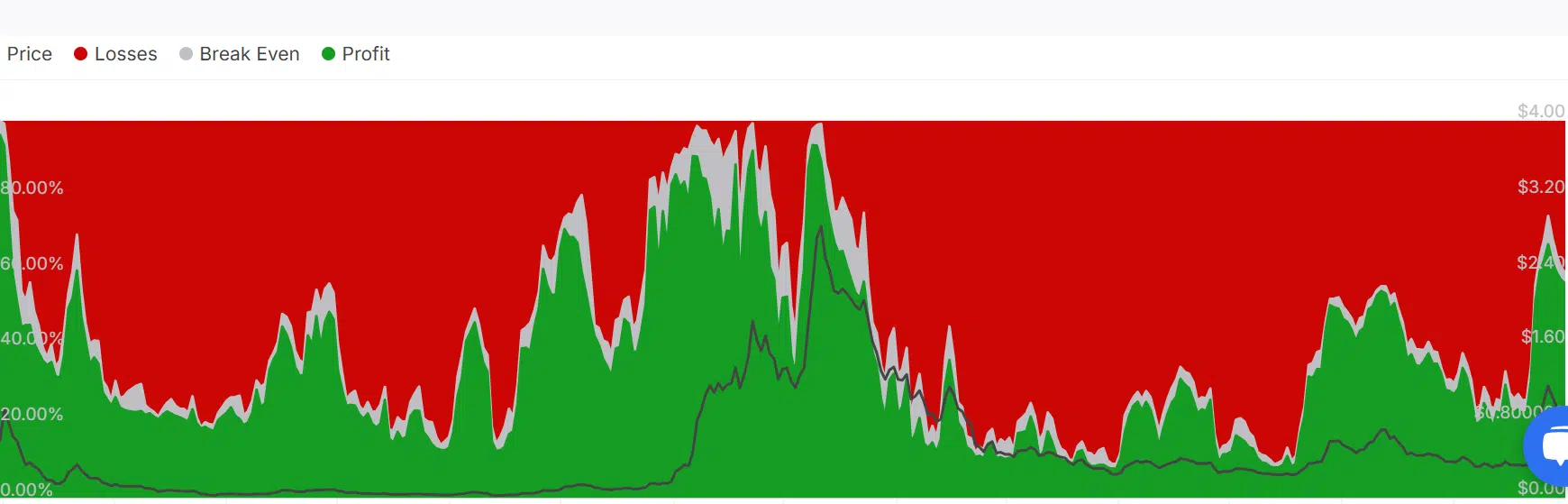

The “In/Out of the Money” chart from IntoTheBlock revealed that approximately 40% of ADA holders were in profit at the press time price level, while the remaining 60% were either at breakeven or in loss.

This indicated that many investors may be incentivized to sell at key resistance levels, particularly around $1.20.

Breaking through this psychological and technical barrier will require a significant uptick in volume and continued whale support.

Profit and loss shows sentiment at current levels

The “Profit and Loss” distribution chart added another layer of insight, revealing that most Cardano holders in profit accumulated their tokens at lower price levels, primarily between $0.80 and $1.00.

This strong support base reduces the likelihood of a sharp sell-off, as investors holding at a profit are less likely to panic sell unless faced with significant macroeconomic or market shifts.

At the same time, the sharp increase in whale buying suggests that these large players view ADA as undervalued or strategically positioned for a breakout.

Their recent accumulation reinforces the importance of the $1.20 resistance level as a turning point for bullish momentum.

Cardano positioned for a critical move

Cardano’s market dynamics are underpinned by strong whale accumulation, solid on-chain support, and steady trading volumes.

The addition of over 40 million ADA to whale wallets in just 48 hours underscores the confidence of large investors.

Is your portfolio green? Check out the ADA Profit Calculator

However, for ADA to break through its critical $1.20 resistance, it will need sustained volume growth and a continuation of the bullish narrative supported by whale activity.

As ADA consolidates near $1.10, traders should watch for further signs of accumulation and increasing volume to confirm the next move.