Can Ethereum note full recovery or will it test support at $172 again?

After registering major losses over the course of the Black Thursday price crash in March, Ethereum has since been steadily inching closer to 100 percent recovery. Ethereum’s price movement has been on an uptrend for some time now, but for how long will the bullish sentiment sustain itself for the world’s second-largest cryptocurrency? Right now, this seems to be a very popular question.

At press time, Ethereum was trading at $212 and registered a market capitalization of $23 billion. Over the past 24 hours, Ethereum noted a trading volume of $19 billion.

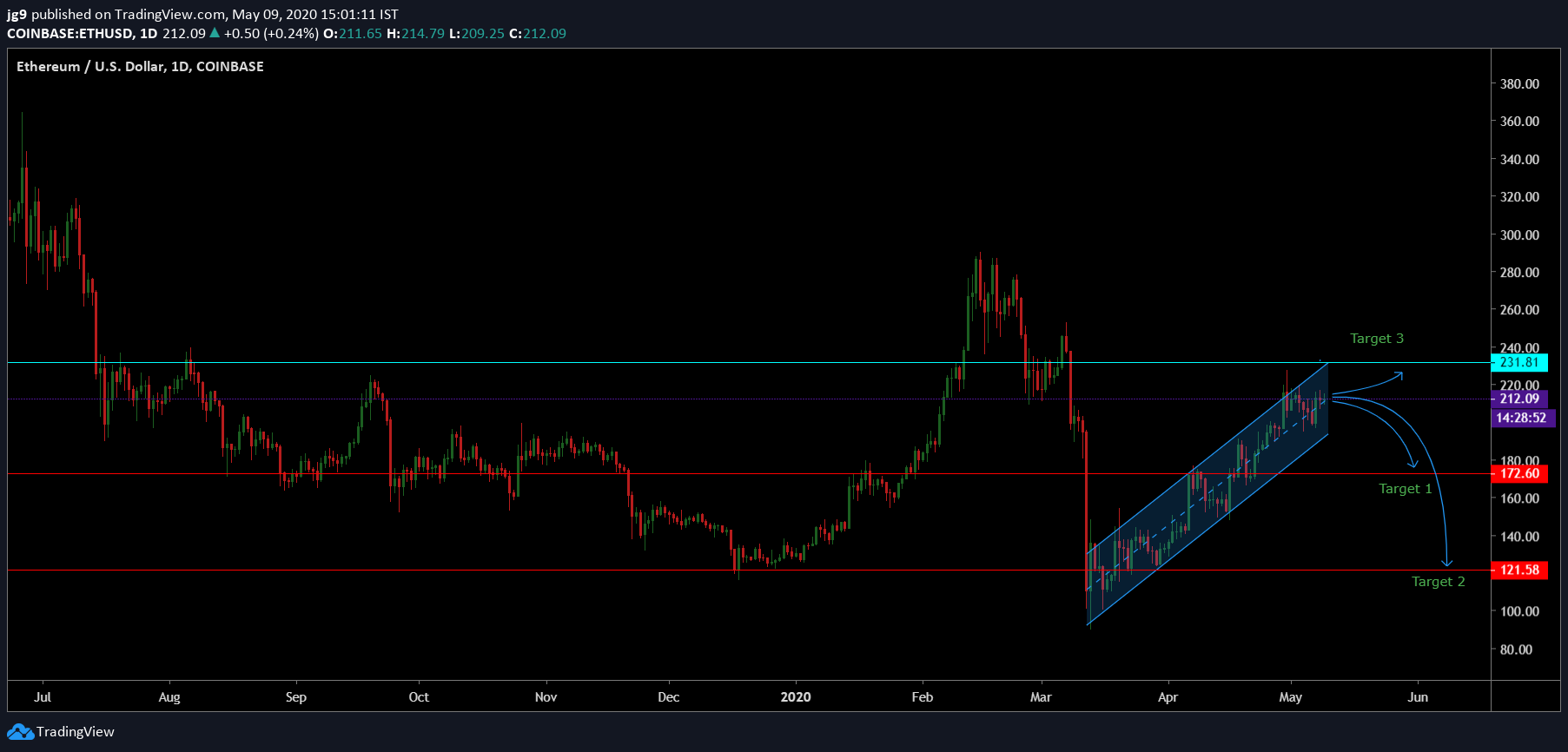

1-day chart

Source: ETH/USD, TradingView

As per the 1-day chart, Ethereum’s price has been in an ascending channel for close to two months now. In such a scenario, the price of Ethereum is likely to see a drop, as is the expected breakout for the price after such a price formation.

At the time of writing, for Ethereum, there were two crucial supports that had been tested in the past at $172 and $121, if the uptrend were to conclude. When the price breakout is complete, it will likely head towards Target 1 during the course of the next few weeks. However, if the uptrend were to continue for longer, the price might reach the resistance at $231 in the next few days.

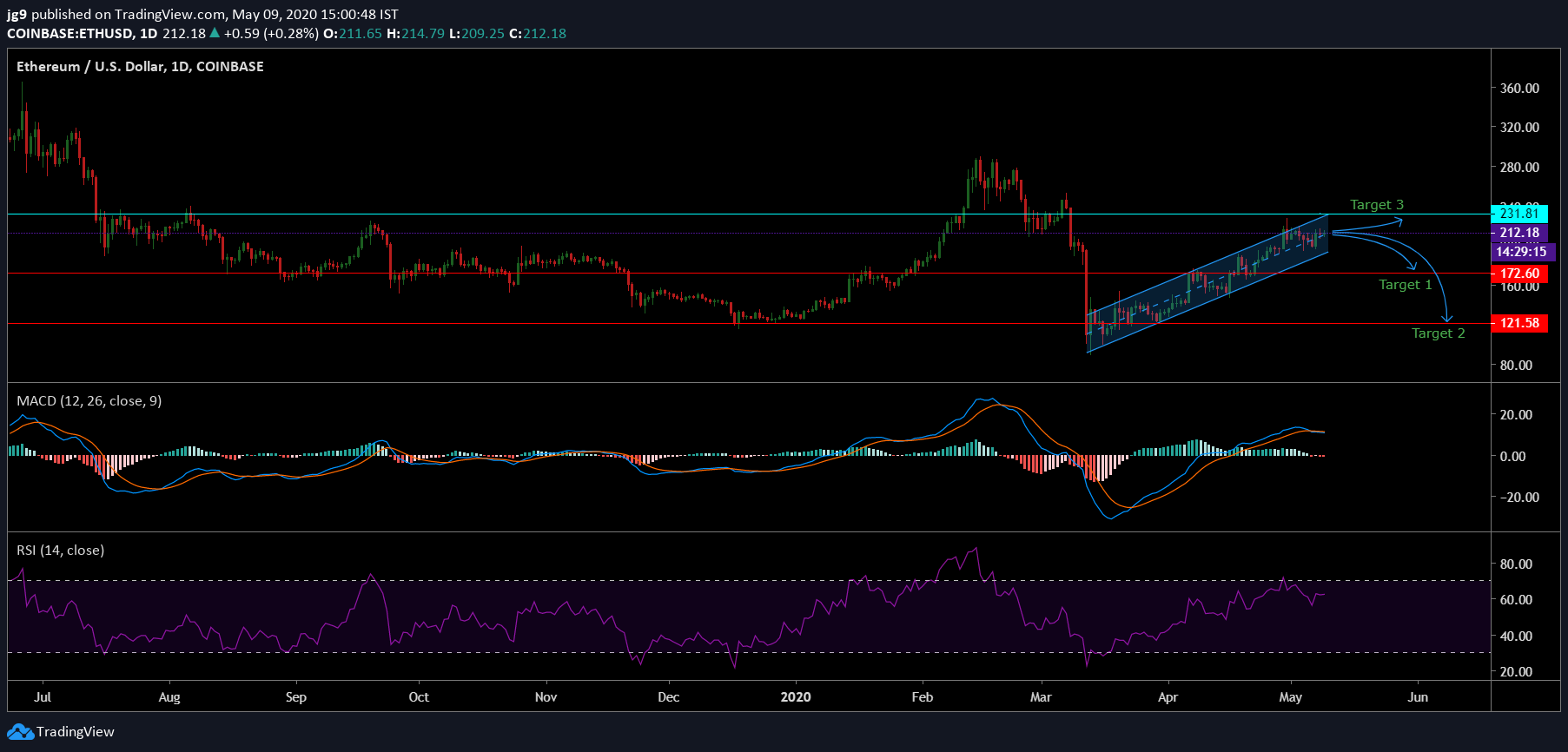

Source: ETH/USD, TradingView

On the 1-day chart, the MACD indicator had just undergone a bearish crossover as the signal line had just moved above the MACD line. The RSI indicator, on the other hand, continued to be closer to the overbought zone.

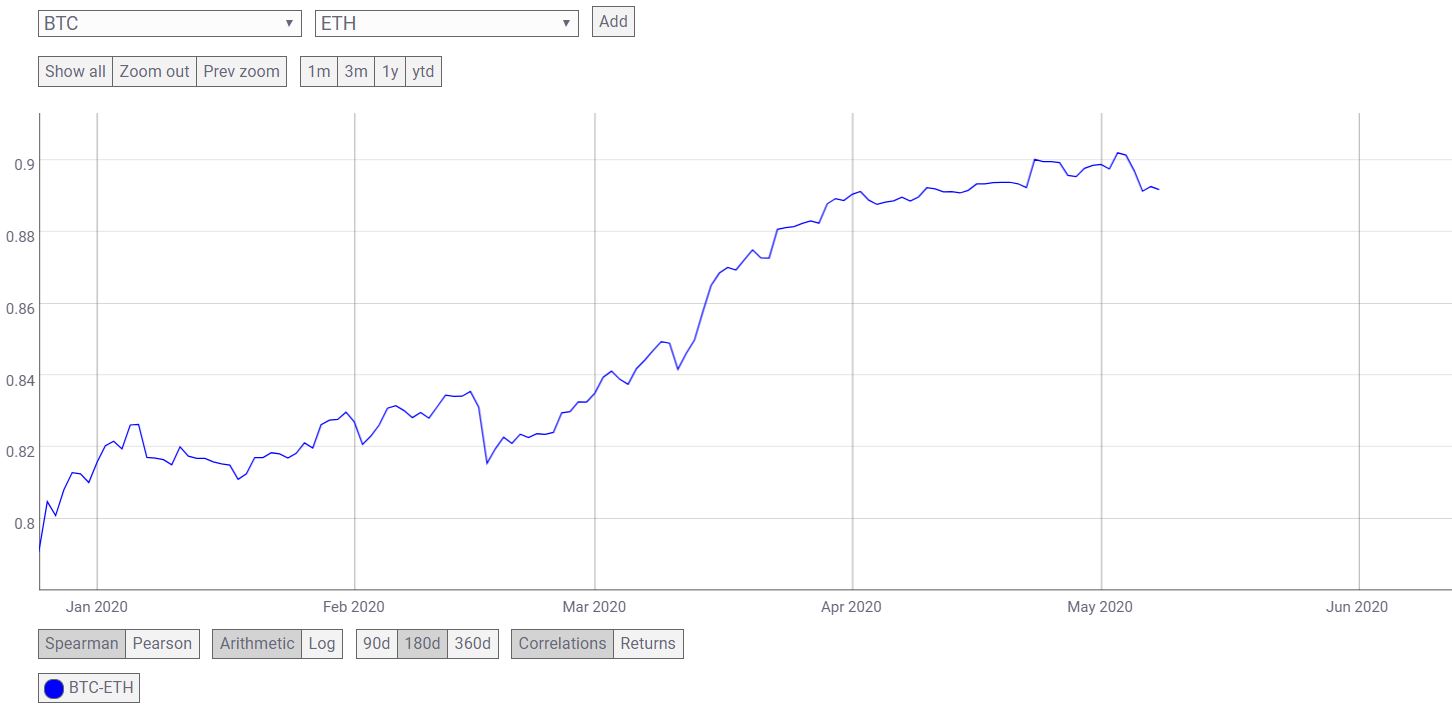

Source: CoinMetrics

Since the start of the year, for Ethereum, its correlation with the most dominant cryptocurrency – Bitcoin, has continued to increase rather steadily. Over the past three months, the correlation has increased from 0.82 to close to 0.9.

Conclusion

Ethereum’s price is likely to see a slump over the course of the next few weeks and is likely to head towards Target 1 at $172, resulting in a drop in value close to 20 percent. For Ethereum, even if the coin’s price heads towards Target 3 in the short-term i.e. in the next few days, the ascending channel’s expected breakout dictates that Ethereum will soon endure a drop in price.

However, the unlikely scenario remains, one wherein Ethereum surges ahead towards Target 3 at $231 mark and breaches the resistance which would also result in a complete recovery for the price since March. On the other hand, if the bearish pressure were to increase significantly, ETH may even find itself going past the first support and heading towards $121.