Bitcoin

Can Bitcoin counter and hedge against market-specific risks?

Bitcoin’s value proposition as a hedge and a long-term investment vehicle seems to be the overarching narrative the king coin is relying upon after its decade long existence. The same can be said to be the key driver for greater institutional investment as well. However, with growing uncertainty in the economy thanks to the pandemic, Bitcoin may once again be tested to see if its claims hold true and whether or not the world’s most popular crypto-asset can navigate the trying waters of the present economy.

A recent research paper titled “Proxy-hedging of Bitcoin exposures with altcoins,” published earlier in the year by researchers from the University of Paris, examined the risks associated with hedging in crypto-markets and Bitcoin’s role in it. The paper highlighted that in terms of a hedge against the traditional market, prior research shows,

“Bitcoin can be used as a hedge against stocks in the Financial Times Stock Exchange Index. Besides, Bitcoin can be used as a hedge against the American dollar in the short-term. Bitcoin thereby exhibits some of the same hedging abilities as gold and can be included in the variety of tools available to market analysts to hedge market-specific risk.”

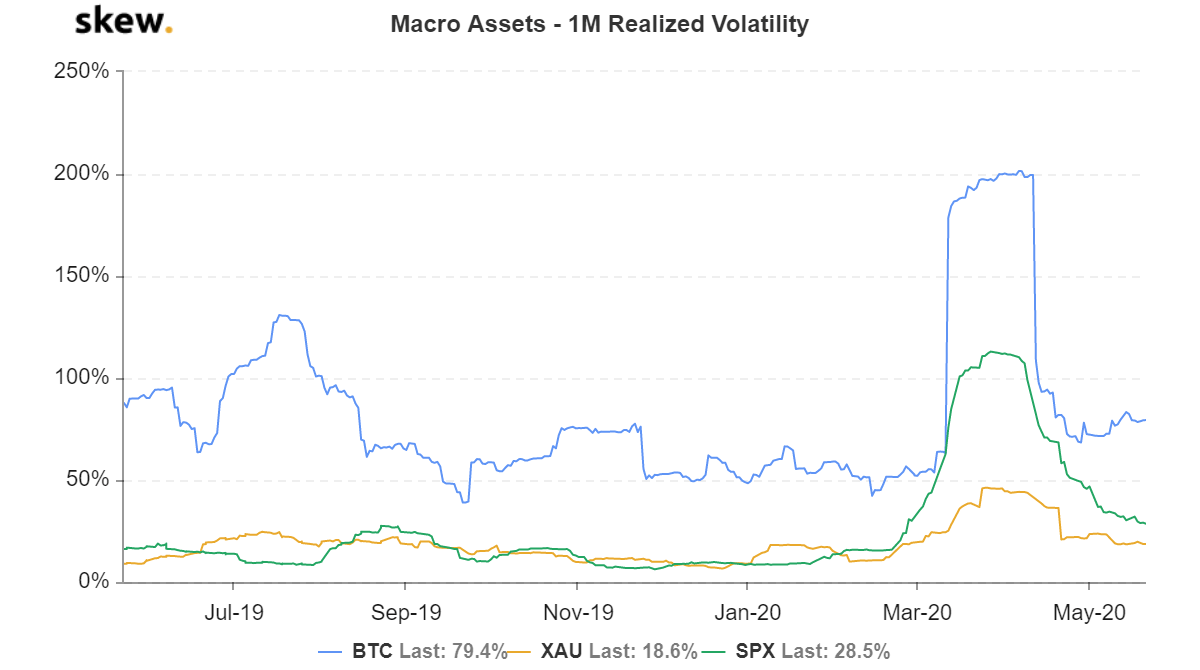

Source: Skew

Interestingly, market data from Skew also shows that Bitcoin’s realized volatility, despite seeing a dip, was continuing to soar above traditional assets like gold and the S&P 500 Index.

The paper also noted that proxy hedging practices like short-selling continue to be highly effective.

“Short selling as a proxy-hedging strategy is best suited for investors carrying a diverse range of cryptos that want to hedge using few coins for their entire portfolio.”

With respect to investment portfolios including digital assets like Bitcoin, recent endorsements from the likes of Paul Tudor Jones seem to have been extremely beneficial for the king coin as it is already making inroads into the institutional investor market. However, the paper pointed out that when it comes to digital assets like crypto, there is still ‘excess risk’ attributed to it. It highlighted,

“Bitcoin, as investment objectives instead of a currency unit, is associated with excess risk and low returns. Such poor performance discourages investors to spend Bitcoin as currency and to pursue the arbitrage profit.”