Can Bitcoin avoid another slip-up?

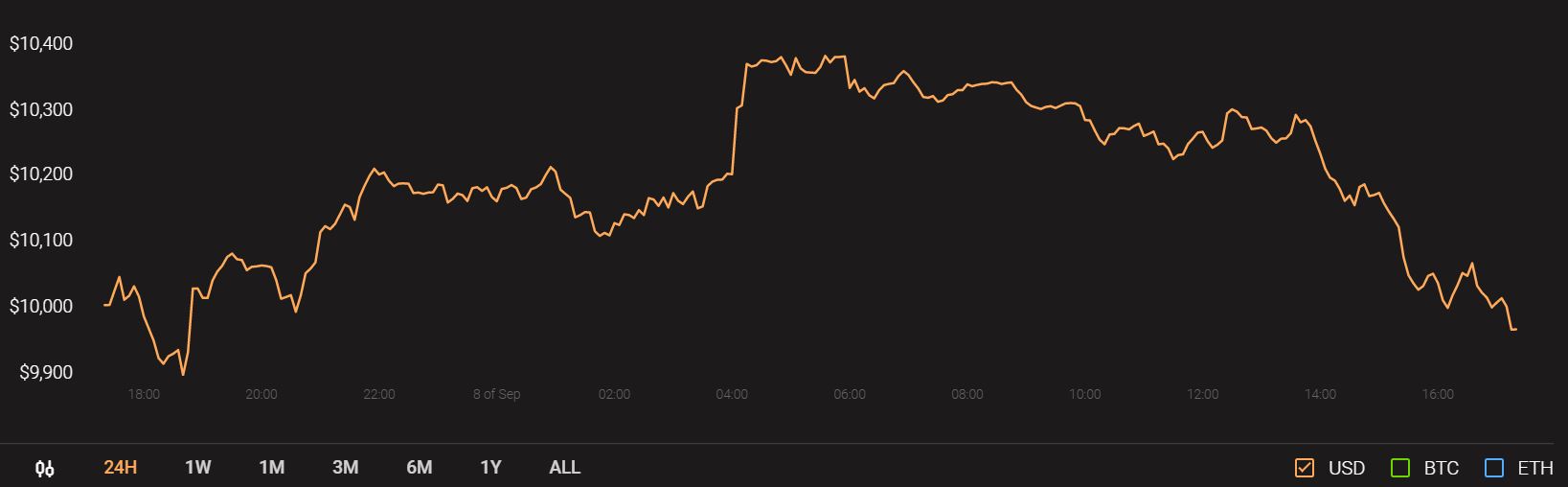

A terrible past week saw the largest digital asset take a massive hit on its apparent bull run. Bitcoin, as we speak had dropped down by $2000 in a span of 48-hours, dropping from $12,048 to $9890 during the 1st week of September. At press time, Bitcoin was valued at $9954 but speculations were still livid in the space about further corrections.

Source: CoinStats

However, Glassnode’s weekly report suggested that things were not absolutely down and out for Bitcoin. According to the analysis, Network Health continued to hold a strong position in the market as a small increase in new-adoption was witnessed during the bearish week.

Liquidity improved for Bitcoin as well with high trading volumes triggering a major uptick in terms of BTC in-flows onto exchanges. Transaction liquidity also went up due to an increase in on-chain transactions.

However, Market Sentiment took a hit as the average investor’s portfolio became less profitable in the present day.

Bitcoin SOPR below 1 for the first time in months

Source: Twitter

According to Rafael Schultze-Kraft, Bitcoin SOPR (Spent-Output Profit Ratio) was below 1 for the first time since April, suggestive that a fraction of on-chain addresses were moving BTC at a loss, hence possibly weak hands were getting sold out.

Kraft mentioned that it was incredibly crucial to shake off this metric and consolidate above 1 as soon as possible other a strong bearish trend will get confirmed. However, since then, the price of Bitcoin has taken a step to correct its current bearish demeanor.

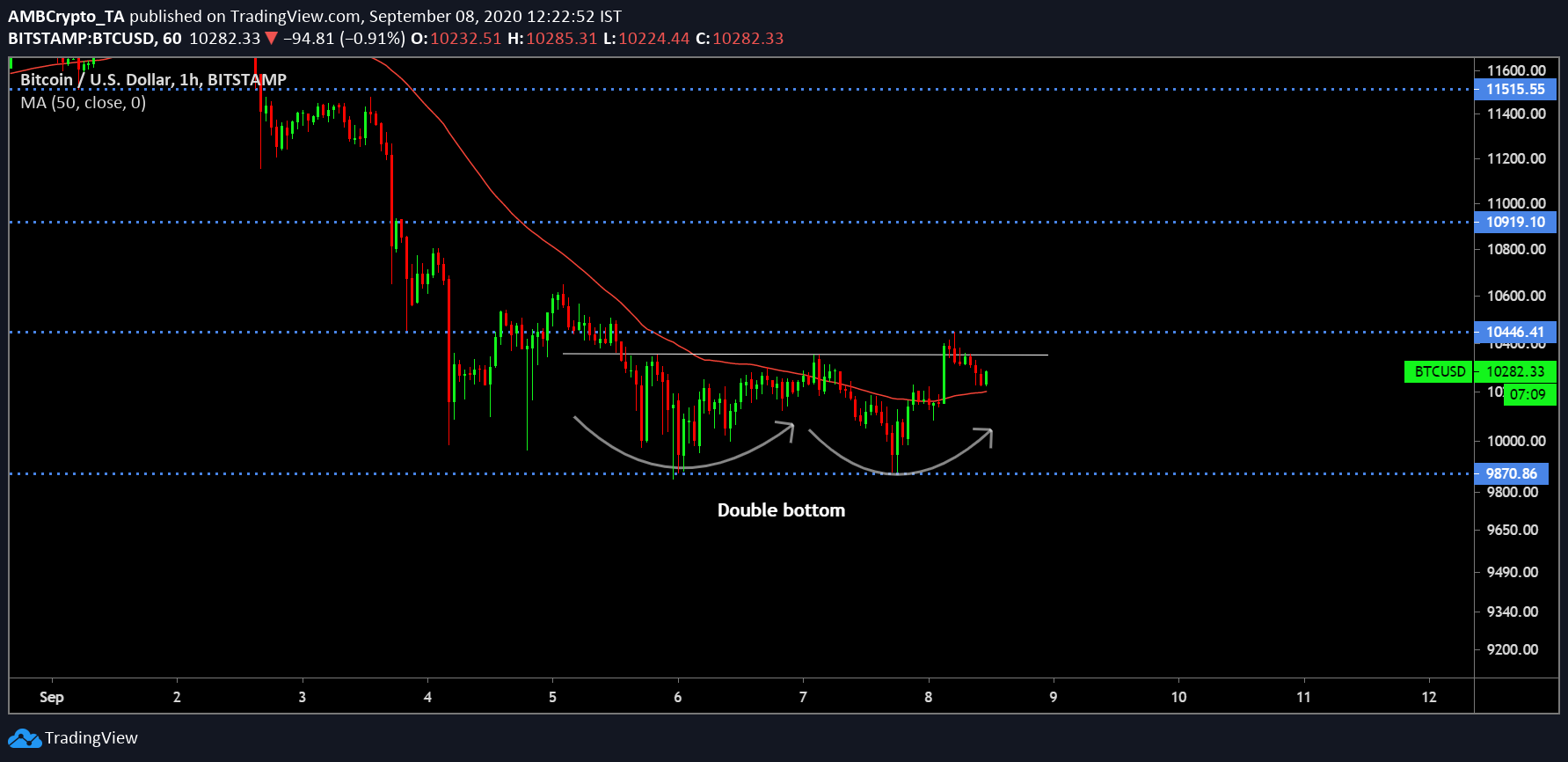

Bitcoin moves above the 50-MA

Source: BTC/USD on Trading View

A positive move witnessed over the past 12-hours had Bitcoin breach above the 50-Moving Average for the first time since depletion struck last week. Bitcoin was also close to completing a double bottom pattern. There is a possibility that if the price moves the neckline, it will take Bitcoin less of an effort to reclaim higher resistance at $10,500 since the buying pressure would bring in a renewed trading action.

Swing Trade session for Bitcoin; which path to follow

On Bitcoin’s immediate future, the jury is out with strong indicators suggestive of both a bullish and bearish turnaround. However, it is also important to note that Bitcoin’s sustenance above $10,000 is similar to its struggles in early June below the range.

In the past, we had discussed that Bitcoin at $10,000 could possibly be a strong bottom for the price to recover from. Hence over the next few days, BTC’s vigil and momentum will surely be tested on whether it can hold its self above the range.