Brian Armstrong downplays competition, bills Coinbase as ‘Amazon of crypto’

Key Takeaways

Coinbase’s CEO has dismissed perceived competition from Charles Schwab’s planned crypto trading venture.

Brian Armstrong, CEO and founder of the U.S.-based crypto exchange Coinbase, has downplayed Charles Schwab’s planned entry into the sector.

At the time, some analysts viewed Charles Schwab’s crypto trading debut as a challenge to Coinbase’s moat. However, Armstrong dismissed the perceived competition and reinforced Coinbase as the “Amazon of crypto.”

He added that the exchange is a ‘one-stop shop’ for custody, payments, staking, stablecoins, borrowing, etc.

Coinbase moat and COIN reaction

Coinbase is currently the custodian of 8 out of the 11 Spot Bitcoin [BTC] ETFs (exchange traded funds) issuers in the United States.

Apart from Fidelity (which has its in-house custody), VanEck and Bitwise partially rely on it. While the rest fully use Coinbase as their primary custodian.

In addition, the exchange is the main distribution partner for Circle’s USDC stablecoin with 20% of all USDC held on the platform.

It also has a stake in Circle, further underscoring its moat in the stablecoin segment.

That being said, the firm’s stock, COIN, recently hit an all-time high of $444.65, thanks to a broader market rally in the crypto sector. It has rallied by 214% since April’s lows of $142.58. At press time, it was slightly down to $405, as per Google Finance data.

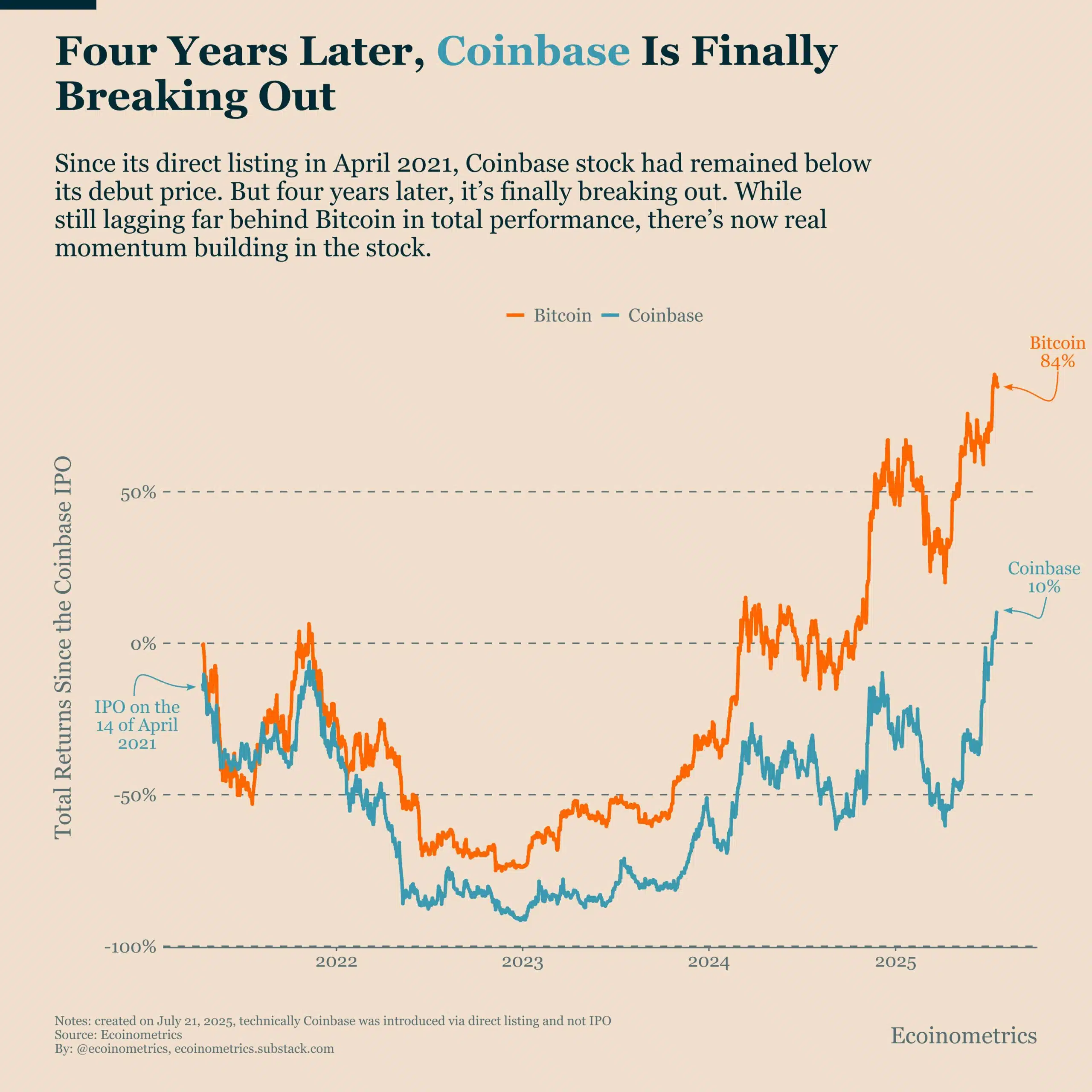

Ecoinmetrics linked COIN’s breakout to Bitcoin’s growing activity and regulatory relief, especially the GENIUS Act being signed into law. In fact, the firm added that momentum has been building for COIN, despite lagging behind BTC since its debut in April 2021.

Last month, Bernstein analysts placed a higher rating on the stock with a price target of $510, about 30% upside from its press time price. The analysts presented Coinbase as the “Amazon of crypto,” stating that it was widely misunderstood by Wall Street.

Meanwhile, the overall analysts’ consensus for COIN is a “moderate buy” with an average price target of $320, $510 as the highest price target, and a lowest target at $185.

However, there has been significant insider selling lately, including from the CEO, who offloaded nearly 200k shares between 16-18 July.

Additionally, Cathie Wood’s Ark Invest has trimmed its COIN holdings and rotated into Ethereum [ETH] treasury firm BitMine Immersion Technologies (BMNR).