BNB prices hit new ATH of $804 – Is $1K within reach now?

Key Takeaways

BNB hit $804 for the first time, making the next key psychological targets at $900 and $1000. There was low sell pressure from holders despite the new ATH.

Binance Coin [BNB] coin surged over 20% in July and tagged a new record high of $804.7 amid broader altcoin rally.

Zoomed out from Q1 lows, the flagship token of the world’s dominant crypto exchange has recovered about 58% from $500 to +$800.

Reacting to the ATH, Binance founder CZ appreciated all industry players, including ETFs applicants, builders, Bitcoin [BTC] and Ethereum [ETH] holders, amongst others.

What’s next for BNB?

On the technical side, $700 has been a hard obstacle to clear since last year. The previous all-time high (ATH) of $793 left bulls exposed to sell pressure that marked out the $700 level as a supply wall.

Another attempt to crack it during the Q2 recovery was blocked at the $700 sell wall (white).

But it has now been flipped into support, raising the question: Will it hold and act as a springboard for further rally, or will it crack?

Source: BNB/USDT, TradingView

The OBV (On Balance Volume) indicator showed that the recent rally hit the last November peak but was yet to cross the March 2024 volume.

This meant the trading volume was huge and there was still room for growth if the trend continued.

In addition, the weekly RSI was yet to hit the overbought zone, further suggesting that the altcoin’s uptrend may be far from over if broader market sentiment remains positive.

On the upside, $814 and $1000 were key levels per Fibonnaci retracement tool (yellow). But a crack below $700 would dent the bullish market structure.

That said, there was muted sell-off, and the recent surge was driven by massive on-chain traction on the BNB chain.

Muted profit-taking

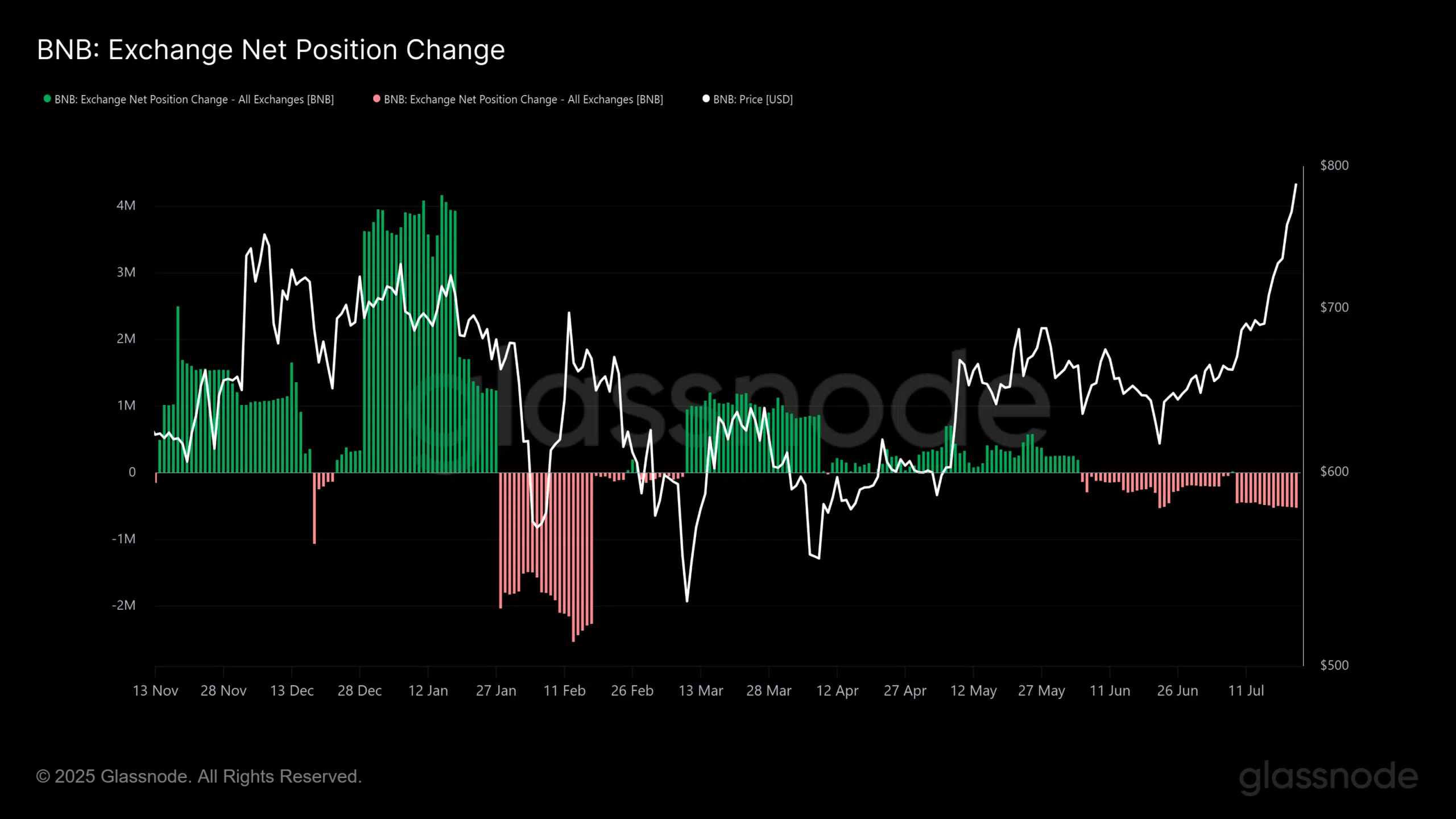

There was virtually no exchange sell pressure as of press time, despite BNB riding to a new ATH.

Glassnode reported a negative Exchange Net Position Change, indicating that exchanges reduced their BNB holdings for sale over the past thirty days.

Source: Glassnode

There was also significant on-chain traction on the BNB chain during the rally.

Notably, net inflows into the chain increased 3x from $689 million in June to $1.69 billion in July. Nearly $1 billion was added to the TVL too, underscoring a strong network growth.

Overall, the rally could extend if the network growth remains robust and muted exchange pressure extends.

Source: DeFiLlama