BNB craters by double digits following Binance CEO’s resignation

- BNB has seen a double-digit decline following CZ’s exit from Binance.

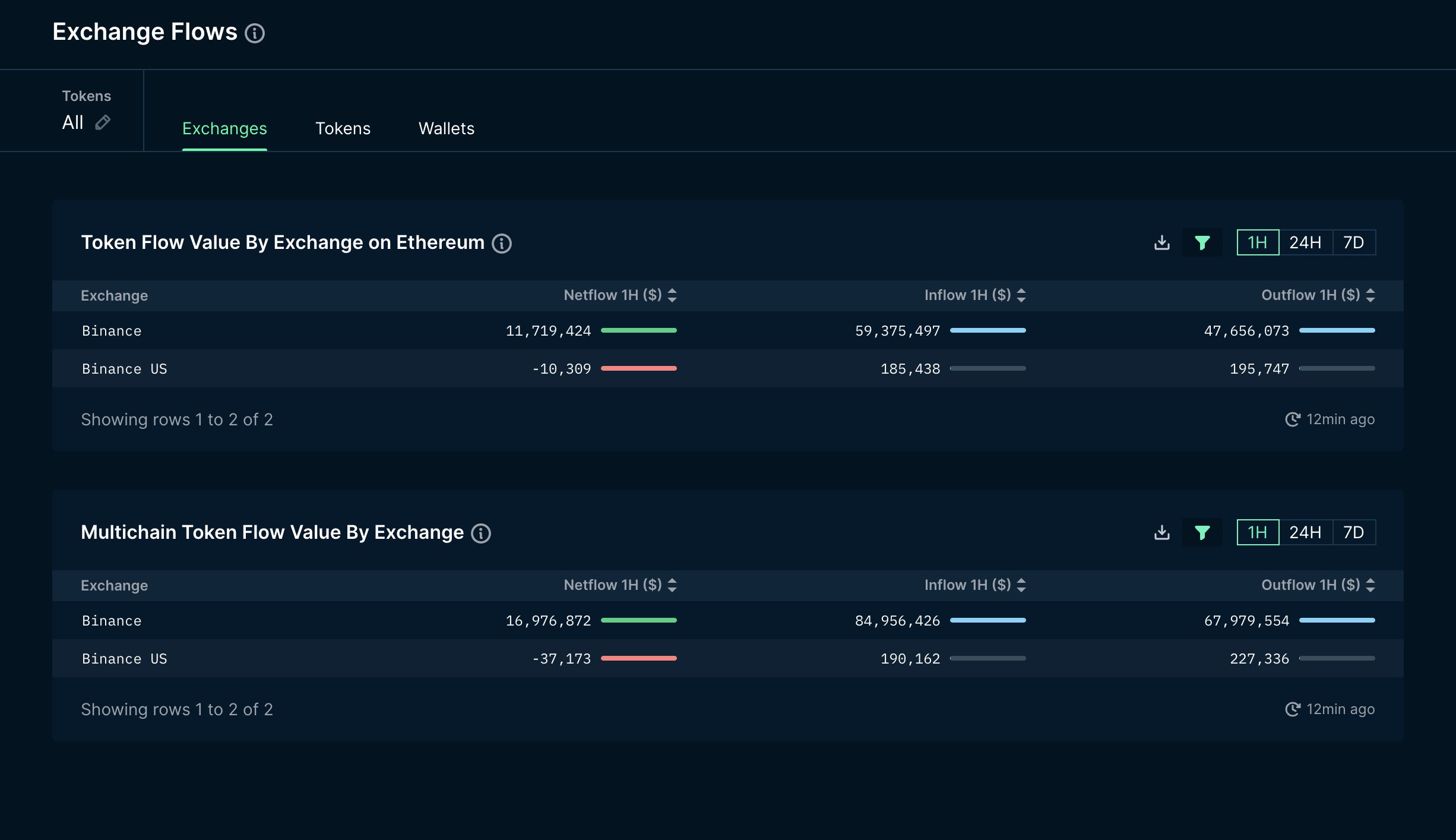

- Binance has recorded a rise in outflows in the last 24 hours.

BNB Coin [BNB] has shed 11% of its value in the past 24 hours, making it the second-worst-performing coin in the top ten by market capitalization at press time, according to CoinMarketCap.

This follows the unexpected news of Changpeng Zhao’s resignation as CEO of Binance, which forms a part of the $4 billion settlement between United States regulators and his cryptocurrency exchange.

Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.

Binance is no longer a baby. It is…

— CZ ? Binance (@cz_binance) November 21, 2023

The decline in BNB’s value in the last 24 hours has been exacerbated by the surge in outflows from Binance since Zhao announced his resignation.

Information retrieved from on-chain data provider Nansen showed that Binance’s fund flow plummeted from a net negative of $10,000 to $45 million within a short window period.

Also, Kaiko’s research analyst Riyad Carey, in a post on X, noted that Binance’s 1% market depth had fallen from $180 million to $110 million in about 2 hours before bouncing back, while its 0.1% depth also fell from $100 million to $85 million during the same period.

Binance's 1% market depth dropped from $180mn to $110mn in about 2 hours. Has since bounced back to $150mn.

0.1% depth fell from $100mn to a low of $65mn, back up to $85mn now. pic.twitter.com/aGkxLl1oB6

— Riyad Carey (@riyad_carey) November 21, 2023

BNB suffers for CZ’s “misdeeds”

At press time, the price per BNB coin was $235.14, its lowest level in the last week. When the news of Mr. Zhao’s resignation broke, the coin’s price fell to a low of $242, its lowest in the last 20 days.

AMBCrypto’s assessment of trading activity in the last 12 hours revealed a significant uptick in BNB distribution. Investors who fear a ripple effect of Zhao’s resignation on BNB’s value have increasingly sold their holdings.

The coin’s Chaikin Money Flow, which measures the volume and price of an asset to assess the balance between buying and selling pressure, was spotted below the zero line at press time.

With a value of -0.18, BNB’s CMF showed a high volume of liquidity exit from the coin’s spot market.

Likewise, key momentum indicators were positioned below their respective center lines, suggesting investors preferred selling their BNB coins. The alt’s Relative Strength Index (RSI) was 45.16, while its Money Flow Index (MFI) was 40.91.

At these values, these indicators signaled that most traders have resolved to sell rather than buy since Zhao’s resignation.

Read BNB Chain’s [BNB] Price Prediction 2023-24

Further, the last 12 hours saw a sharp rise in BNB’s Aroon Down Line (orange) to 92.86%. This indicator is used to identify trend strength and potential trend reversal points in a crypto asset’s price movement.

When an asset’s Aroon Down line is close to 100, as in this case, it indicates that the downtrend is strong. It also suggests that the most recent low was reached relatively recently.