Altcoins

Blast continues to grow despite skepticism and FUD

The Blast network has secured an investment of $5 million from Japanese Web3 investment group CGV.

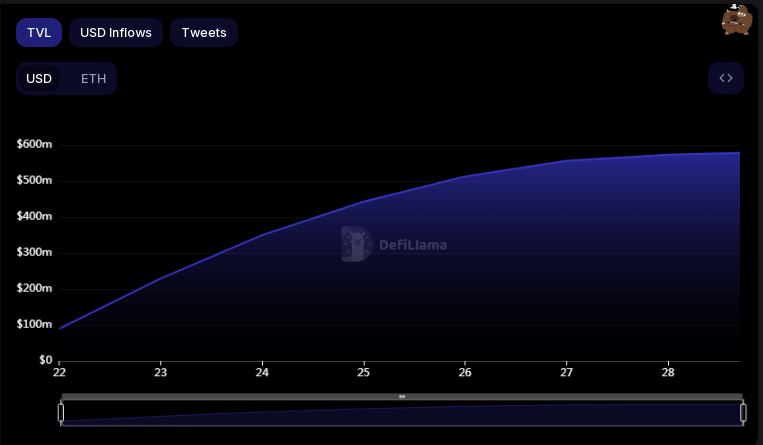

- Blast’s “native yield” capabilities have helped its TVL cross $570 million.

- CGV stated that the investment would be used for incubating and investing in projects on the network.

Within a week of its unveiling, upcoming layer-2 (L2) network Blast has attracted a Total Value Locked (TVL) in excess of $570 million, AMBCrypto observed with the help of DeFiLlama’s data.

Someone is having a Blast!

The phenomenal rise in deposited funds, most of them in staked Ethereum [stETH] and stablecoin DAI, was unprecedented for any L2 network in such a short period of time. And that too when the network hasn’t even been fully launched.

As of this writing, an “early access” phase was in motion wherein the network was open only to selected users and the people they invited.

The network’s so-called “native yield” capabilities, the first of its kind in the currently congested Ethereum [ETH] L2 market, could be driving the rise in inflows. Blast claimed to offer yields of 4% on staked ETH and 5% on stablecoins.

Basically, yield from L1 staking through Lido Finance [LDO] would be automatically transferred to users via rebasing ETH on the L2, Blast claimed on its official website.

Clearly, people have been influenced by these claims and have decided to invest in a network that is still in its early stages.

Investments continue to pour in

Interest shown by big investment firms was also adding to the hype. CGV, a Japanese Web3 investment group, pledged to spend $5 million in the Blast ecosystem to help it flourish. CGV stated that the investment would be used for incubating and investing in projects on the network.

Note that the network has already secured investments worth $20 million from well-known crypto-focused investment firms like Paradigm and Standard Crypto. These endorsements have also helped in building Blast’s brand image.

The controversial aspects

The blockchain would go live only by February. Until then, assets bridged over to the platform cannot be withdrawn. In the meantime, reward points would be handed to early bird users. Early members get more points based on how much they bridge and who they invite.

However, it is this part that has raised questions over the network’s integrity. Many in the space have equated it to a Ponzi scheme.

In fact, an executive at Paradigm also criticized the decision to open the bridge before the L2 launch and restrict withdrawals.