BlackRock, Fidelity spark BTC ETF frenzy, but will ETH ETFs take the cake?

- Bitcoin ETFs led market inflows, driven by price surges and investor confidence.

- Ethereum ETFs showed consistent growth, poised to potentially surpass Bitcoin ETFs in 2025.

Bitcoin [BTC]’s price volatility between $94,000 and $98,000 has mirrored the activity in the U.S. spot BTC ETF market, which experienced a significant rebound on 3rd January.

Bitcoin ETF inflow analysis

According to Farside Investors data, net inflows surged to $908 million, reversing the $242 million outflow recorded the previous day.

Leading this recovery was BlackRock’s iShares Bitcoin Trust (IBIT), which garnered $253.1 million in net inflows, signaling a strong comeback after enduring a three-day streak of losses totaling $392 million.

This influx solidified IBIT’s dominant position in the $107 billion BTC ETF market, where it now commands $53.4 billion in assets, holding 548,506 Bitcoin.

That being said, Fidelity’s Bitcoin Fund (FBTC) emerged as the standout performer among Bitcoin ETFs, registering an extraordinary $357 million in net inflows on the 3rd of January, one of its strongest daily performances to date.

This surge brought its total new investments to over $12 billion, underscoring its robust market presence.

Additionally, ARKB, managed by ARK Invest and 21Shares, also attracted significant interest with $222.6 million in net inflows, reflecting the growing investor confidence in BTC ETFs.

However, not all funds shared this momentum—while some ETFs saw minimal inflows, others, like Grayscale’s GBTC, recorded no activity during the same period.

Is Bitcoin’s price action playing a role in ETF inflows?

For perspective, Bitcoin’s price movement has been closely tied to the surging interest in Bitcoin ETFs, with its value climbing from around $94,000 to $98,000 on 3rd January.

CoinMarketCap data reported Bitcoin trading at $98,314.18, reflecting a 3.61% rise in the past 24 hours.

This price rally underscores the growing investor enthusiasm for BTC ETFs, as market participants increasingly align their investments with Bitcoin’s performance.

Additionally, the trend highlights shifting investor sentiment influenced by evolving policies and leadership changes under President Donald Trump, further fueling momentum in the crypto sector.

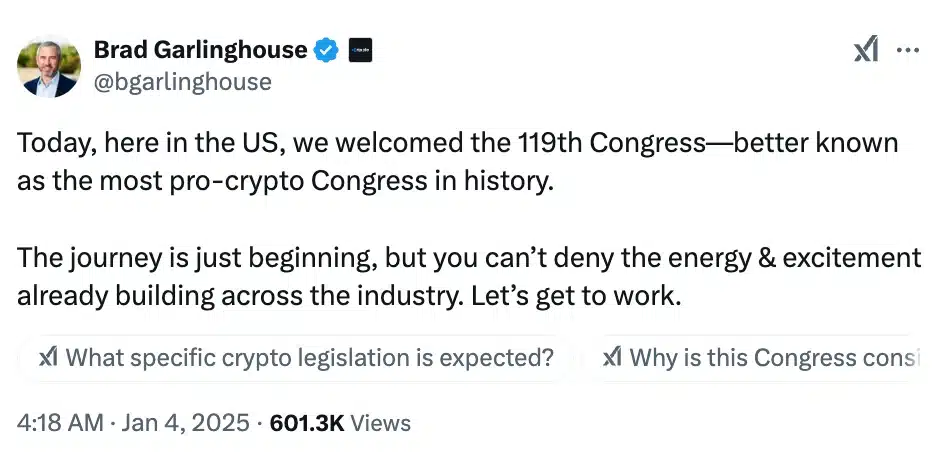

Remarking on the same, Ripple’s CEO Brad Garlinghouse took to X and noted,

Ethereum ETFs to outshine Bitcoin ETFs?

While Bitcoin ETFs continue to dominate the market with their staggering inflows, Ethereum [ETH] ETFs are steadily closing the gap, reflecting growing confidence in Ethereum’s long-term potential.

Despite recording comparatively modest inflows of $58.9 million on 3rd January, Ethereum ETFs demonstrated remarkable consistency, closing 2024 with an impressive $35 billion in inflows.

This resilience underscores the appeal of Ethereum’s versatile ecosystem and innovative staking capabilities, which offer unique yield-generation opportunities.

Analysts speculate that if current trends persist, Ethereum ETFs could surpass their Bitcoin counterparts in 2025, signaling a potential shift in investor preference within the evolving crypto landscape.