Press Release

Bitsgap 2.0: At the forefront of cryptocurrency trading

Bitsgap is a cryptocurrency trading terminal with a multifunctional interface for automated trading, portfolio management, spot, and futures trading. An all-in-one platform with unique instruments to let traders and portfolio managers discover and develop their own manual strategies and trading configurations for Bitsgap’s automated bots.

Spot and Futures trading 2.0

With a recent update, Bitsgap team has finally released its Futures trading 1.0 dashboard for the Binance Futures exchange. It has now become possible to monitor futures positions, set stop-loss and take profit orders and initiate new trades without having your Binance terminal open in the second browser’s window. With a click of only 1 button users can quickly switch between Spot and Futures trading modes.

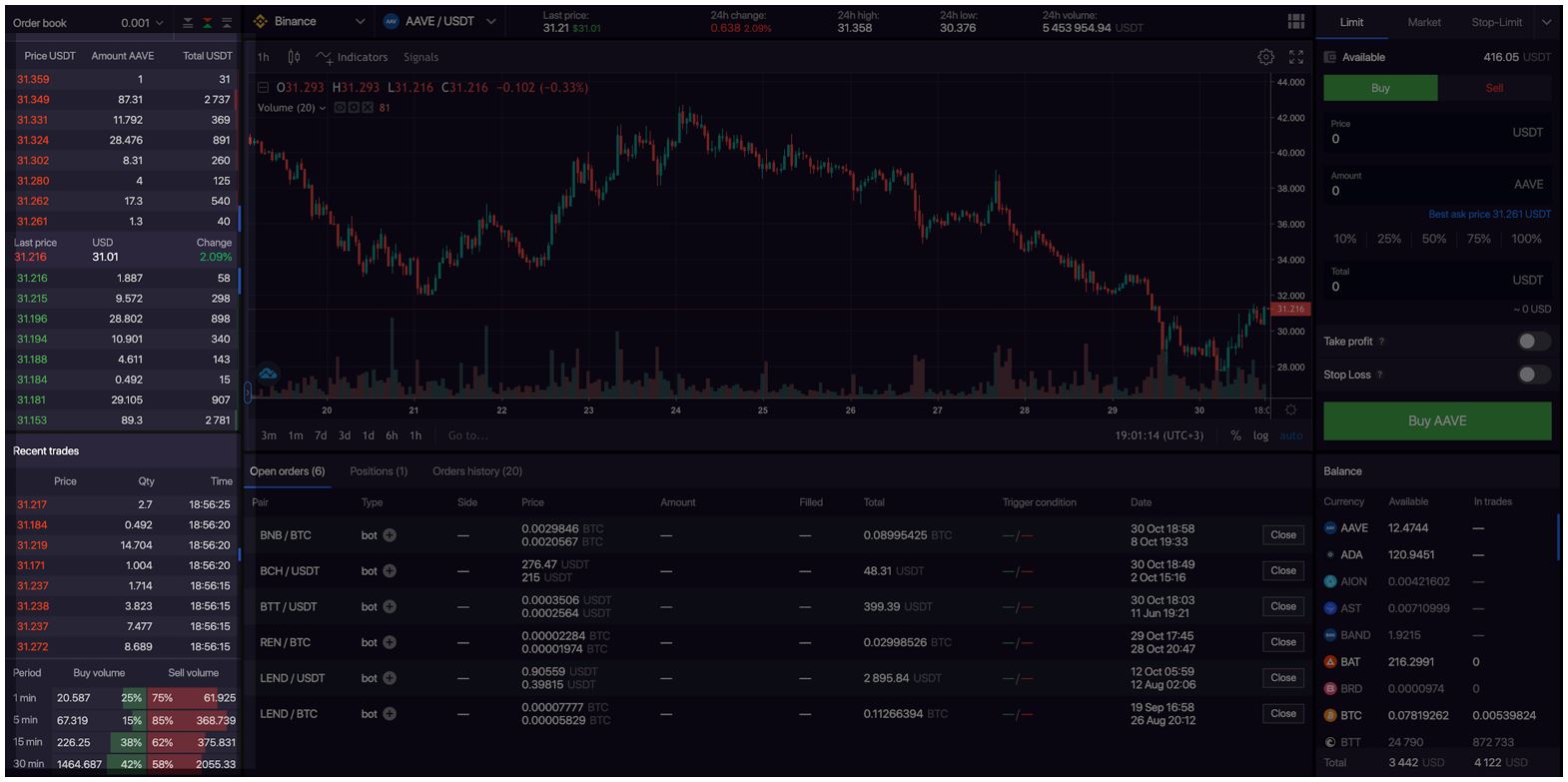

After long research, due diligence, and focus group analysis a brand new trading dashboard layout was recently presented to traders and portfolio managers. On the left side of a terminal’s dashboard, you have an “Order book” to monitor and analyze cryptocurrency’s demand and supply. Below is a “Recent trades” section with all information about recent trades executed on the market. The cool feature is at the very bottom, which is known as the “Bulls and Bears ratio.”

It provides users with information about buying and selling volume for the last 1,5,15 and 30 minutes. You can use this constantly updating data to analyze the selling and buying pressure on the market.

Moving to the right-side of a trading terminal, a simple and yet mobile panel to create a limit, market, stop-limit orders are at traders’ disposal. What grabs attention the most is a so-called “Shadow order” and “TWAP,”

Notice, that as you create a limit order you can set multiple take profit target prices. You can manually define the target price and the system will automatically calculate the profit for it. Conversely, if you set a profit target, for example, 5%, the system will calculate the price at which the order must be executed. As soon as you set all take profits, a projected return will be calculated below. In the example below, we have 5 take profits for AAVE/USDT worth 3095 USDT.

The projected return, in this case, is 186 USDT:

New order types – “Shadow” and “TWAP”

The aim of the “Shadow order” is to execute stealth trades off the order book without reserving available balance on a cryptocurrency exchange. As soon as the market price hits the target price a limit order will be placed.

TWAP (Time-weighted average price) is an interval-based trading strategy to proportionately sell or buy a selected cryptocurrency. The whole investment volume is being divided into equal smaller portions. Each small portion is then sold/purchased with a market order at a certain time interval. As soon as the last small portion is being sold/purchased on the market the final sell/buy price will be automatically calculated.

Consider this strategy if you have a very large volume to sell or buy and you don’t want to significantly impact the market with a 1-time trade. Alternatively, if you see the market is falling and you expect that it will soon bounce from the closest support level, buying with an interval-based strategy you will get a better entry price. This is known as the ‘cost-average effect’.

Automated trading 2.0 – statistics and analytics

Bitsgap stands out for its time-tested and fully transparent automated algorithm, GRID. There are 2 trading strategies which traders and portfolio managers can use depending on market conditions, financial goals, and risk tolerance. The bot is trading within a defined trading range and executes buy and sell limit orders, which are interchangeable as the price constantly swings and hence provides a plentiful amount of trade opportunities for the algorithm to buy low and sell high.

Apart from Trailing, Stop-Loss, and Take profit instruments, which are designed for risk management, bots have some unique built-in security mechanisms. Depending on set configurations, current market activity, and some other conditions, there 5 bots’ activity statuses in total that were added in the recent update:

- Starting – Orders data transfer from crypto exchange

- Active – The market price is within a trading range and the bot is successfully executing trades

- Pump protection – Bitsgap’s know-how security mechanism from the extremely volatile pump and dump scenarios on the market. The bot stops trading until the market stabilizes.

- Out of range – The market price is above the bot’s initial trading range and a Trailing UP instrument is OFF. The second case is when the market price is below bots’ initial trading range as the market is falling. The bot stops trading.

- Trailing – The market price is above bot’s initial trading range by 1%. Trailing UP instrument is ON. If all conditions are satisfied then the bot adjusts a trading range with a market’s rise.

Wrapping things up

Bitsgap is an active team that has started its journey in 2018. It has proven to be valid and fully transparent in terms of security and financial expertise. Each quarter they release new updates, which can include: interface changes, new trading instruments, improved analytics. Moreover, they have credible content production on a weekly basis to educate users regardless of trading experience.

The best way to test Bitsgap is through its trial program and demo-mode trading (a risk-free trading account with 100,000 virtual USDT). In addition to that, a backtesting instrument is provided. It is implemented into the trading terminal to let traders and portfolio managers stress-test automated trading strategies on historical prices of any cryptocurrency.

Disclaimer: This is a paid post and should not be considered as news/advice