Crypto News

Bitmex’s recent Bitcoin OI is a clear signal to the market

Bitcoin’s price was rallying before CFTC charges hit BitMEX, and immediately after, retail traders started scaling back positions on BitMEX. Open interest in XBTUSD perpetual contracts on BitMEX dropped to 55000 BTC.

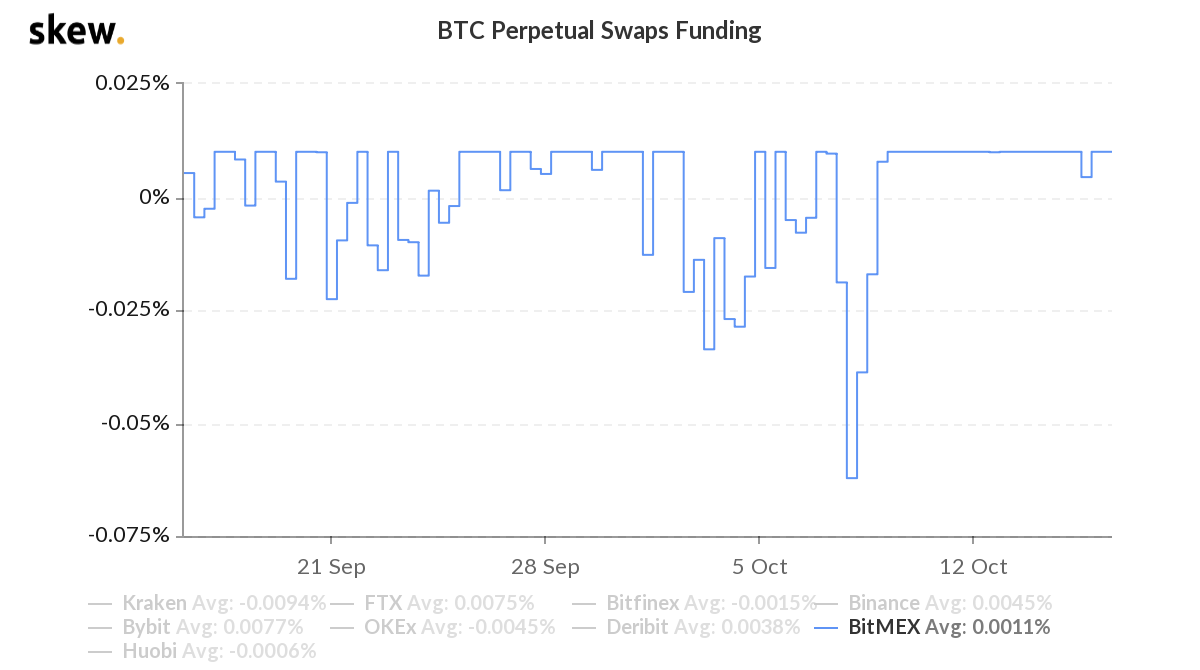

BTC Perpetual Swap Funding Rate || Source: Skew

The funding rate dropped below -0.05% in the first week of October in response to the CFTC charges, however, the recovery is nowhere close to complete. Several derivatives traders shifted to CME and Deribit, and the open interest in perpetual contracts is now back to the March level.

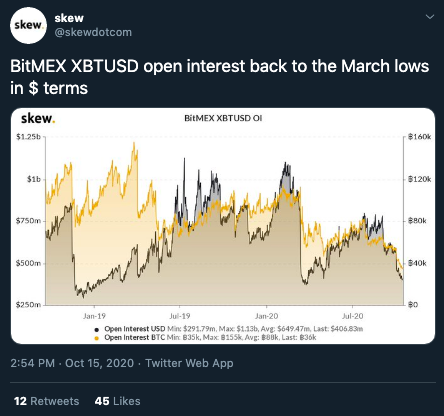

BitMEX XBTUSD Open Interest || Source: Twitter

Based on data from the open interest chart on Skew, if Open Interest drops further it may hit June 2019 levels. This drop-in open interest on BitMEX did not have a significant impact on the price of Bitcoin or the open interest on other top derivatives exchanges. The price is now more sensitive to supply/demand and after supply to exchanges dropped for two months straight, the price has started rising again. After dropping below $11000, Bitcoin is back at $11300 and the inflow to exchanges is below the 90-day average this week. The inflow of smart money is increasing demand and it has emerged as a real driver of growth.

BTC Futures Aggregated Open Interest || Source: Skew

The aggregated Open Interest is at the mid-September level, if trade volume increases in parallel there may be a further increase in the open interest. Specifically, on exchanges with the largest market share, Open Interest may continue rising with rising prices.

Bitcoin open interest on exchanges || Source: Twitter

Based on data from Arcane Research, BitMEX has been dethroned in the BTC perpetual swap market and the dominance has nearly halved with BitMEX’s share dropping from 55% to 20%. The influence that BitMEX had on Bitcoin’s price is diminishing and the market is not leveraged based on the news. Bitcoin fundamentals are stronger than ever and this is why news or the pouring in of smart money is not creating massive volatility. Recovery of trade volume on BitMEX may take months, however, there is no impact on prices on spot exchanges.