Bitcoin

Bitcoin’s volume drops to 2020 average as price flirts with $7K

The 9.38% surge Bitcoin’s price recorded yesterday was followed by a correction that was represented by a huge red candle on the charts. At press time, the world’s largest cryptocurrency was being traded at $6735, with a 24-hour trading volume of $17.7 billion.

Source: Coinstats

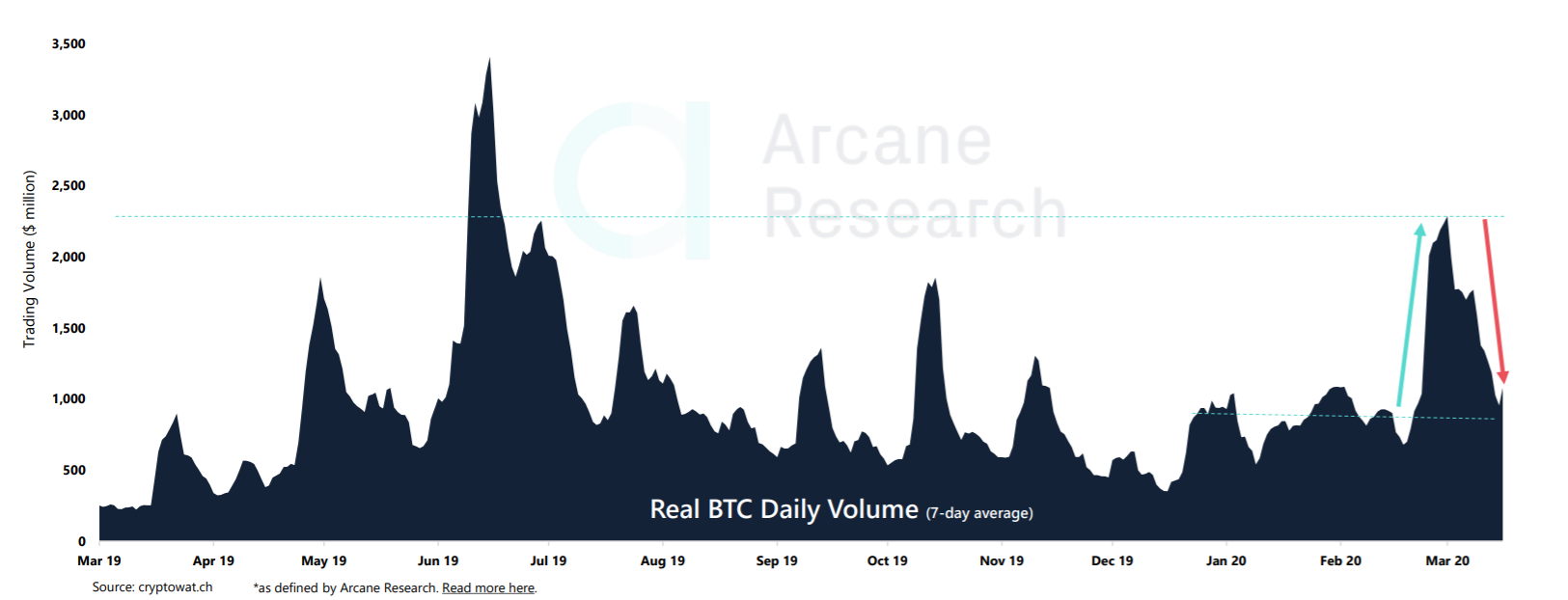

Even though the king coin’s price has been trying to move upwards, there is not a lot of volume to support the price. According to Arcane Research’s latest report, Bitcoin’s trading volume has been slowing down for quite some time now. In fact, the 7-day average real trading volume continued to drop this week, with an increasing price accompanied by reducing volume being a bearish signal.

Source: Arcane

The volume of the Bitcoin market at the time of writing had reached the average volume for the year 2020. However, it must be noted that this was still significantly higher than the volume recorded over the last few months of 2019.

As the volume kept dropping, Bitcoin’s volatility increased rapidly. The 30-day volatility was at 9.3%, higher than last week. According to data provided by Coin Metrics, BTC’s 30-day volatility stood at 0.10319, a value unseen since 2014.

Source: Coin Metrics

With the global market acting unstable, the crypto-market hasn’t been immune to such tremors either. This instability contributed to the crypto-market collapsing on 12 March, along with the global markets. However, the crashing prices did highlight increased network demand.

Source: Arcane

As per data provided by Bytetree, fees as a % of miners revenue spiked during the recent market adjustment. Since miner revenues are made of block rewards and fees on the blockchain, fees are useful in determining the network demand. It calls attention to the competition for space on the blockchain.

During the crash, the fees had spiked to 5% of daily revenue, a figure which was last seen in July 2019. As per the report, the fees as % of total revenues have been increasing during bull markets, with the highest recorded activity on the blockchain.