Bitcoin’s Q1 outlook: Will February bring gains for the crypto?

- Per QCP Capital, BTC could remain range-bound in January.

- BTC sold off after the December options expiry amid low trading volumes.

Bitcoin [BTC] closed the year muted, despite rallying 120% YTD (year-to-date). Since December 19th, the cryptocurrency has remained below $100K.

According to Chris Burniske, ex-ARK Invest crypto lead and partner at crypto VC Placeholder, low trading volume as large players consolidated their books led to end-year poor BTC performance.

BTC: January 2025 projection

Crypto trading firm, QCP Capital, echoed Burniske’s sentiment. The firm added that an end-year sell-off was expected based on historical trends after major options expiry. It stated,

“As expected, we saw the typical quarter-end post-expiry vol selloff as vols are 2-3 vols lower since Friday’s record-breaking expiry.”

Nearly $14B in BTC options, the largest in Deribit exchange history, expired on the 27th of December. The lower volatility (vols) after the expiry indicated likely muted price action into January.

QCP also noted that BTC could remain range-bound in January before recovering in February.

“January’s average returns (+3.3%) are relatively similar to December’s (+4.8%), and we could expect spot to remain in this range in the near-term before things start to pick from Feb onwards.”

Coinglass data shows that Q1 is typically one of the best periods for BTC, with an average gain of 56%. However, QCP notes that January isn’t BTC’s strongest month.

Instead, February and March have historically been BTC’s best performers, with average gains of 15% and 13%, respectively.

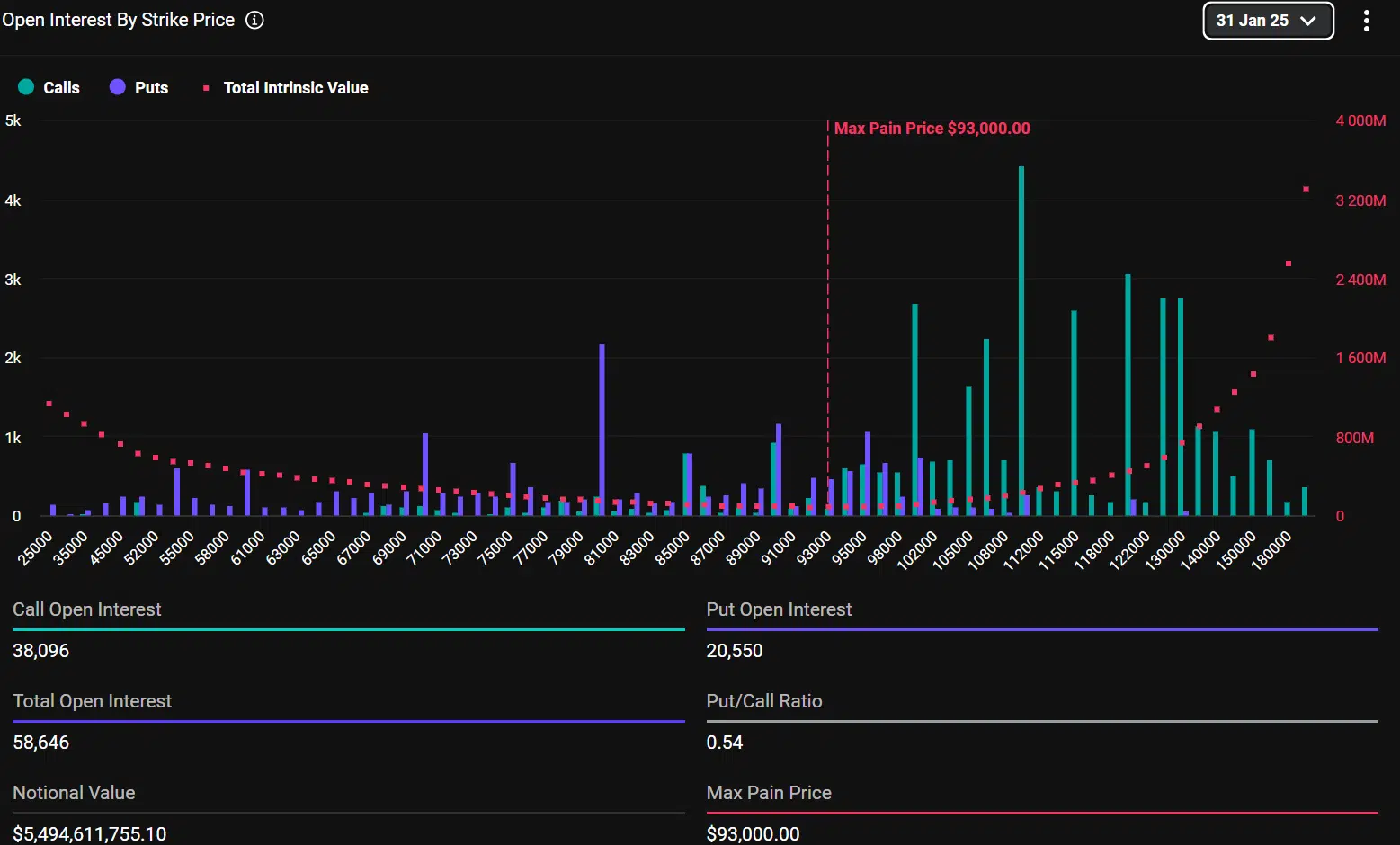

For the January-end expiry, options traders have placed the highest bullish bets (calls) at $110K and bearish bets (puts) at $80K. The max pain level, where most option contracts could expire worthless, is $93K.

Put differently, traders expected BTC to climb to $110K or slide as low as $80K. But the March expiry saw massive targets of $120K and $130K.

In short, BTC option traders expected more traction in February and March than in January.