Bitcoin

Bitcoin’s inclusion to diversify cross-currency portfolios may spell gains

Bitcoin has been the face of the cryptocurrency industry for many years now, but the traditional market has always perceived it as a risky asset for investment. Despite the prejudice against Bitcoin, however, its inclusion in varied portfolios may have a notably diverse impact on risk-adjusted returns.

A recent research paper titled, “On the investment credentials of Bitcoin: A cross-currency perspective,” delved into the performance evaluation of portfolios, with and without Bitcoin. It included eight global indices to construct a diversified portfolio representing an investment in six asset classes, namely, equity, fixed income, real estate, alternative investments, commodities, and money market, which were originally denominated in USD, but later converted into fiat for better understanding of cross-currency analysis.

Source: On the investment credentials of Bitcoin: A cross-currency perspective

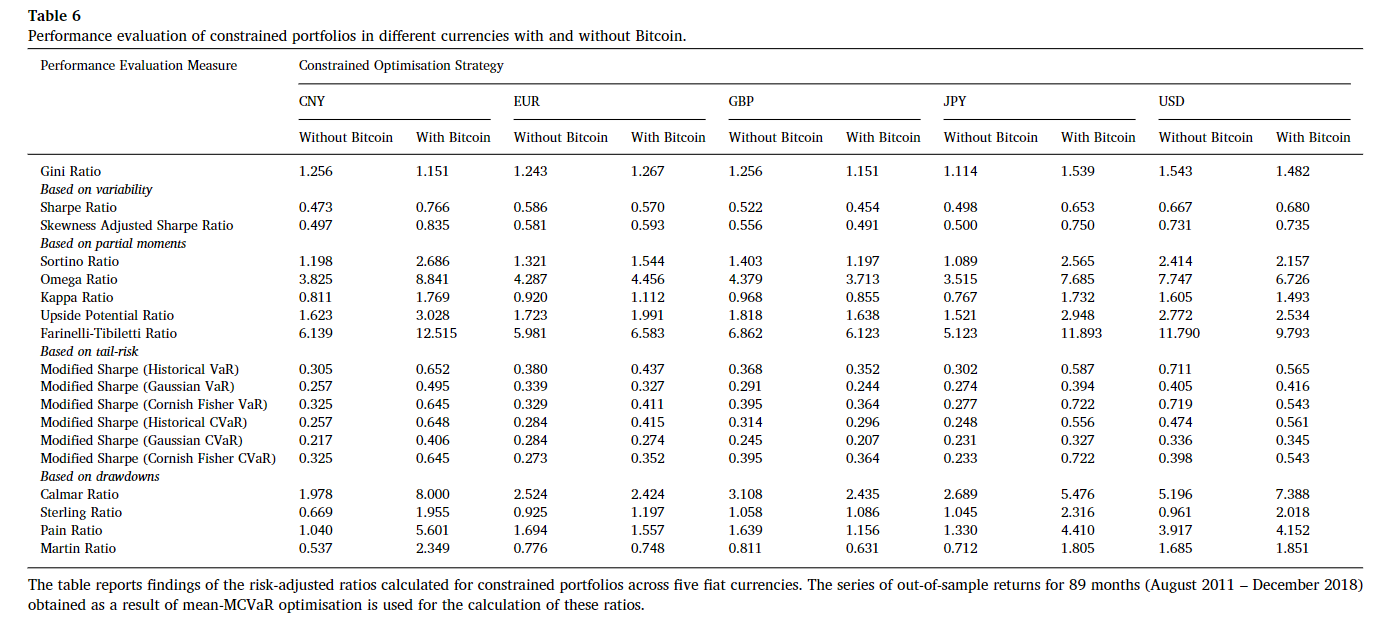

As represented by the attached chart, it was found that Bitcoin’s inclusion had a different impact on portfolios denominated by different currencies. For instance, the Japanese Yen and Chinese Yuan benefitted the most due to investment in Bitcoin as they recorded an improvement across all 18 ratios. On the contrary, Bitcoin portfolios that were determined in Euros and US dollars generated high risk-adjusted returns as per 12 and 10 ratios, respectively.

The inclusion of Bitcoin in USD portfolios also exhibited an improvement in risk-adjusted returns, but their performance is dependant on the type of risk measure used for evaluation. Thus, there has not been a perfect formula for generating positive yields, but it can be noted that the portfolios denominated in Chinese Yuan and Japanese Yen may incur maximum gains in terms of risk-adjusted returns.

However, such results are confined to research only and a world with proper regulations is necessary to it being practically used in any part of the world. Bitcoin has been a highly volatile asset and thus, there have been skeptics doubting its role as an investment asset as it poses lower-risk tolerance. As more and more countries like Japan start to recognize the legal and financial position of crypto, discussions about investment portfolios, with and without crypto, are bound to continue.