Bitcoin

Bitcoin’s Implied Volatility possibly drying up BTC futures volume

Markert readers would suggest that not a lot has changed over the past two weeks for Bitcoin. The price has mostly mediated between the range of $9000 to $10,000 but significant changes have definitely occurred.

The bullish on-chain sentiment that was widely expected to persevere following the halving has started to dwindle in the industry and several fundamental metrics have started to decline.

Previously, it has been observed that Bitcoin’s network demand score had drastically improved but right on the side, the daily transaction count had started to drop. With the narrative depleting on the metric-side, many hoped that the derivatives market will be able to keep the bullish rally alive alongside high spot trading.

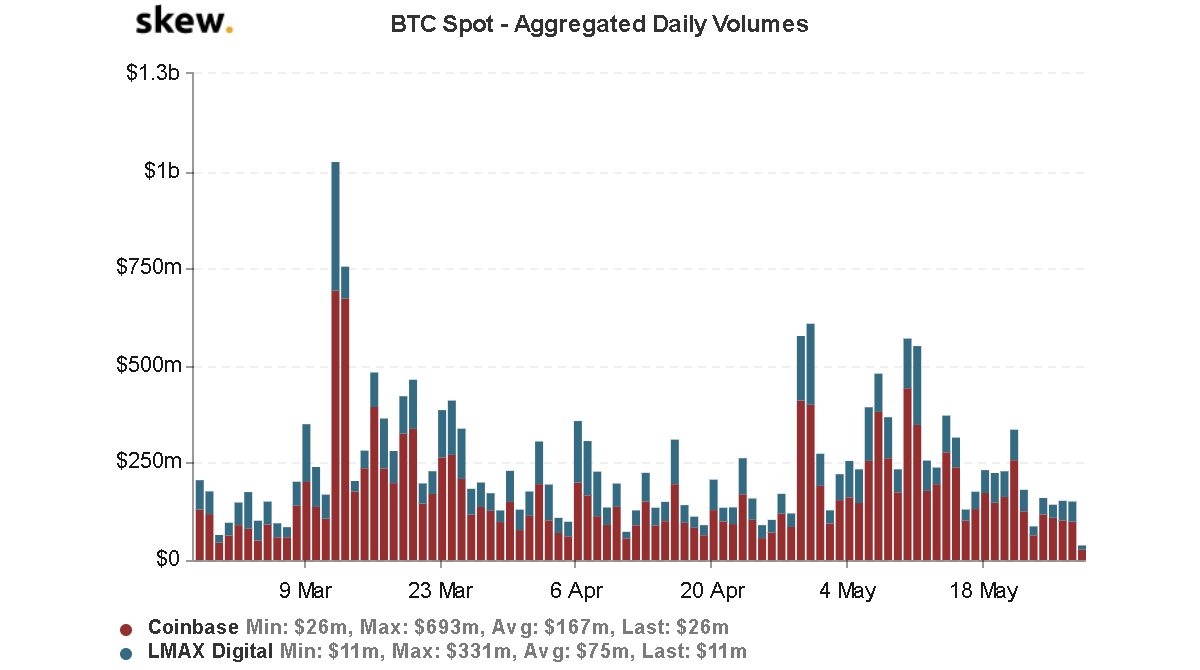

Sadly, data from Skew charts begged to differ.

Source: Skew

Source: Skew

According to the above charts, it can be pictured that the spot and futures volume has dropped down to early March levels after witnessing a high level of activity towards the end of April and beginning of May. The decline has been steady and appeared almost inevitable with the prices hitting a period of stagnancy.

Although spot trading might have been affected due to the correction phase, the decline in BTC futures might have occurred due to Bitcoin’s Implied Volatility.

Source: Skew

As exhibited in the above chart, Bitcoin’s 1-month at-the-money Implied Volatility has drastically dropped from 96 percent on May 12th to 69 percent at press time. Such a drastic drop suggested that traders expected that price to remain less volatile over the next few weeks, with less emphasis placed on a turbulent price swing.

With respect to the industry, a drop in volatility is a good sign for stability but futures volume gets significantly staggered in such cases.

Additionally, Bitcoin’s correlation with the S&P 500 and Gold has also dropped over the past week, as Gold prices continue to fall for a third consecutive day in the market.

Market Outlook

For the time being, Bitcoin is not in direct crosshairs with the bearish trend as the asset has been able to hold its own at a higher range. However, with the bullish sentiment drying out on multiple fronts, price swings can be expected but the time period is not certain.