Bitcoin’s funding rate shoots up on Bitmex, FTX and other exchanges

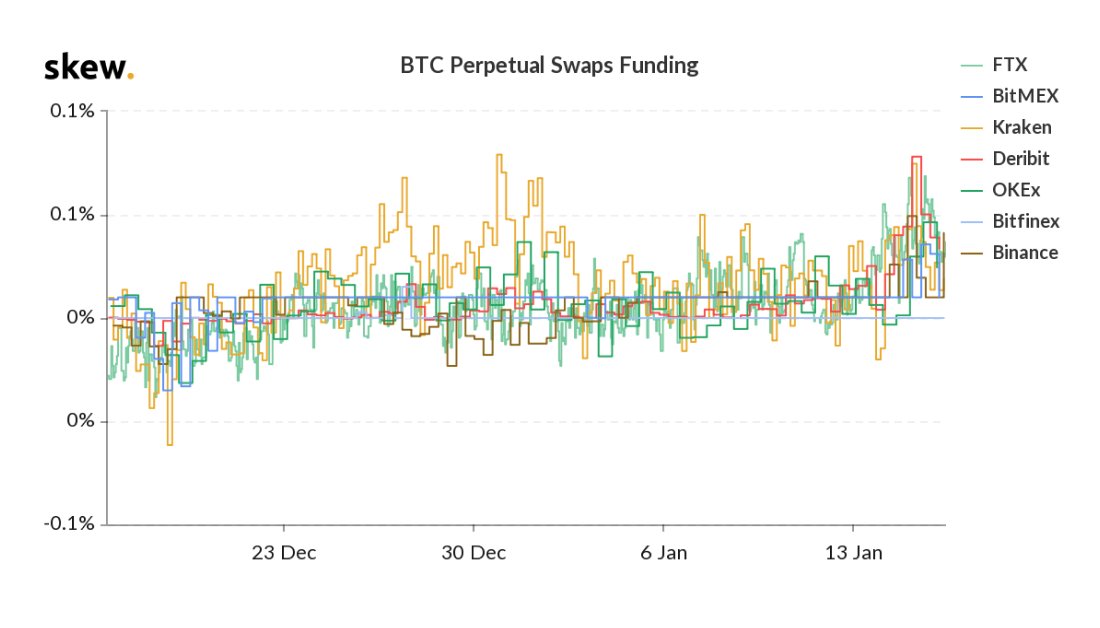

Bitcoin’s stagnated price showed signs of recovery in the new year carrying most of the market along with it. An 18% surge has been registered by the digital asset in the past 15 days, and the market sentiment appeared bullish. However, some analysts predict that since Bitcoin saw an unexpected rise, a correction is imminent. The perpetual contracts for Bitcoin have been noting a positive funding rate, according to data provider Skew.

Source: Skew

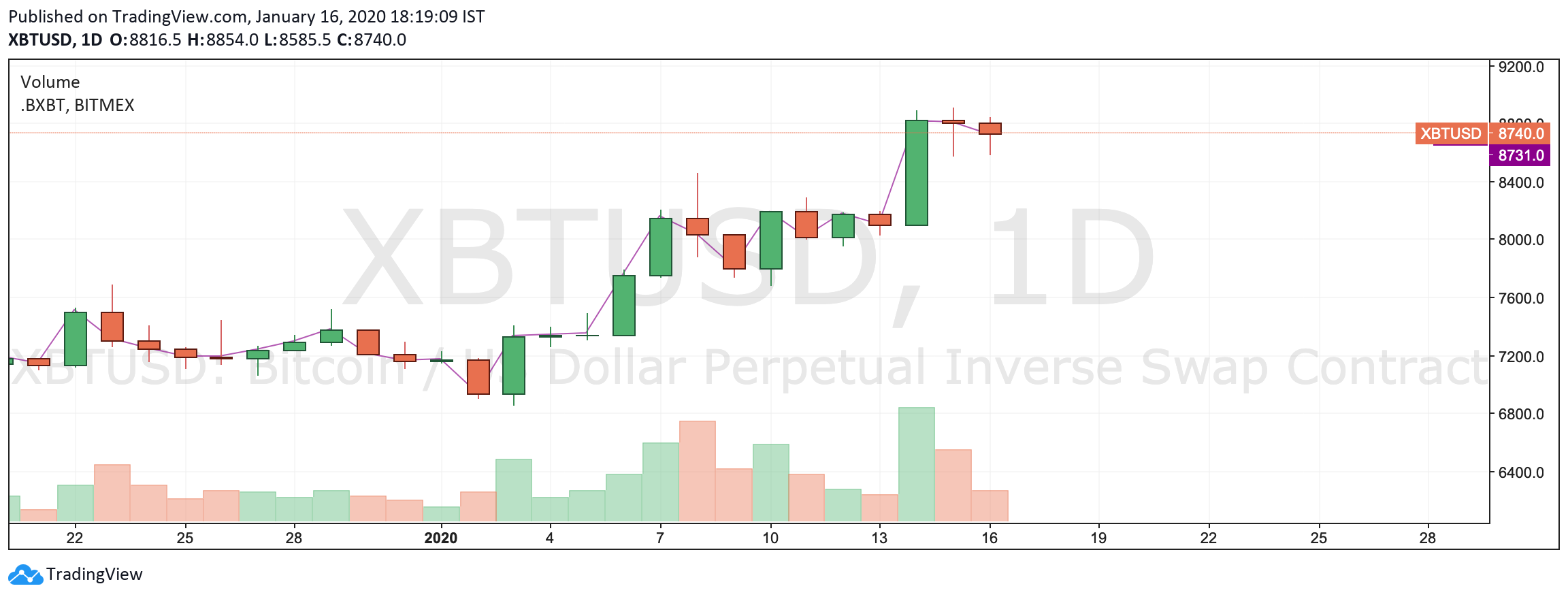

According to BitMEX, the funding rate was noted to be 0.0322% and the perpetual swaps are trading at a premium rate to spot price.

Source: BitMEX

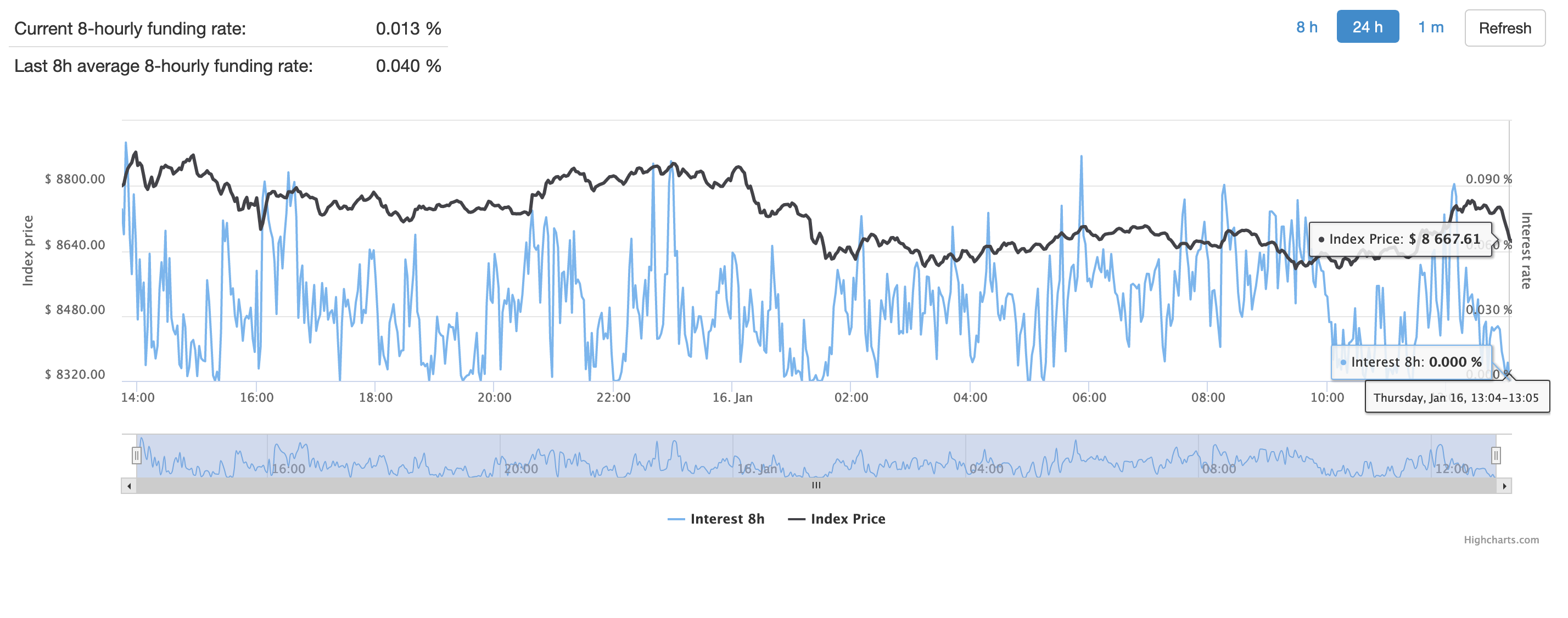

As the funding rate saw a positive spin, the premium price noted an upward swing and XBT/USD was trading at $8,740, even when the spot price was restricted to $8,731. Deribit, a Bitcoin Futures and Options Exchange, also noted the funding rate rising to 0.013% as the contract traded higher than the spot price.

Source: Deribit

Similarly, various other exchanges such as FTX, Kraken, OKEx, and Binance also reflected increased funding, as highlighted by the chart presented by Skew. The data aggregators also noted:

“Funding tends to be a good signal of market positioning”

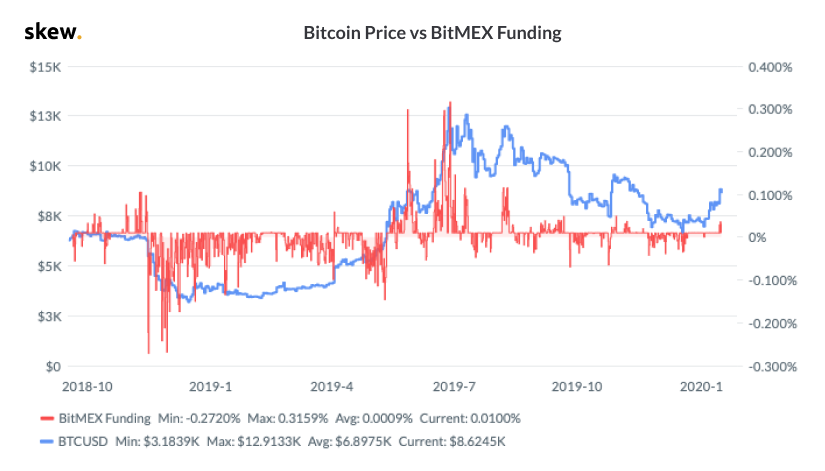

Source: Skew

The above chart noted that the price and funding rate have been marching alongside, and as the rate noted a spike in the chart, the price of the commodity also reflected a rise. Recently, BitMEX’s funding rate shot above 0.1 as the longs were taking over the market, while shorts closed their positions. The open interest had also noted an all-time high on 14 January noting $9.8 million, while 16 January noted the open interest at $8.8 million, indicating the increased number of contracts outstanding in future and options trading on BitMEX.