Bitcoin

Bitcoin’s correlation with Gold, S&P dip; is the worst over?

After two days of reporting gains, the price of Bitcoin has reached $6,711.77. However, the stock market is yet to make a turn-around, which could mean the correlation between BTC and traditional assets might be decreasing.

Source: BTC/USD on Trading View

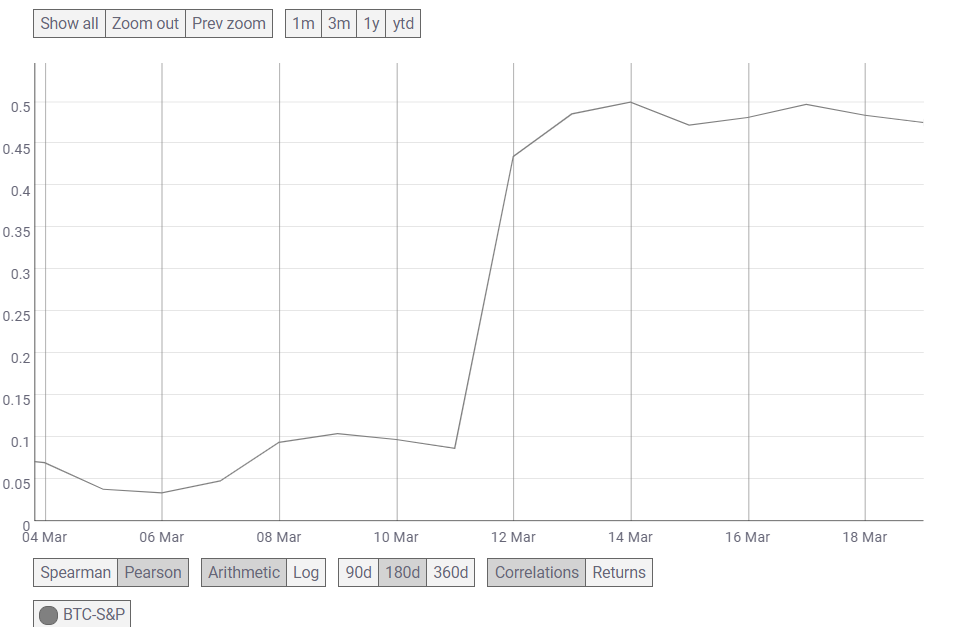

The correlation between S&P and BTC had spiked on 12 March, when BTC crashed. On 12 March, BTC-S&P correlation stood at 0.43 and later surged to 0.49. However, the correlation appeared to be plateauing at 0.47 on 19 March.

Source: Coin Metrics

Bitcoin that has been often looked upon as ‘digital gold’, has also noted a decoupling with Gold [GLD]. Like the S&P correlation, BTC’s correlation with gold also strengthened to 0.22, however, it immediately went back to 0.12. The correlation between digital gold and the metal on 19 March dipped to 0.06.

Source: Coin Metrics

Despite sailing through a similar volatile market as gold’s, BTC offered investors a potential 100x price increase at $6k level, according to Messari. Store of value assets often derive value from their limited supply, however, gold’s market value has been pushed from $7 trillion to $10 trillion according to research.

Source: Messari

Bitcoin is said to retain its value as ‘digital gold’ due to its scarcity and a hard cap of only 21 million.

A recent report from Kraken had highlighted that BTC was more positively correlated to traditional risk assets and more negatively related to traditional safe-haven assets, including Gold. Despite a negative correlation with the metal, Gold’s historical charts reflected a similar curve to that formed by BTC before its boom. According to Skew, the present bullishness in the BTC market resembled gold during the 2008 financial crisis.

In 2008, many sold their stocks and gold before, after which gold decoupled and noted a steep rise.

Source: Skew

The amount of incoming fiscal and monetary stimulus could be indicative of the same trend for BTC.