Bitcoin

Bitcoin’s $109M outflow: A dip in demand or something else?

The pause in Bitcoin’s price momentum made investors hesitant.

- The latest figures turned the tide after two consecutive week of inflows.

- Bitcoin accounted for 86% of the total inflows.

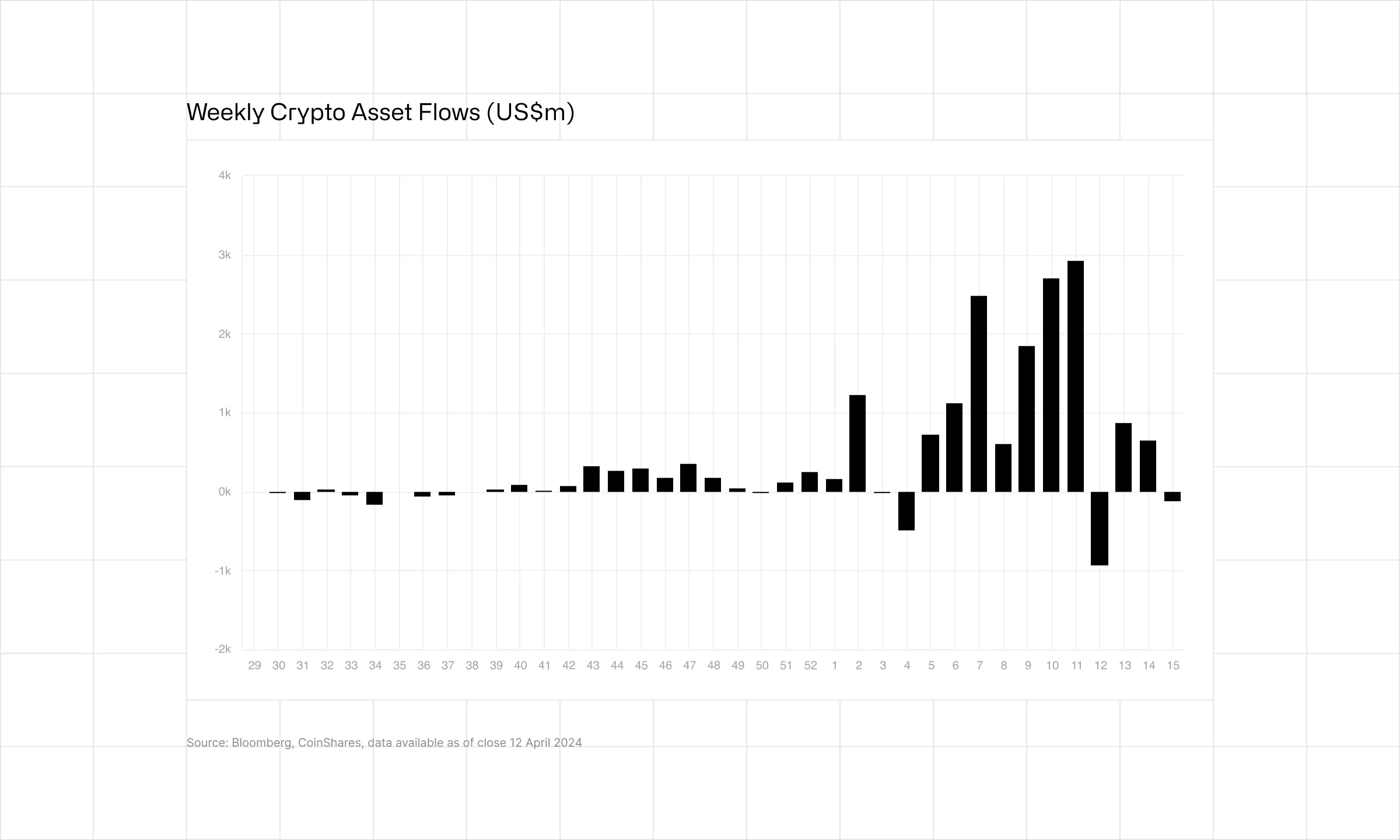

Digital asset investment products recorded minor outflows last week, impacted by weaker demand for U.S.-based Bitcoin [BTC] spot exchange-traded funds (ETFs).

According to the latest report by digital asset management firm CoinShares, about $126 million moved out of funds which help traditional investors engage with the cryptocurrency market. The latest figures turned the tide after two consecutive week of inflows.

Bitcoin leads outflows

Bitcoin, the largest institutional crypto product, accounted for 86% of the total inflows, around $109 million. Having said that, the total inflows into the king coin remained positive on a month-to-date (MTD) basis, standing at an impressive $555 million.

As per CoinShares, the pause in Bitcoin’s price momentum made investors “hesitant”, resulting in lower inflows into funds associated with the coin.

Indeed, the world’s largest digital asset descended from $72,000 to $67,000 last week, AMBCrypto noticed using CoinMarketCap data. The negative price action resulted in more than $84 million in outflows from U.S. spot Bitcoin ETFs, data from SoSo Value showed.

With the latest capital exit, the total assets under management (AuM) in Bitcoin-linked funds fell to $72.8 million, marking a 22% drop from the previous week.

Note that AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract.

How did ETH and other altcoins perform?

Ethereum [ETH]-linked funds continued to struggle, witnessing $29 million in outflows last week. This marked the fifth consecutive week of outflows from the second-largest cryptocurrency.

Note that Ether’s market value has crashed more than 16% over the month. To add to this, low expectations of a spot ETF approval might be restricting investors from making big investments into the digital asset.

Other major altcoins like Solana [SOL] and Avalanche [AVAX] also experienced outflows, at $3.59 million and $130,000 respectively.