Bitcoin weaker than Ethereum, stronger than XRP

For years the top-3 coins in the cryptocurrency market have not changed. Tether might’ve spoiled the three-wheel party of Bitcoin, Ethereum and XRP by intruding, but it’s less a cryptocurrency, and more a trading tool. These three coins are regarded as the elite in their own fields – currency, network, and institutions, yet in terms of price changes, there is a clear difference.

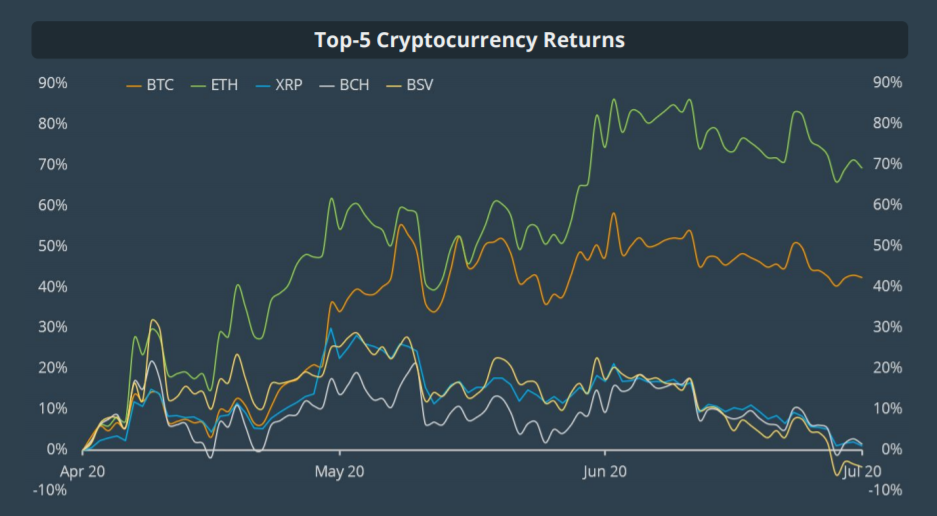

In the recently concluded Q2 2020, a quarter which included Bitcoin’s third block halving, and its consistent recovery, Bitcoin was not the biggest gainer among the three, Ethereum was. And while XRP did end the quarter on a high, compared to the gains of BTC and ETH, its minuscule improvement was a drop in the ocean. According to the quarterly report by CoinGecko, Ethereum saw a whopping 69.3 percent increase in price in the past three months. At the same time, Bitcoin gained 42.5 percent and XRP saw a meager 1 percent gain.

Source: CoinGecko quarterly report

The top altcoin in the market, with a market capitalization of $25 billion was trading below $90 at the time of the ‘Black Thursday’ drop, which took Bitcoin to $4,000 and XRP to $0.13. By the beginning of the quarter, on April 1, Bitcoin was trading at $6,300, Ethereum at $133, and XRP at $0.17, which eventually closed at Bitcoin trading around $9,000, Ethereum shuttling between $240 to $250, and XRP AT $0.17.

In addition to XRP, Bitcoin Cash saw minor 1.5 percent price gains, and its hardforked crypto, Bitcoin SV saw a decrease of 4.1 percent in quarter 2. The report stated,

“XRP, BCH & BSV failed to rally alongside, and ended the quarter with either minor gains or losses.”

It should be noted that this period was not without faults for the top-2. Ether’s price was expected to dump owing to the $186 million ETH which was transferred from the Plus Token Ponzi scheme wallet, and the transaction goof-up which saw a transfer of 0.55 ETH be given a transaction fee of $2.5 million. Bitcoin, despite closing out the quarter 78 percent from the aforementioned lows of Black Thursday, saw a trading volume in quarter 2 which was 20 percent less than the trading volume in quarter 1.