Bitcoin-Tether ‘minor correlation’ ineffective against price for now

2020 has been a monumental year for the digital asset industry, a year that has been plagued by extreme economic uncertainty and disruption. However, one of the major talking points of the year has undoubtedly been the issuance and growth of stablecoins, particularly Tether.

Tether’s free float supply has improved by a staggering 4 billion since the infamous market collapse of March, a development that allowed its market cap to rise by close to 45 percent. The stablecoin also became the world’s third-largest crypto-asset in terms of market cap after it ousted XRP earlier this month.

Now, the supply growth of USDT has slowed down over the past few weeks and according to a recent Coinmetrics report, Bitcoin’s price has mirrored the limited supply growth of USDT with valuation stagnancy.

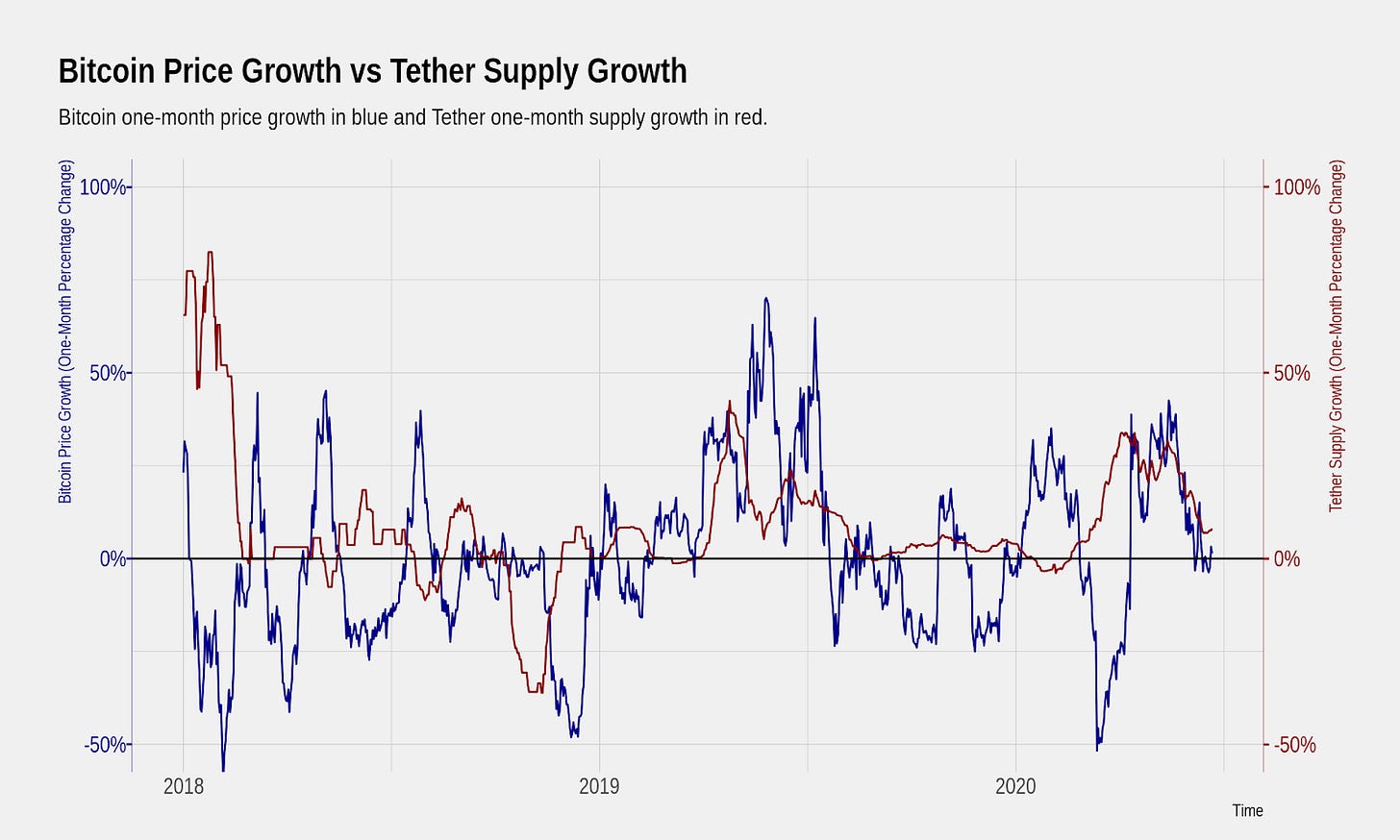

Source: Coinmetrics

According to the attached chart, Bitcoin’s one-month price growth and Tether’s one-month supply illustrated a tight correlation between the two, highlighting the fact that when Tether’s supply slowed down, Bitcoin’s price rally came to a stall on the charts as well.

Did Bitcoin’s price really hit a slump due to Tether?

Now, even though the report’s argument seems valid, it will be very short-sighted to limit the reasoning to only this extent.

Here, it is important to note that Tether noted increasing supply growth when COVID-19-related lockdowns first started coming into effect. After the traditional asset class had plummeted, Bitcoin shaved off 38 percent of its value as well, with the cryptocurrency’s valuation dropping down below $4000.

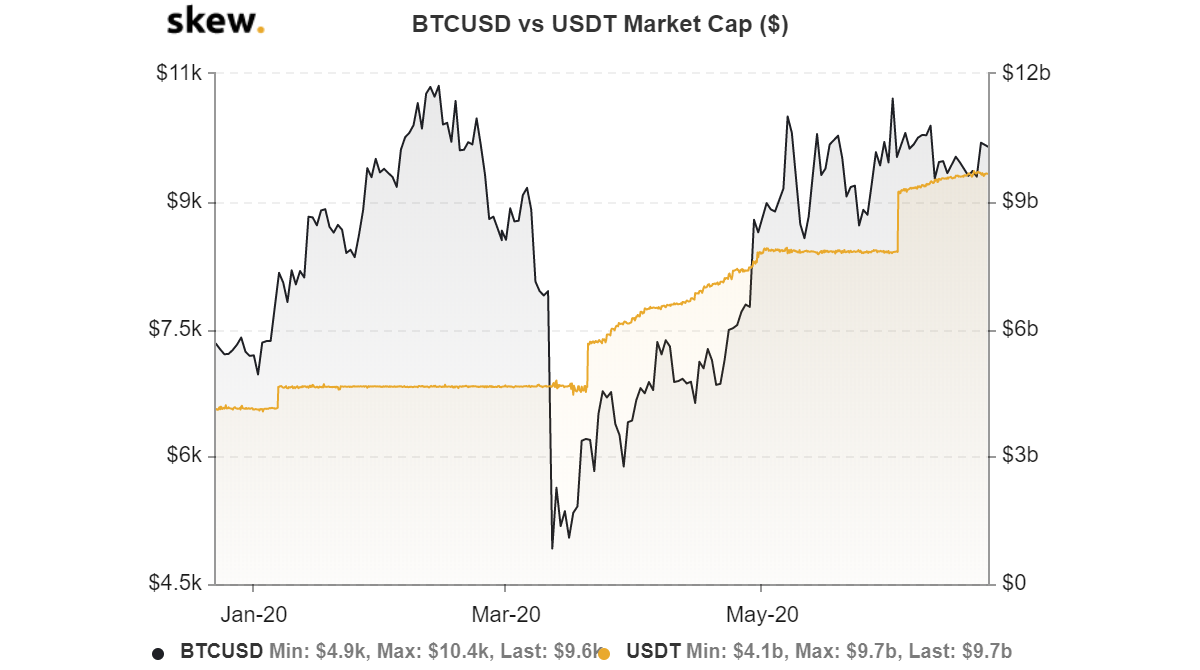

Source: Skew

Let us analyze the attached chart for better clarification. Admittedly, Bitcoin’s price and Tether’s supply growth followed an inclining graph from the end of March to the start of May. However, there is another possible argument for the increasing floating supply of USDT. During the early stages of the incline, a majority of the investors were buying or converting their assets into USDT due to the extreme volatility sustained by the rest of the industry.

Previous discussions have been carried out over the sentiment of investors during that period from March to May, a time when USDT was favored and its demand was increasing as people wanted to invest back in Bitcoin when higher stability was attained. So, once the price started pulling ahead, USDT registered a limited supply.

Furthermore, since the start of May, Bitcoin’s price has largely been between the range of $10,000 and $9,000, whereas USDT’s supply faced another growth spurt and its market cap ballooned by $1.5 billion. Bitcoin’s price did not mirror USDT’s increasing supply growth then, contrary to the argument put forward by the report which said that Bitcoin’s valuation should have responded as well.