Bitcoin

Bitcoin selling pressure to continue until BCH, BSV halving

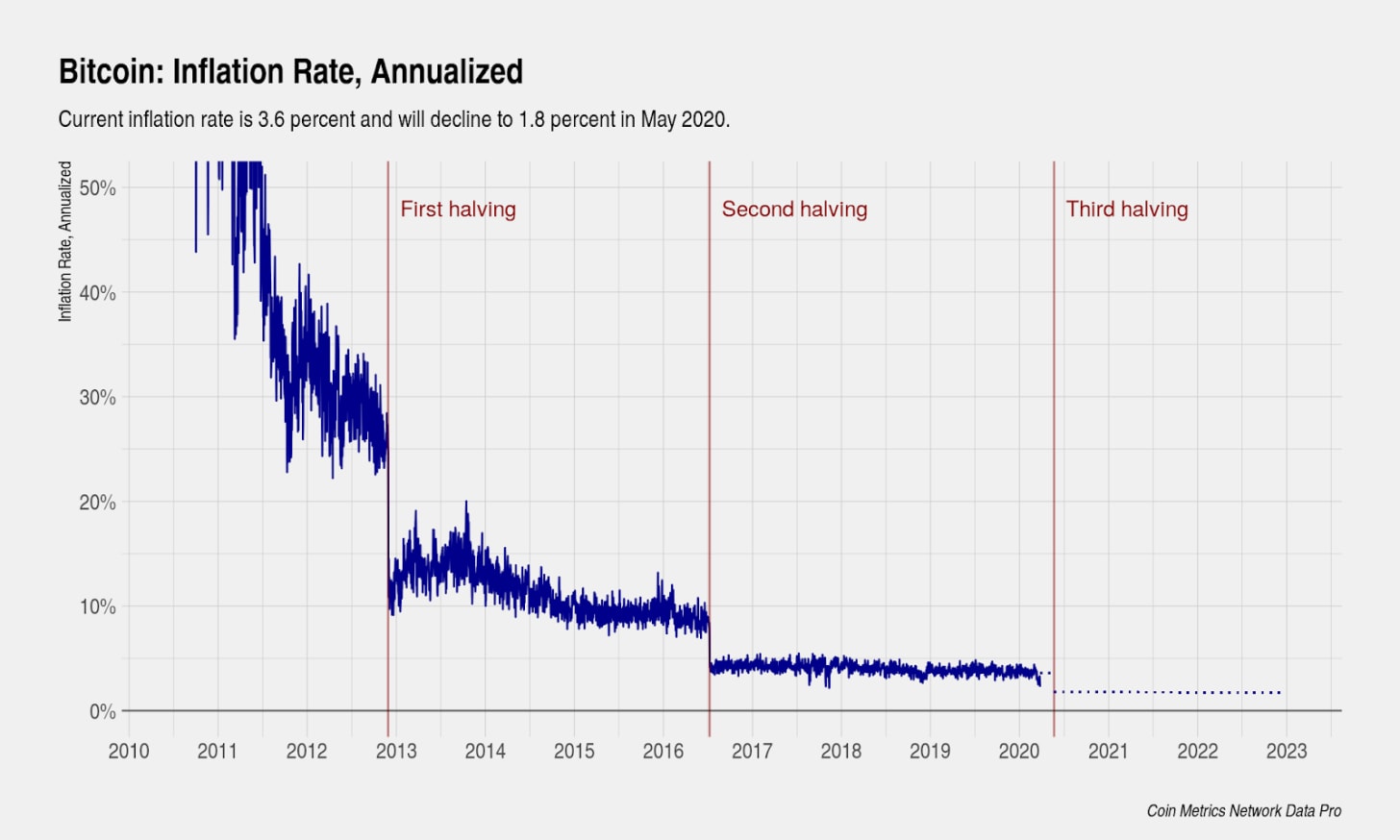

Bitcoin’s halving is expected to take place on 14 May 2020 and with respect to the same, there has been constant debate regarding whether or not the halving is priced in. While there are points in favor of both sides, there are other aspects to halving as well.

The immediate impact of the third halving will be that the block reward will be reduced from 12.5 coins per block to 6.25 coins per block. The annualized issuance of BTC will be reduced from 3.6% to 1.8%.

Source: Coin Metrics

Bitcoin’s price has been down for quite some time and we have passed the breakeven price set for the miners. The pro-cyclical behavior of miners suggests that miner-led selling pressures are also increasing. Miners have likely permanently or temporarily opted out. Further, the mining difficulty adjustment that took place on 25 March could be indicative since it was the biggest drop in Bitcoin’s history.

Source: Coin Metrics

According to the latest Coin Metrics report, the difficulty adjustment also suggested that inefficient miners are reaching a point of capitulation, one where they might be forced to sell all the coins they mine to cover their costs.

The selling pressure will continue to rise as the Bitcoin fork, Bitcoin Cash [BCH], is set for its own halving on 8 April, and its fork, Bitcoin SV, [BSV] will undergo halving on 9 April. The report added,

“All three assets share the same SHA-256 mining algorithm and miners can seamlessly redirect their hash power to the asset that provides the highest return on investment.”

The halving of BCH and SV might lead miners to direct more hash power to Bitcoin as the block rewards still are 12.5 coins and wouldn’t fall to 6.5 coins until a month later.

Source: Coin Metrics

Thus, the readjusted difficulty for Bitcoin also might increase, shrinking the profit margins for miners.