Bitcoin’s Q1 2020 losses may not be a sign of things to come

In the first three months of a new decade, a decade where Bitcoin is not just rogue ‘magic Internet money,’ but an institutional asset class with its derivatives contracts traded on the Chicago Mercantile Exchange [CME] and the Intercontinental Exchange’s [ICE] digital assets platform, is a quarterly loss a sign of things to come?

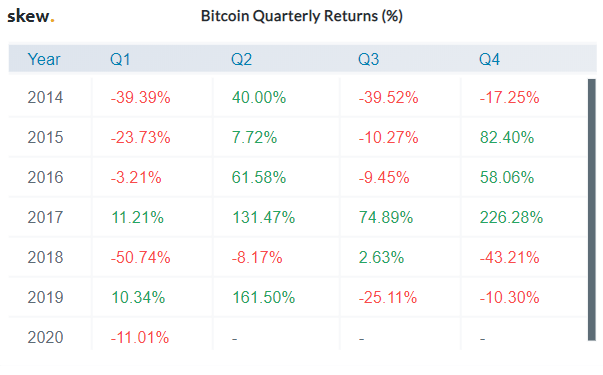

Bitcoin Quarterly returns 2014-2020 | Source: skew

According to data from Skew markets, as things stand, with Bitcoin trading at $6,400 a pop, Quarter 1 of the decade is set to end with a loss for the cryptocurrency. Looking at previous price drops, Bitcoin has ended up losing more than it gained in the first three months of the calendar year 4 times since 2014, recording only two gains.

Further, this past month alone, Bitcoin lost 56 percent of its value, peak to trough, and 30 percent of its value from monthly high to current price.

Better than the rest

As things stand, it does seem like the bearish woes are set to continue, triggered mainly by prevailing market conditions. Bitcoin, turning into a macro-asset, is reeling under the after-effects of the black swan that is COVID-19, just like the global stock and commodity markets.

To put things in perspective, the U.S S&P500 is down by 18.26 percent since the beginning of the year and that is after the Federal Reserve pumped billions through Quantitative Easing, slashed interest rates close to 0, and the U.S Congress signed off on a $2 trillion stimulus package to artificially save the economy.

Back to basics

Source: SPX via Trading View

In retrospect, Bitcoin’s 11 percent drop in Q1 of 2020 isn’t going to look all that bad. Remember last year when Bitcoin crawled out of the ‘crypto-winter‘ and mounted a commendable 10.3 percent increase in the first quarter, before its ‘mooning,’ as some call it?

The second quarter was when the bulls arrived. On 2 April, Bitcoin jumped by over 17 percent in a single day, rising over $5,000 and by the end of the month, its golden cross had occurred and $6,000 was left it the dust. Over the next three months, Bitcoin reached five-figures and went as high as $13,800 in June of 2019, its highest point all year.

The basics for Bitcoin are far more different than its contemporaries.

Best look ahead

Source: BTCUSD via Trading View

For Bitcoin, keeping your eye on the road serves better than looking in the rearview mirror. That statement cannot be any more true given the fact that the halving falls smack in the middle of Quarter 2 of 2020.

As to the question of whether Bitcoin’s halving effect has been ‘priced in’ or not is still hotly debated, this quarter will see massive movements in any direction, both history and the halving can attest to it. Options data suggests that the move preceding the halving will be much more subtle, compared to the move succeeding it.

Whichever way you look at it, while Q1 did have Bitcoin losing a tenth of its value, it was merely an opening act to a spectacular show ahead.