Bitcoin options open interest explodes as coin reclaims $37,000

- Bitcoin’s options open interest has rallied to an all-time high.

- As the coin reclaims $37,000, volatility begins to set in.

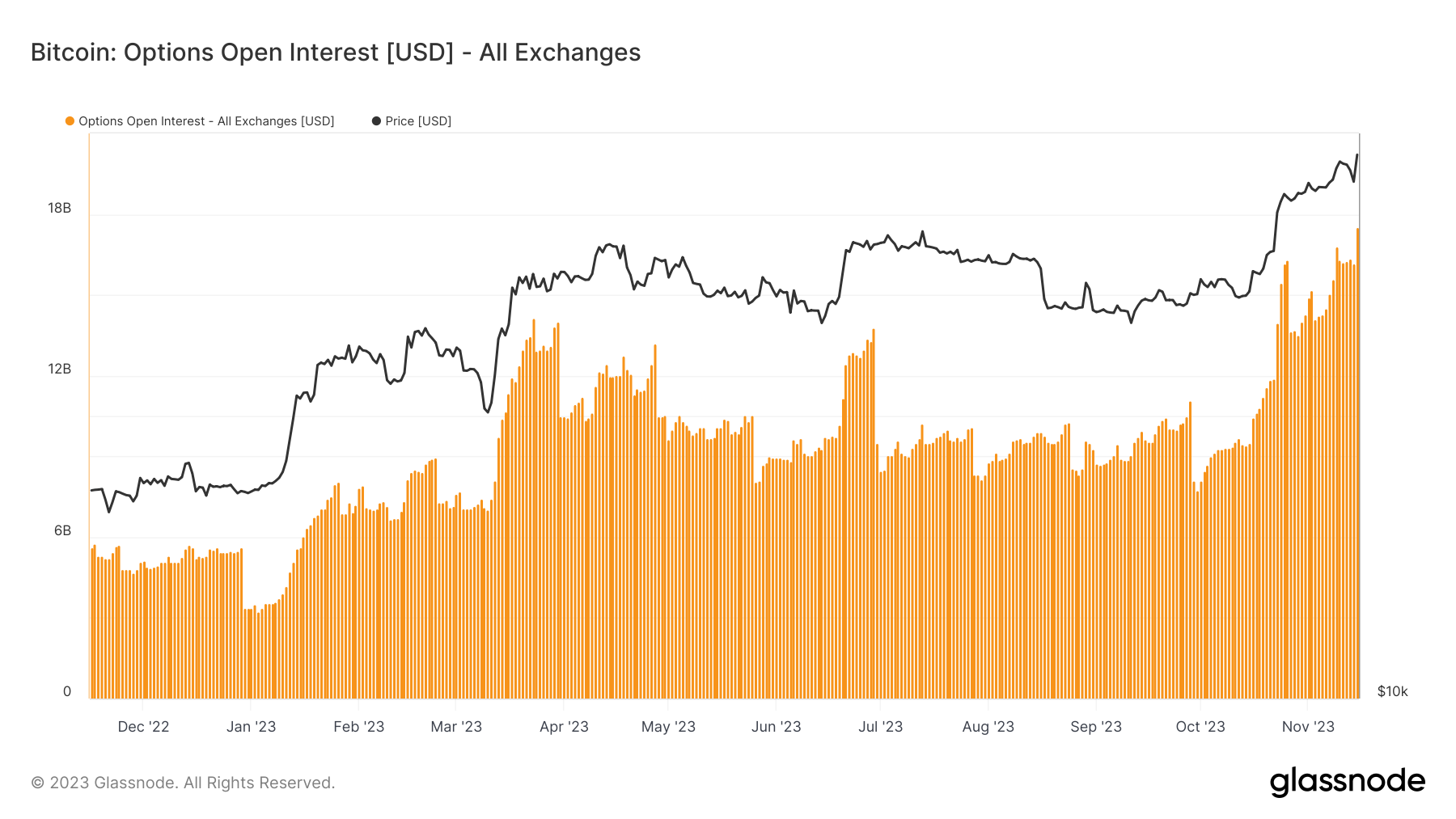

Over its 15-year existence, Bitcoin’s [BTC] options open interest has reached a historic high, surpassing $16 billion, data from Glassnode showed.

BTC’s options open interest measures the number of options contracts that have been traded but have not yet closed out or expired. When it rises, it suggests that BTC’s futures market is highly liquid with many participants.

The rise in open interest coincides with Bitcoin reclaiming the $37,000 price level during the intraday trading session of 15th November.

The coin experienced a sharp uptick in October only to consolidate within a tight range since the beginning of November, facing resistance at $37,000.

At press time, the leading asset traded at $37,446. The last time BTC traded at this price was in May 2022, according to data from CoinMarketCap. In the last 24 hours, the coin’s value has rallied by 5%.

Short traders continue to lose out

Before the price rally witnessed in the last 24 hours, BTC’s price traded within a tight range since the month began. This was due to slowed accumulation and an increase in profit-taking activity.

As a result, some traders in the coin’s futures market opened short positions in anticipation of a price decline.

However, BTC maintained momentum above $36,000, so these short positions experienced liquidation. On 9th November, short liquidations totaled $128 million, exceeding long liquidations.

Also, the recent rally above $37,000 also resulted in the liquidation of short positions worth $51 million, the second-highest in the last 15 days, according to data from Coinglass.

Volatility preparing to make a comeback?

During BTC’s price oscillation within a tight range, price volatility, which had rallied to multi-month highs in October, cooled. However, with a resurgence in trading activity in the coin’s spot market, significant price swings might be imminent.

According to AMBCrypto’s assessment, some volatility makers observed on a daily chart were beginning to rise.

Is your portfolio green? Check the BTC Profit Calculator

For example, the coin’s Average True Range – which measures market volatility by calculating the average range between high and low prices over a specified period – has increased by 13% since 13th November.

Likewise, BTC’s Bollinger Bandwidth (BBW) indicator, which experienced a decline at the beginning of the month, has initiated an uptrend.