Bitcoin

Bitcoin Network Health declines post-halving

It is just the beginning of June and the Bitcoin market had already witnessed a continued push and pull sentiment in the market. On 1 June, the buyers pushed the price of the cryptocurrencies higher than $10k, however, due to restricted volume, the digital asset could not maintain its value and fell the next day. As the market was picking up pace, so is the volatility.

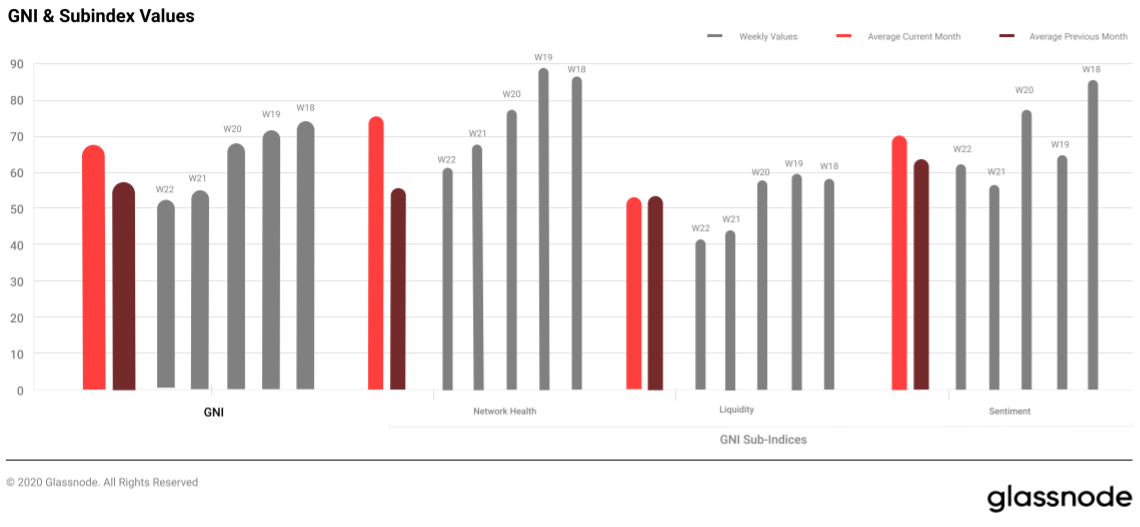

According to a recent report by Glassnode, its Glassnode Network Index [GNI] noted the declining health and liquidity in the network post-halving. The GNI began the month of May on an uptrend and reached an annual high of 76 points. However, post-halving, as the volatility seeped in the market, the GNI value was on a decline for the rest of the month and closed at a 56 point mark.

Source: Glassnode

Despite signs of weakness, GNI remained mainly positive as its gains were supported by other sub-indices, Network health and Liquidity that peaked on 12 May with 90 points and 62 points, respectively. However, the halving event did cause these values to decline.

The GN compass that identified 4 distinct BTC environment; as the x-axis measure the state of the blockchain fundamentals, the y-axis measure the current Bitcoin momentum. Based on the two values, BTC either fell in the bearish quadrant [Regime 4], bullish quadrant [Regime 1] or in quadrant 2 and 3 which indicated the instability of the digital asset. In May, BTC remained on the edge between Regime 1 and transitional Regime 3.

Source: Glassnode

Even though in early May the on-chain fundamentals solidified in the strong region, the GN compass moved away from the bullish territory as the price was unable to consistently breach the $10k resistance. However, unlike April, the BTC fundamentals and price maintained a significant distance from the bearish regime.

Whereas sub-index, Sentiment that started off at a high position of 90 points, immediately fell prey to the declining price and suffered a loss of 30% compared to early May. Joining this behavior was another sub-index Liquidity, that rejoiced in the increased trading and transactions near halving, fell by 33% in just two weeks, after the halving event. Despite the on-set of volatility bringing down the indices, the BTC network health appeared to have pulled away from the bearish territory and has been positioned itself closer to the bullish zone.