Analysis

Bitcoin, Monero dip slightly as DASH gains a bit of momentum

After a surge in its price post-halving, Bitcoin’s valuation slowed down over the course of the past 24-hours. This bullish momentum was still evident in the market, at press time, but the king coin’s resistance at $10,000 continued to hold firm. Other crypto-assets, namely Monero and Dash, maintained sideways movement on the charts, with both noting a minor slump and hike over the day.

Bitcoin [BTC]

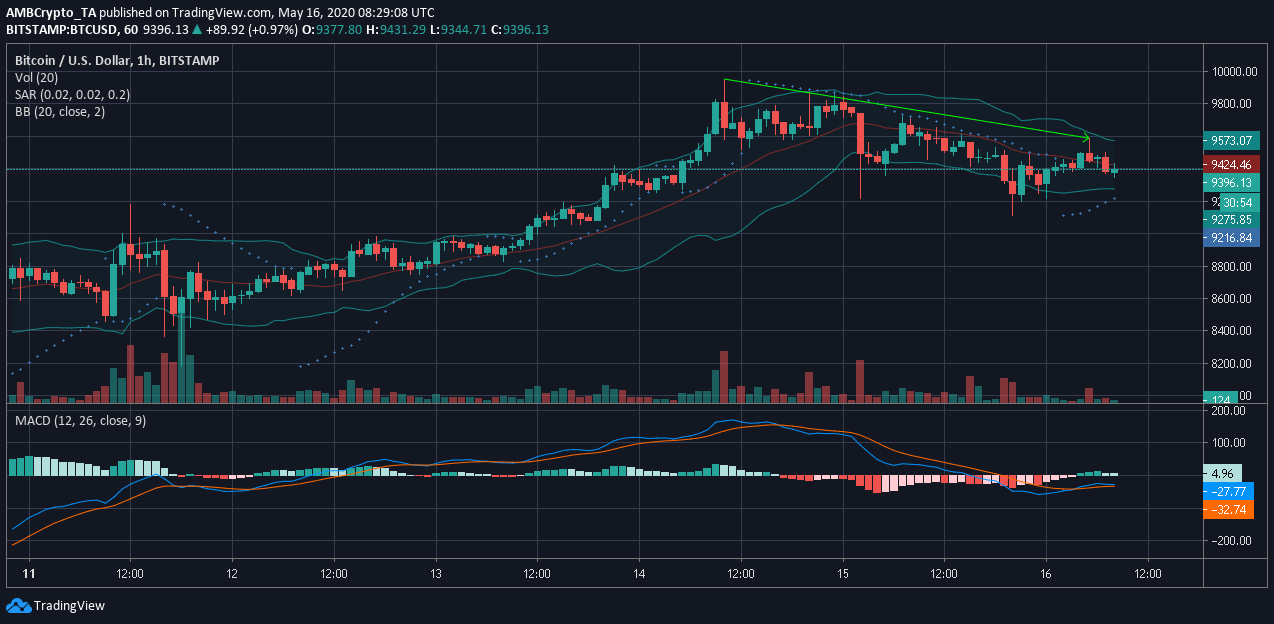

Source: BTC/USD on TradingView

Over the last 24-hours, Bitcoin registered a downtrend from $9,946 to $9,560 on the charts and at press time, was valued at $9424. The world’s largest crypto-asset had a market cap of $172 billion, with the same accompanied by a 24-hour trading volume of $42 billion.

Market indicators remained bullish in the short-term as the Parabolic SAR continued to hover under the price candles. Further, the MACD also maintained its position above the signal line, exhibiting a bullish nature in the charts. However, the Bollinger Bands suggested a period of reduced volatility as the bands of the indicator were converging on the charts.

The growing significance of Bitcoin, the world’s largest cryptocurrency, was highlighted recently after the world-renowned author of the Harry Potter series, JK Rowling, expressed an interest in the functionality of Bitcoin.

Monero [XMR]

Source: XMR/USD on TradingView

With a market cap of $1.3 billion, Monero maintained its position at 14th on CoinMarketCap. However, the token’s trading volume was extremely poor, with only $84 million traded over the past 24-hours. Monero was priced at $63.81, with strong resistance at $65, at the time of writing.

The Chaikin Money Flow or CMF suggested that capital was flowing out of the market, rather than coming in, with the Bollinger Bands pointing to a reduced period of volatility, similar to Bitcoin.

XMR was in the news after a recent announcement stated that Monero would be delisted from Bithumb in June. Bithumb’s delisting auditory board decided to permanently remove the coin after it was provisionally delisted in April.

DASH

Source: DASH/USD on TradingView

Finally, Dash continued its sideways movement on the charts, with a minor uptick of 0.80 percent over the past 24-hours. A market cap of $698 million kept it at 22nd in the rankings, but the asset registered a high trading volume of $572 million.

The Chaikin Money Flow of CMF indicated a bullish trend as capital inflows were higher than capital outflows, whereas the Relative Strength Index or RSI exhibited a neutral trend between the buying and selling pressure.