Bitcoin

Bitcoin mining difficulty hits ATH followed by minor dip for the first time in 2020

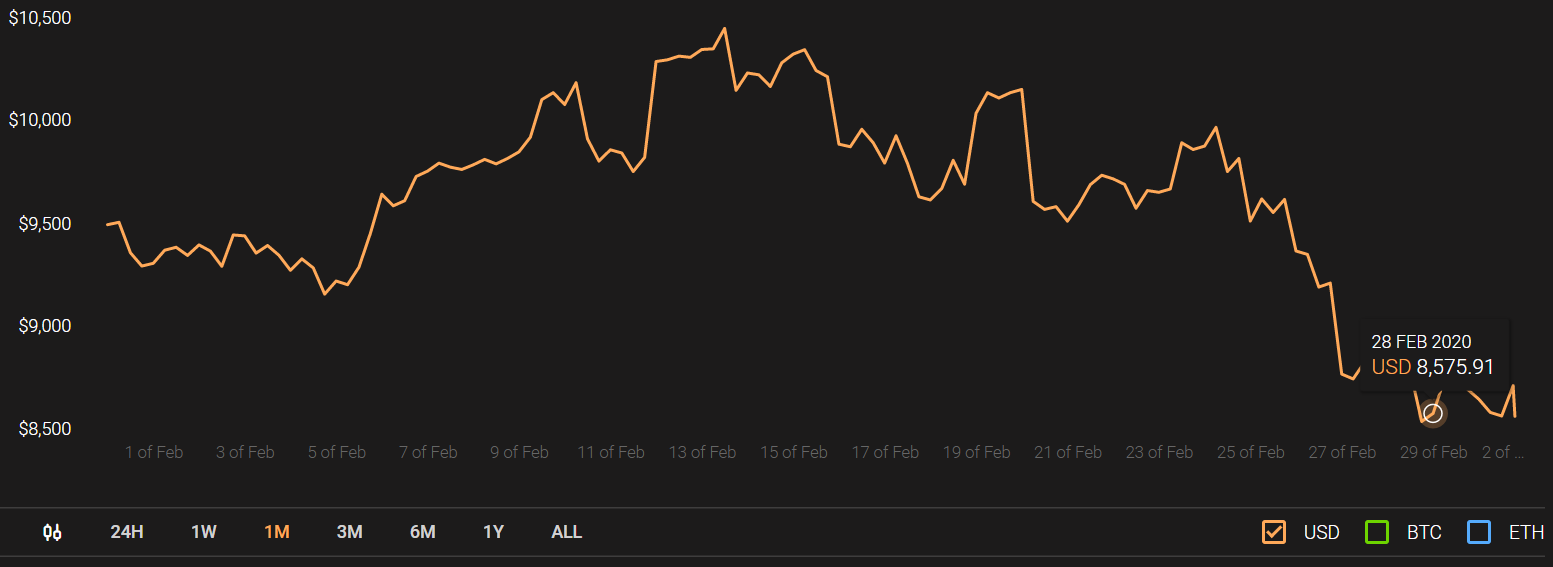

It’s 71 days till Bitcoin block reward halving which is scheduled for 12th May this year. Bitcoin has been on a roller-coaster ride in the first quarter of 2020. At press time, Bitcoin’s value stood at a price of $8,587 after a minor decline of 0.90%. Additionally, it held a market cap of $156.6 billion and a 24-hour trading volume of $36.06 billion.

Source: CoinStats | Bitcoin

As the halving nears, the king coin’s on-chain metrics depicted an overall positive picture.

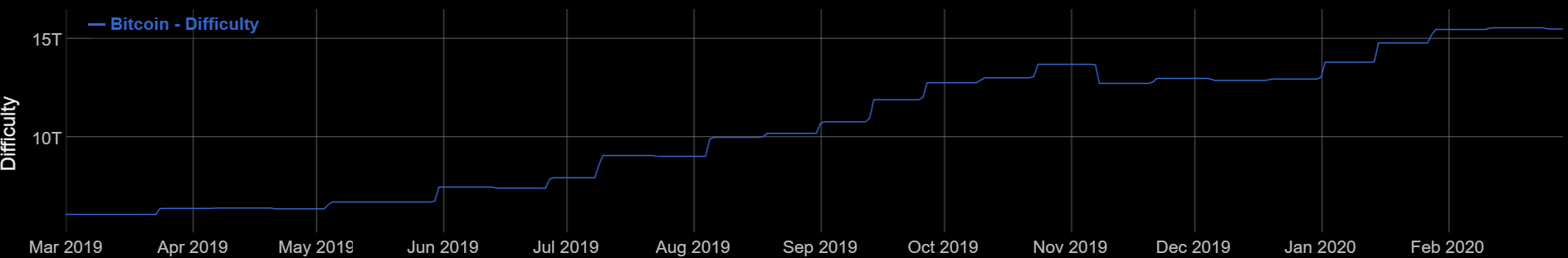

Bitcoin mining difficulty is one of the crucial indicators that determines the network’s health. According to data by BitInfoCharts, Bitcoin difficulty recently climbed to an all-time high of 15.52 TH/s on 11th February. This was indicative of higher competition to solve the blocks for block rewards.

Source: BitInfoCharts | Bitcoin mining difficulty

For the first time in 2020, the difficulty level witnessed a minor slump of 0.38% in the network’s subsequent adjustment on 25th February when it went down to 15.50 TH/s. A downward correction was last noted on 9th November 2019 when the difficulty was readjusted to 12.72 TH/s from 13.66 TH/s.

According to the mining pool, BTC.com’s latest estimates, the total mining difficulty in the next readjustment should climb up to 15.57 TH/s.

Bitcoin’s hash rate, on the other hand, which is another important indicator that determines the state of the network was also positive. It hit an all-time high on 126.1E on 17th January. The overall network hash rate was on the rise as it stood at 118.30E on 29th February.

Source: BitInfoCharts | Bitcoin mining hash rate

Hash rate distribution of Mining Pools

According to the hash rate distribution charted by Blockchain.com, at press time, F2Pool continued to dominate with a hash rate distribution of 18% followed by Poolin with 16.7 and BTC.com with 11%.

Source: Blockchain.com | Hash rate Distribution