Bitcoin’s latest milestone: What it means for your investment strategy

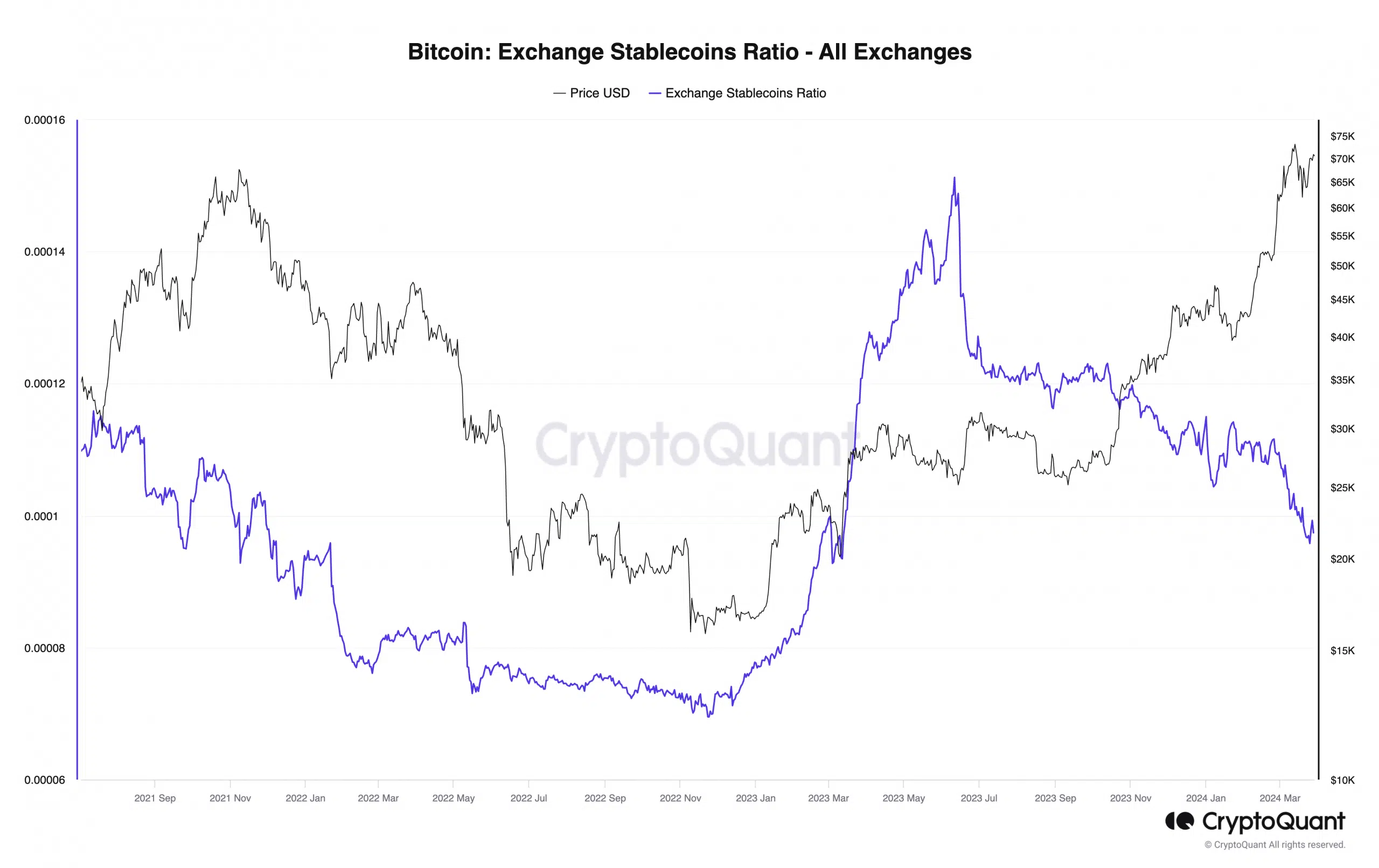

- The Bitcoin Exchange Stablecoin Ratio has dropped to a 12-month low.

- The coin is currently witnessing its longest period marked by bullish sentiment.

Bitcoin’s [BTC] Exchange Stablecoin Ratio has fallen to its lowest since March 2023, according to CryptoQuant’s data. At the time of writing, it was 0.00009749, having declined by 15% since the beginning of the year.

The Bitcoin Exchange Stablecoin Ratio tracks the potential buying pressure in the coin’s market. It does this by comparing the number of BTCs held across all cryptocurrency exchanges to the total amount of stablecoins held on them.

When the ratio is high and in an uptrend, it suggests that a lot of BTC, compared to stablecoins, are held on exchanges, indicating a hike in selling pressure. Conversely, a low ratio signals a hike in buying pressure, as there are more stablecoins relative to BTCs on exchanges.

Confirming the above position, pseudonymous CryptoQuant analyst CryptoOnchain, in a recent report, noted:

“While less than a month left until the Bitcoin halving, Bitcoin is fluctuating between $62,000 and $73,000. Although from the point of view of technical analysis, the direction of the breakout of this range will indicate the future trend of Bitcoin, but the analysis of the Exchange Stablecoins Ratio shows that the selling pressure is at its lowest level since March 2023.”

According to the analyst, with a decline in selling pressure, despite the new resistance faced at the $70,000 price level, there remains a possibility for an upswing “at the same time as halving.”

Bullish sentiment on its longest run

While assessing BTC’s futures market performance, another CryptoQuant analyst, Crypto Sunmoon, found that Bitcoin has achieved a new milestone.

According to the analyst, the coin’s funding rates across exchanges showed that it is currently witnessing its longest period of bullish sentiment without “experiencing bearish sentiment for (the) longest period in Bitcoin futures market history.”

According to Sunmoon, while it remains unknown when the bullish sentiment may end, any significant decline in BTC’s price may present a buying opportunity.

Is your portfolio green? Check the Bitcoin Profit Calculator

In the short term, the bullish sentiment is expected to hold as BTC’s futures open interest has initiated an uptrend following a brief decline. As of this writing, the coin’s open interest was $39.03 billion. It has increased by 12% in the past five days, according to Coinglass’ data

At press time, the leading crypto asset was trading at $70,446, registering a 7% price uptick in the last week, according to CoinMarketCap’s data.