Bitcoin

Bitcoin is yet to reach a top, here’s why

Bitcoin’s price began to climb up the price ladder in November and has now been holding on to a good price level. The current price of the digital asset was $19,107, with the traders’ constant push and pull. However, with the rising price the long-term holders in the market have also begun to realize their profits.

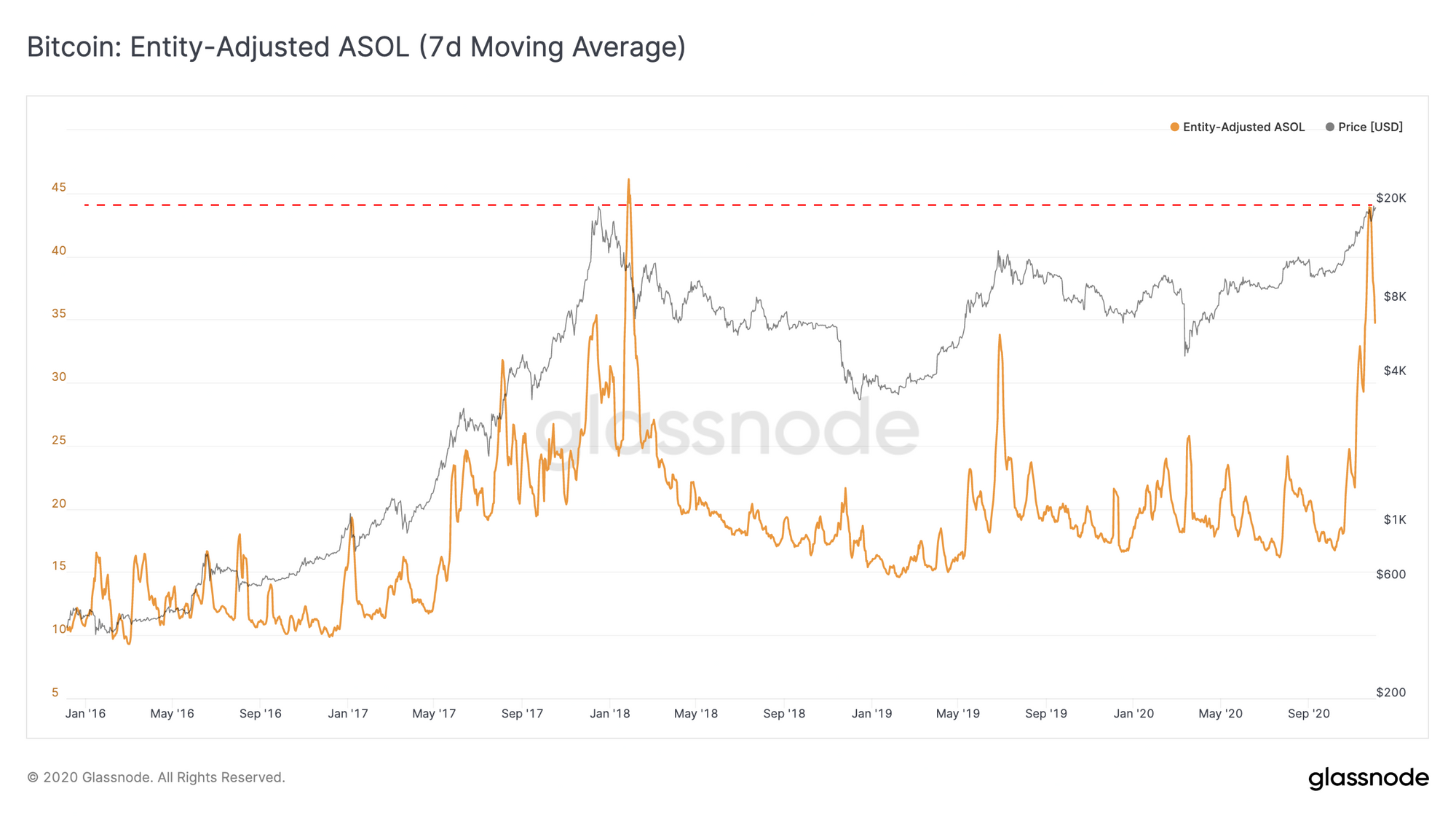

The Average Spent Output Lifespan [ASOL] metric, noted the movement of the older coin as the BTC price increased. It highlighted the average age of the coins being transacted and a higher value denoted the older coins were being moved. It may signify the long-term holders realizing profits.

Source: Glassnode

Currently, the ASOL value has been at a high level as indicated by the chart above.

Along with the movement of older coins in the hands of long-term holders, the long-term holder supply profit has been decreasing. Even though the price rise has pushed the total amount of profit, the number of coins in profit has not seen a significant rise. This meant that most long-term holders bought their BTC under $10k and have been holding throughout most of the recent bull run.

A report from glassnode noted:

“…the increase in ASOL in late November suggests that some long-term holders stopped hodling and started realizing profits around this time.”

Source: Glassnode

Even though this could be alarming news, but it was not a bearish signal.

Long-term Holders have historically realized profits before and during bull runs. Due to this the total supply held by long-term holders notably decreased before the market tops along with the LTH supply in profit. This trend can be visible in the chart under.

Source: Glassnode

As the LTH realize profits they allow new retail investors to enter the market and this has been a factor in driving BTC’s largest bull markets. This could mean a top is yet to be reached.